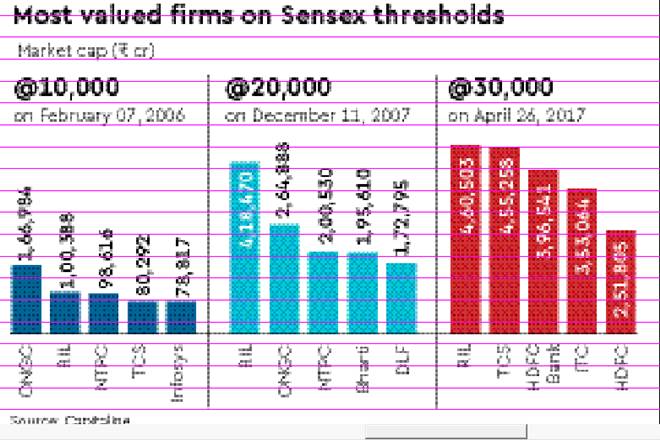

Although the Sensex has closed above the record 30,000-mark for the first time, the excitement was somewhat muted by the absence of any public sector unit (PSU) stock among five most valuable components on the benchmark index. Earlier, when the 30-share Sensex had touched the milestones of 10,000 and 20,000, two PSUs — ONGC and NTPC — had figured on the top-five list.

As the Sensex drove past the 30,000-mark on Wednesday, Reliance Industries (RIL), the country’s most profitable company, tops the list of the top-5 most valuable firms.

RIL was also the most valuable stock when the Sensex had hit the 20,000-threshold in 2007. The company was the second-most valuable company when the benchmark index had touched 10,000 for the first time in 2006.Though the RIL stock had been underperforming the benchmark for almost eight years now, there had been a sudden spurt in its movement in the last two months following the launch of its telecom subsidiary Reliance Jio, which started generating cash.

Also Watch:

Another aspect of the Sensex reaching the 30,000-mark is the fact that the move from 20,000 to 30,000 — just 50% took over four times longer than the move from 10,000 to 20,000 — which was 100% move. Similarly, NTPC, which was one of the five most valuable components when it

had hit 10,000 and 20,000, is now languishing at the 15th position, underlining the shift in in the Indian economy from PSUs to the private sector.

Two new entrants on the list of top-five most valuable stocks are HDFC and HDFC Bank. This also suggests that the banking system is undergoing a major shift, with HDFC Bank being only the third company in the history of Sensex to cross the `Rs 4-lakh-crore market capitalisation threshold.