Maruti Suzuki India, the country’s largest carmaker which has enabled the aspirations of many first-time car buyers, is now started to witness a slowdown for one of its most successful products the – Alto.

The entry-level car which ruled the charts in the top 10 list is suddenly finding it difficult to beat many expensive vehicles in the chart, despite seeing almost negligible competition. While there could be some factors around the maturity and demand for premium cars, but then there is also the fact that a lot many first-time vehicle buyers who are looking for a budget-friendly entry-level car are slowly turning away from the Alto.

Avik Chattopadhyay, Founder, of Expereal, a brand consultancy firm believes that the demand for Alto has been on the decline for three key reasons. “Firstly, the traditional buyer cannot afford it as salaries have gone down. Second, the prospective buyer has decided to save rather than spend. And finally, the automaker has done nothing to make the Alto both financially and visually attractive to encourage those sitting on the fence to cross over and buy.”

Gaurav Vangaal, Associate Director, Light Vehicle Production Forecast, Indian subcontinent at S&P Global Mobility says “Over the past decade, there has been a decline in consumer interest in the A-segment vehicle category in India. In 2014, the production of light vehicles in this segment reached approximately a million units, but by 2022, it had decreased to around 830,000 units. This decline in demand can be attributed to consumers becoming more mature and opting for B-segment vehicles. Additionally, the introduction of various mandatory regulations has created margin pressures for A-segment vehicles, leading several carmakers to exit this segment.”

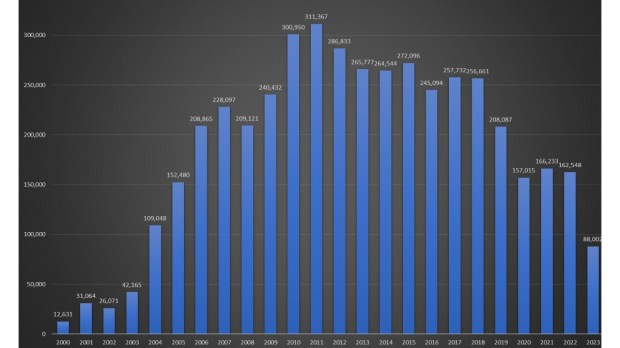

In fact, it was in 2011 when Alto reached peak sales of 311,367 units. In 2014, when the light vehicle segment crossed the million-unit milestone, Alto had gone home to close to 264,544 customers.

And for the last three years, the model has struggled to even cross 200,000-unit sales.

Ground reality

But why is that despite a low-per capita base and still a significant potential customer base the segment is struggling?

Chattopadhyay believes that the demand for A-segment cars is going down because the prospective customer pipeline has dried up. “Whether we wish to admit it or not, post demonetisation, GST, and Covid, a huge number of Indians just cannot afford a four-wheeler. In fact, many of them cannot afford the more expensive two-wheelers. The traditional A-segment buyer is saving for possible bad days ahead instead of looking at a car as an expression of achievement and status. At the same time, the automakers are not making it any easier for the prospect by increasing prices at whim, giving all types of excuses and reasoning. It will take strong fundamental shifts in the business plans of automakers as well as a sustainable revival of the economy to see any revival of the A-segment in India for the next 4-5 years.”

On the other hand, Vangaal is of the opinion that the segment will persist as the Maruti Alto holds significance in rural areas and mountainous regions with narrow roads.

“In India, there is still a considerable portion of the population that needs to transition from two-wheelers to four-wheelers, making the A-segment vehicle Maruti Alto / Renault Kwid is an essential choice for them.”

In terms of pricing, the Maruti Alto 800 base-variant is priced at Rs 354,000 and when one adds the RTO and Insurance price, it easily crosses the Rs 400,000 mark. In fact, the on-road price for the Alto 800 comes to Rs 413,243 in Mumbai. Compared with the per capita income in India which stands at $2,450 or Rs 202,051.

Future of A-segment cars

It is easy to argue that there has been a huge pickup in sales of SUVs and premium vehicles as a sign of customers now moving to higher-valued vehicles and hence automakers are focussing on meeting their needs.

“The segment has the potential for revival through an increase in first-time buyers and the introduction of new vehicles exclusively targeted at this segment,” quips Vangaal.

Chattopadhyay too believes that “The sheer potential numbers of the A-segment will ensure the latest safety and emission regulations can be met at the right price point for the prospective buyer. Automakers have to stop using the bogey of prices going up to justify no investment in this segment as they do not make enough profits. Maybe someone will come and upset the applecart for these automakers.”