Biocon (BIOS) has indicated that it is making steady progress on its biosimilar pipeline. Apart from the four lead molecules, the company has initiated global Phase III trials for bevacizumab (biosimilar Avastin) in CY17. While filing for approval in US/EU is likely in CY18, it may be launched in some EMs prior to that. Avastin global market size in $7 bn and its patents are expiring in US-EU in 2019-20.

Biosimilar Glargine has 25% market share in Japan within a year: BIOS has launched insulin glargine in Japan at 5% discounted price to Eli Lilly’s product which is already at a 15% discount to the Sanofi’s Lantus. The generics have been able to garner a market share of 25%.

EU launch opens likely entry into MENA markets: BIOS highlighted that launch of biosimilars in EU would allow it to market its products in the MENA (Middle East & North Africa) as it tends to follow the EU. MENA incidentally has a large patient base for diabetes.

Interchangeability switch studies make sense for chronic: Management was of the view that switching studies for interchangeability make sense only for chronic drugs such as Humira, Lantus and not acute drugs. Initial focus of BIOS will be to market non-interchangeable biosimilars in US/EU.

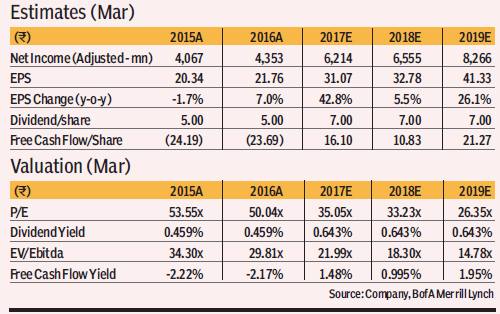

Price objective basis & risk: Our SOTP-based PO of R1,115 has been derived as follows: (i) R332 i.e. the aggregate of risk-adjusted DCF valuations of the four key biosimilar opportunities namely —Lantus, Humira, Herceptin & Neulasta, and (ii) R783 for the base business valued at 20x P/E Dec-2018E EPS—in line with the India Pharma sector average on account of superior EPS growth prospects (23% CAGR over FY16-19e) and improving return ratios. Downside risks: (i) Regulatory /legal delays in launching biosimilar products in US/EU, (ii) sharper than expected price erosion in biosimilar market, (iii) lower than expected share in biosimilar market, (iv) lower biosimilar penetration in US/EU. Upside risks: (i) Earlier than expected approval for key biosimilar molecules, (ii) stronger growth in Biologics in EMs (iii) sustained improvement in custom research business.