Cash hoarding continues to plague India Inc. According to a study conducted by Institutional Investor Advisory Services (IiAS), based on FY19 financials, 60 of the S&P BSE 500 companies can conservatively return Rs 88,600 crore of surplus cash to their shareholders. This is just about one-third of their aggregate on-balance-sheet cash as on March 31, 2019.

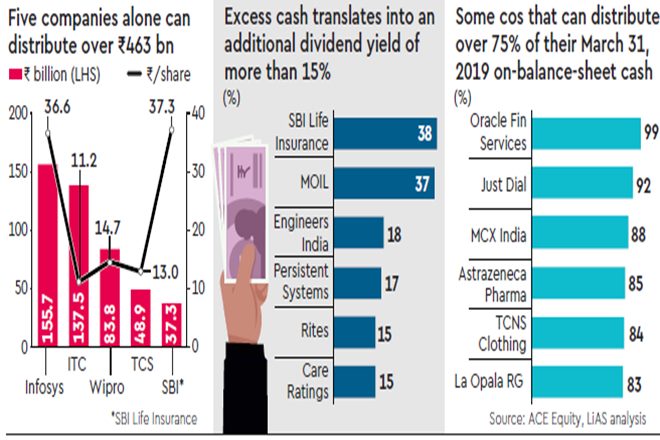

Of the 60 companies, just five aggregate over 50% of the total incremental distributable cash of Rs 88,600 crore (see chart). According to IiAS, the excess cash if distributed by these 60 companies, translates to a median dividend yield to 3.8%, significantly higher than the current 1.1%.

The 60 companies can return a median of 52% of their total cash to shareholders. The consolidated profit after tax for these 60 companies increased by 13.4% over FY18, while the profit after tax for the BSE 500 companies in aggregate increased by 0.3%. While the 60 companies have outperformed the index (based on profitability), almost half of these companies reported a decline in the FY19 return on equity, compared to the previous year.

This should compel their boards to review capital allocation and return some of the excess cash to shareholders, IiAS said in its report.