Maruti Suzuki India, the country’s largest carmaker with its tech-agnostic approach stands to gain the most if India government rationalises taxes on hybrid vehicles says a JM Financial report.

It says India’s carbon reduction goal depends not just upon CO2 reduction of each technology, but also on the volume of vehicles each technology can generate. For example, the fundamental tenet of Toyota’s ‘1:6:90 Rule’ emphasises that resources used for one electric vehicle could replace 90 ICE vehicles with hybrid electric vehicles, resulting in 37 times greater carbon reduction (vis-à-vis one electric vehicle).

Then there is the challenge of the customers’ unwillingness to pay premium for an EV and inadequate charging infra, which is driving shift to hybrid vehicles globally. Noting this shift, the government of India is also considering rationalising taxation of hybrid vehicles.

It finds that globally too, passenger vehicle makers such as Mercedes-Benz, BMW, Ford Motor Co, GM and Stellantis among others have indicated strong growth in hybrids. Toyota Motor Corp, for instance, indicated that pace of electrification has been slower than anticipated owing to three key factors – lack of critical mineral supply, inadequate charging infrastructure and affordability.

Further, the company stated that margins of hybrid models are almost similar to ICE variants. Ford’s management also indicated similar margin for hybrids.

Further, it said that customers are unwilling to pay a significant premium for EVs and thus hybrids will play an important role in the medium-term.

BMW also indicated that its plug-in hybrid electric vehicles (PHEVs) have seen strong demand in both Europe and US and it expects hybrid technology to stay for a foreseeable time.

The preference for hybrid vehicles is led by rising consumer preference, which is increasingly seeing most global OEMs now looking to launch multiple hybrid models alongside EVs in CY24/CY25. The situation is no different in India; the government has proposed to rationalise hybrid taxation: Despite EV price reductions, the reality remains that the pace of electrification has slowed in the recent quarters. At the same time, strong hybrid sales are picking pace led by recent launches from Maruti Suzuki India and Toyota Kirloskar Motor.

The penetration of strong hybrid cars at 2.3% surpassed 2% for electric vehicles cars during Q4 CY2023 owing to affordability issue and lack of adequate charging infra. On the other hand, despite unfavourable taxation, hybrid cars offer better value with higher mileage and no charging hassle.

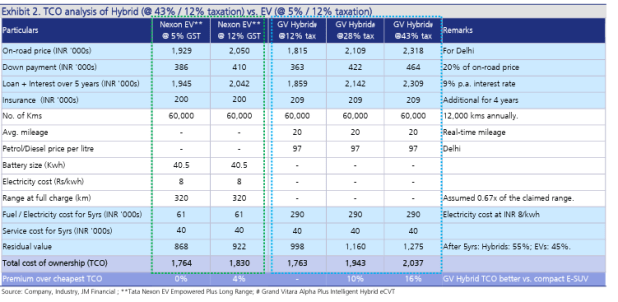

JM Financial calculation highlights that rationalisation of GST rate (to 12%) can reduce TCO of for instance a Strong Hybrid like the Maruti Suzuki Grand Vitara by 13% and bring it at par with a long-range compact e-SUV. The country’s largest carmaker Maruti Suzuki India too is upping its game; it is well-placed to benefit from pick-up in hybrid sales: MSIL’s decision to focus on CNG (5x vol. growth in last 5yrs) and exit diesel engine (penetration above 20% now) has all turned out to be beneficial in hindsight. Similarly, the report states that Maruti Suzuki India’s tech-agnostic – ICE, CNG, hybrids, EVs, etc – approach similarly will once again turn out to be a prudent strategy, given evolving customer preferences.