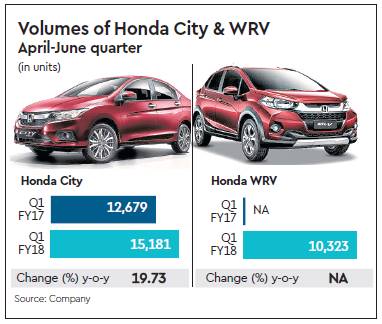

On the back of increasing demand for the new Honda City (a mid-size sedan) and WRV (a compact SUV), things have started to take a positive turn in the domestic market for Japanese car maker Honda. In 2016, the company witnessed significant decline in volumes owing to the lack of new products and intense competition form Maruti Suzuki and Hyundai. In the April to June quarter of the current fiscal year, the volumes of Honda City increased by 19.7% y-o-y to 15,181 units and have significantly reduced the gap with the volumes of its main competitor, Maruti’s Ciaz. During the same period, the volumes of the Ciaz increased by 14.67% y-o-y to 15,698 units.

In FY16, the volumes of the City declined by 25.2% to 57,984 units, which is one of the lowest for the most popular product from Honda’s stable. Volumes of the Ciaz increased by 18.8% y-o-y to 64,448 units.

Volumes of another new product, the WRV, stood at 10,323 units during the April to June period, which is substantially higher than any other product of the company in the utility vehicle segment. “We have increased the WR-V supply for our waiting customers from last month and this is reflected in the good numbers posted by the model in July. The post-GST price benefits, healthy monsoon and the onset of the festive season in many regions from August will give another boost to our sales,” said Honda Cars India president and CEO Yoichiro Ueno.

In the last two years, the products launched in the domestic market — the BRV and the Jazz — did not generate enough volumes for the company. Volumes of its most popular product, the City, also started to slip as a result of the launch of the hybrid variant of the Ciaz by Maruti, which attracts only 12.5% excise duty as opposed to 28% for the City.

According to industry experts, volumes of the City are likely to increase further as the taxes on the hybrid variant of the Ciaz has increased substantially to 43% under GST from 28% (excise and vat) earlier, which may lead to a potential shift in the choice of customers. “The new facelift of the City has been able bring the customers back to the dealerships of Honda. Customers usually went away from the vehicle because of the substantial price difference with the Ciaz. The WRV has also been doing reasonably well compared to the other products. So this year may turn out to be successful one for the company,” said a consultant from the top four consultancy firms.

In the first six months (Jan-June) of 2016, the volumes of the City stood at 33,738 units, slightly ahead of Ciaz volumes, which stood at 33,032 units. The main reason for the decline in Honda’s volumes in the last fiscal was huge decline in the volumes of the City, which was the highest-selling mid-size sedan in the country since it was launched.