Goods & Services Tax (GST) collections have breached theRs 2 lakh crore milestone. The gross GST collection hit a record of Rs 2.10 lakh crore, an increase of 12.4% year-on-year, in April. This is as per the statement issued by the Finance Ministry.

“The GST collections hit a record high in April 2024 at Rs 2.10 lakh crore. This represents a significant 12.4% year-on-year growth, driven by a strong increase in domestic transactions (up 13.4%) and imports (up 8.3%),” the Ministry said.

According to the Ministry, the growth is a result of an increase in domestic transactions and imports. Meanwhile, the net GST revenue for April 2024 was recorded at Rs 1.92 lakh crore, an increase of 17.1% when compared to April 2023.

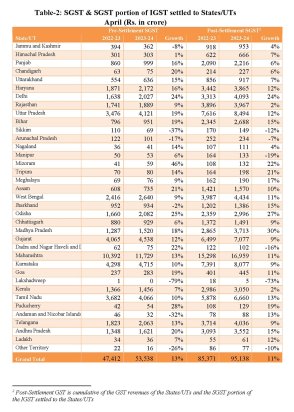

Talking about the GST collection numbers for April 2024 by Gunjan Prabhakaran, Partner & Leader, Indirect Tax, BDO India, said, “The all-time high GST collection in April 24 has come on the back of strong growth in GST collections from Northern States like UP, Punjab, Haryana, Delhi etc. The GST collection in April month has traditionally been higher (the previous highest GST collection was also achieved in April, 23), given that it reflects the economic activity in the month of March, which is the last month of the fiscal year.”

Have a look at the April 2024 GST collections:

- Central GST – Rs 43,864 crore

- State GST – Rs 53,538 crore

- Integrated GST – Rs 99,623 crore

Notedly, the Integrated GST collection comprised collections on imported goods of Rs 37,826 crore.

Additionally, the cess collection stood at Rs 13,260 crore, including Rs 1,008 crore collected on imported goods.

Saurabh Agarwal, Tax Partner, EY believes that the unprecedented milestone of surpassing ₹2 lakh crore in GST collections for April 2024 underscores the steadfast resilience of the tax system amidst evolving economic landscapes. “Every component of the GST collection has contributed significantly. The CGST, SGST, IGST, and Cess segments have all demonstrated positive performance, further solidifying our fiscal position. The concerted efforts of the GST officials including zero tolerance for non-filers, coupled with rigorous measures to combat fake invoicing and the registrations has significantly bolstered GST collections in the state’s coffers,” Agarwal added.

Interestingly, Mizoram recorded the highest percentage growth with 52%. The state collected Rs 108 crore in April 2024 against Rs 71 crore collected in the same period of previous year. Contrary to this, Jammu and Kashmir, Sikkim, Arunachal Pradesh, Nagaland, Meghalaya, Lakshadweep, Anadaman and Nicobar Islands are among the states with a negative growth. Out of this, Lakshadweep has the highest percentage of negative growth with 57%. The union territory in April 2023 had collected Rs 3 crore while in April 2024, it could only collect Rs 1 crore.

“The significant rise in domestic transactions can be attributed to consumer spending being focused on beating the summer heat, with purchases like air conditioners, beverages, as well as increased travel during the long vacations from schools and colleges. Interestingly this time the eastern states have shown a significant growth as compared to their previous trends.This one time leap is a new benchmark, which reflects robust economic buoyancy and high consumer spending. Seems the election season is not having any impact on the spending plans. If sustained, it would be great for country’s fiscal targets discussed in provisional budget,” Sanjay Chhabria, Senior Director, Indirect Tax, Nexdigm, said.