Cummins India has announced its financial results for Q2 FY2024, with revenue of Rs 1,871 crore, down 3 percent YoY. The net profit on the other hand grew by 30 percent YoY at Rs 329 crore.

Commenting on the results, Ashwath Ram, MD, Cummins India said, “The Indian economy remains resilient to geopolitical events, softening demand in developing economies, and inflationary trends both in India and worldwide. GST collections continue to remain strong, indicating underlying trade activities. Index of Industrial Production (IIP), PMI, etc., are indicating a reasonably stable economic outlook. The impact of deficient and uneven monsoons on the economy, especially the rural economy, is yet to play out fully.”

He further stated that the stable fiscal and monetary policies, the government’s continued emphasis on infrastructure development, and PLI led capex is keeping the economy on course for growth in the range of 6.3% to 6.8% based on various estimates.

“Geopolitical events, especially further escalation of conflict in the Middle East, fluctuations in crude oil prices, rising US Bond yields, and their impact on capital flow are a few key watchouts. Cummins India continues to execute its profitable growth strategy and is well-positioned to meet the demands of its end markets,” added Ram.

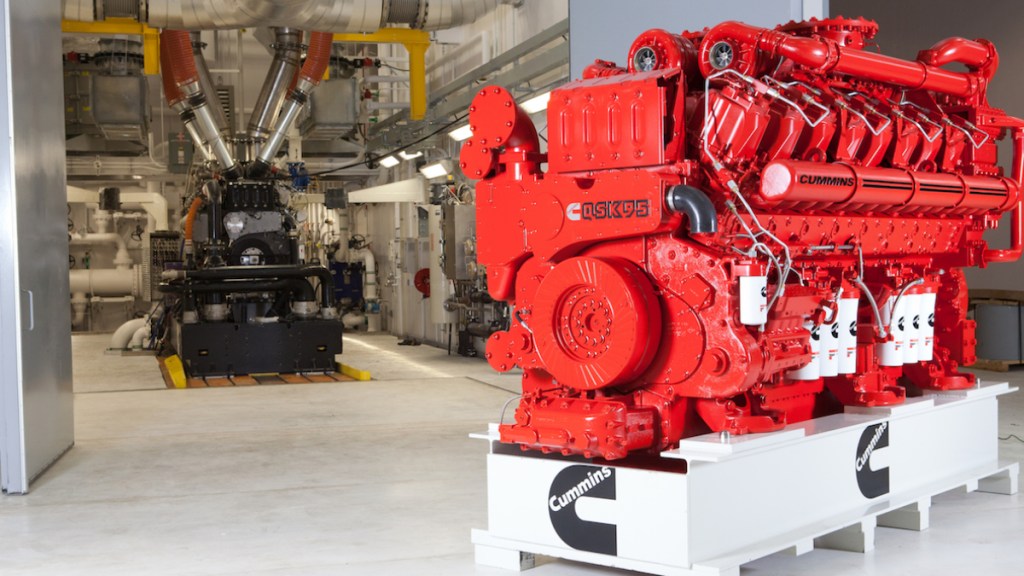

The company recently launched the CPCB IV+ emission norms-compliant products in the market. The prior two quarters witnessed some demand shifts as both CPCB II and CPCB IV+ products that are allowed to be sold till June 2024.

He expects the demand to normalise and sustain for the rest of the year. With most of the developed market experiencing slowing demand, Cummins India is closely monitoring its end-market conditions.

“Although the geo-political events, ongoing conflicts, and their impact on supply chain conditions continue to be unpredictable, the company is confident and well-prepared to tackle challenges. The company continues to have prudent capital allocation and cost management and has a strong balance sheet and cash position. We remain optimistic about the company’s prospects for continued profitable growth,” concluded Ram.