The Hinduja Group plans to more than triple its renewable energy capacity from the current 3 gigawatts (GW) to over 10 GW by 2030, and looks to invest $3-4 billion for that.

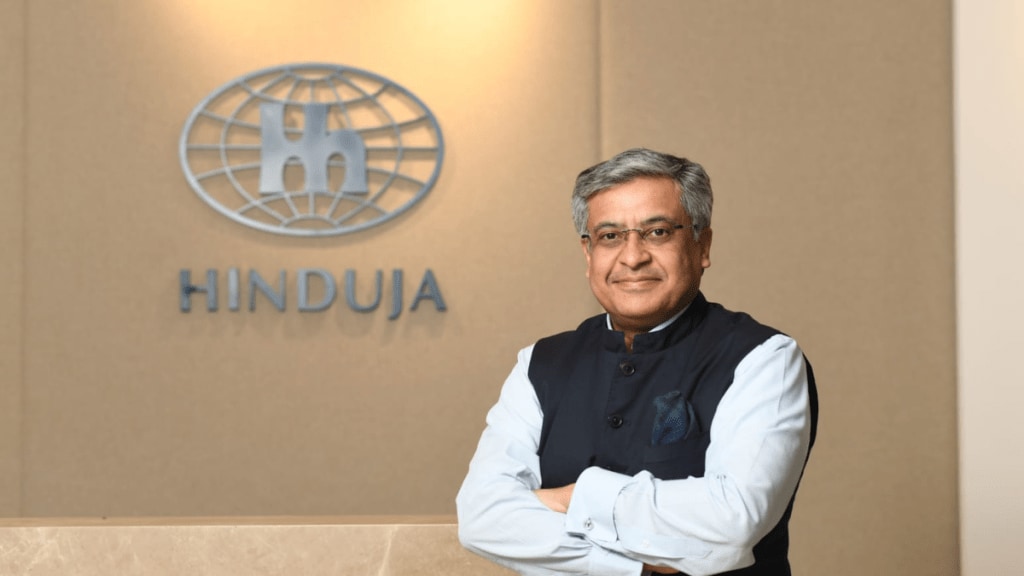

The group will focus on a mix of solar, wind, hybrid projects and battery energy storage systems (BESS), while continuing to operate its thermal assets, said Amit Saharia, group president – strategy, Hinduja Group.

“We see energy as a very strategic space for the group, on par with mobility and financial services,” said Amit Saharia, group president – strategy, Hinduja Group. “Our aim is to cross 10 GW by 2030 through a well-diversified portfolio,” he said .

Hinduja’s plans come at a time when the country is looking to have a power capacity of 500 GW from non-fossil fuel sources by 2030, according to the ministry of new & renewable energy (MNRE).

Adani Green Energy, which has the largest operational capacity in renewables currently with nearly 16 GW, aims to achieve a renewable energy capacity of 50 gigawatts (GW) by 2030.

Investment & growth strategy

Hinduja Renewables Energy (HREPL) operates about 3 GW of solar, wind and hybrid projects, with 80-90% of capacity in solar. The portfolio is complemented by a 1,040 MW coal-based thermal power plant in Vizag, Andhra Pradesh, run by Hinduja National Power Corporation (HNPCL).

Hinduja’s expansion will lean heavily on hybrid-based solar with storage. “Storage cycle durations, which are currently at two hours, are moving towards four hours and could reach six to eight hours,” Saharia said. Pumped hydro is also under consideration to increase reliability to thermal-equivalent levels, he said.

The $3–4 billion capex will be funded through a mix of debt and equity, with a ratio of nearly 70:30.

The group is mulling to get an investor in the business. “External debt raising makes sense only at a certain scale. Now that we are at 3 GW, it’s a good time to explore investor interest,” Saharia said, adding that the group is open to both domestic and international funding sources.

The group may approach long-term investors such as pension funds once the portfolio scales up further, he said.

He said both thermal and renewable will co-exist. “Both thermal and renewable will grow. The government plans to add 80 GW of thermal capacity in the next 4-5 years, and we are exploring brownfield expansion at Vizag,” Saharia said.

Integrating renewables with mobility

The group is also integrating renewable power into its electric mobility operations. Through Gulf Oil, it has acquired UK-based Indra, a slow-charging solutions provider with vehicle-to-grid capabilities, and India-based fast-charger maker Tirex. “Integrating renewable energy into EV charging is key for us,” Saharia said.

Digital analytics is being deployed across operations, from plant command centres to corporate functions, to improve performance and efficiency, he said.

Around 1.5 GW of Hinduja’s renewable capacity is already operational. Most utility-scale projects are backed by SECI or NTPC to ensure short payment cycles of 15–30 days. Land acquisition and grid connectivity remain challenges, but Saharia sees opportunities in falling solar panel and battery prices.

“RTC projects will create excess capacity that can be sold in the merchant market, making them more viable,” he said. A balanced portfolio of utility-scale and commercial & industrial (C&I) projects is central to the group’s valuation approach, with a deliberate push to increase wind and storage share.