US-based electric truck start-up Lordstown Motors filed for bankruptcy after its investment agreement with manufacturing giant Foxconn Technology Group rapidly unraveled.

The company’s Chapter 11 petition filed on Monday listed as much as $500 million of both assets and liabilities. Lordstown said in a statement that it would start a sale process to maximise the value of its Endurance electric pickup.

The bankruptcy filing caps several tumultuous years that saw the company go public through a merger with a special purpose acquisition company, fight off short-seller claims and a Securities and Exchange Commission inquiry about inflated vehicle pre-orders, and sign the deal with Foxconn in a bid to raise much-needed cash.

Lordstown warned on May 1 that it may need to file for bankruptcy if the Foxconn dispute wasn’t resolved. The Taiwanese manufacturer notified Lordstown that it could terminate its investment due to a breach in their agreement.

Last year, Foxconn agreed to invest as much as $170 million in Lordstown and take two board seats. The deal gave the EV maker much-needed capital while offering Foxconn, the Taiwanese manufacturer best known as the maker of Apple iPhone, a firmer foothold in automotive production.

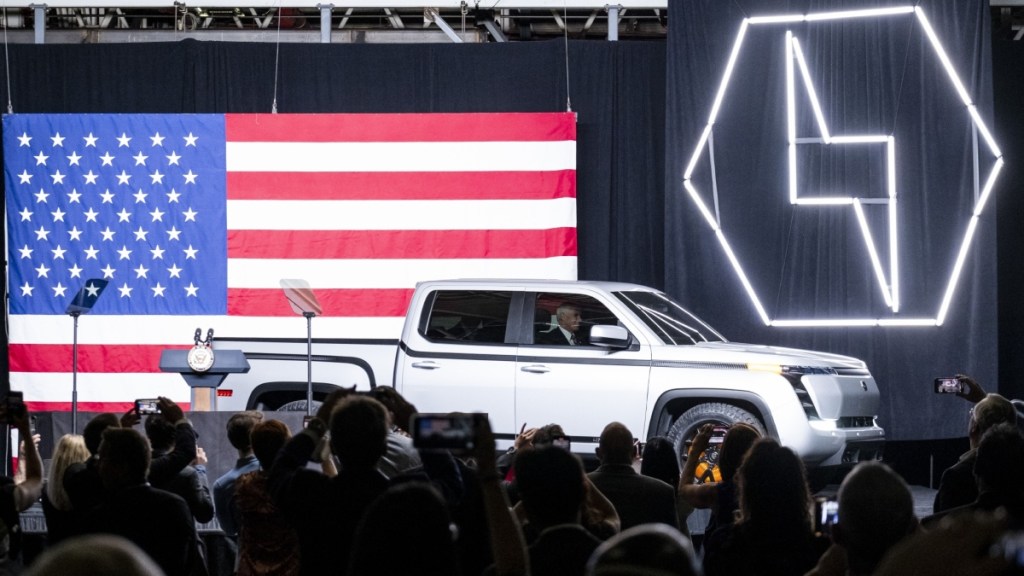

Foxconn also purchased a former General Motors Co. factory in Lordstown, Ohio, from the company, and it planned to make Lordstown’s debut vehicle under contract. But in January, Lordstown asked Foxconn to suspend production because the cost of making the Endurance exceeded the targeted sale price of $65,000 — and said it would need another partner beyond Foxconn to share costs.