In today’s uncertain economic climate, financial planning is no longer a luxury; it’s a necessity. With rising living costs, volatile markets, and changing job dynamics, managing money wisely has become central to achieving financial security. Experts believe that personal finance, when approached strategically, can empower individuals to take control of their future and reduce financial stress.

Experts recommend starting with a clear assessment of one’s financial situation. According to a 2024 report by the Reserve Bank of India (RBI), nearly 70% of Indians still rely primarily on informal methods of saving rather than structured planning, a gap that highlights the need for better financial awareness.

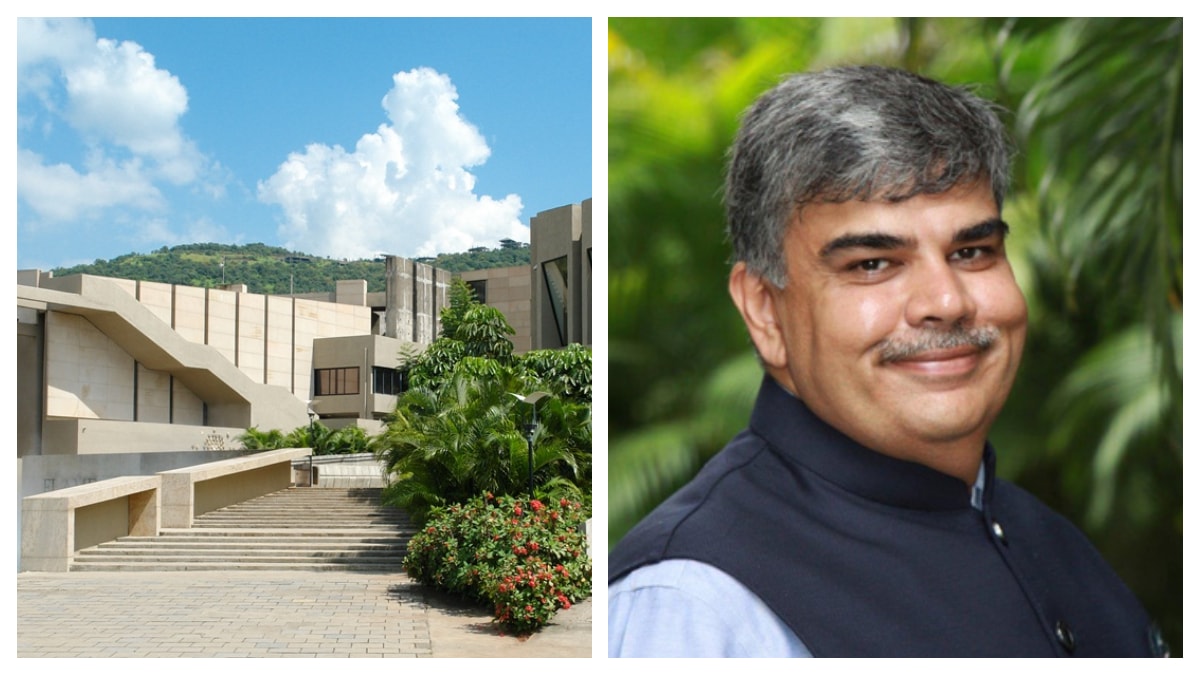

A new entrant, HandaUncle.com, founded by educator-turned-entrepreneur Ravi Handa, aims to democratise financial planning through artificial intelligence. The advisory platform claims to merge automation with financial literacy for everyday users. “India’s middle class deserves access to honest, jargon-free financial guidance, not products sold for commission,” said Handa, Co-founder of HandaUncle.com. At its core, the platform functions as an AI financial assistant that simplifies personal finance in conversational form. Users input their financial goals early retirement, child education, or tax optimisation and the AI generates step-by-step savings and investment plans. It also prepares downloadable summaries and adjusts plans as markets evolve.

Handa emphasise that financial education should begin early, ideally during school years. When children learn concepts like budgeting, saving, and compound interest early on, they develop a healthier relationship with money. Introducing financial literacy in school curricula can empower future generations to make smarter financial decisions, reducing the likelihood of falling into debt traps later in life.

HandaUncle claims that it differentiates itself by offering commission-free investment recommendations. A key part of HandaUncle’s edge lies in its early collaboration with engineers from the Scaler School of Technology (SST), a new-age institute for UG in Computer Science and AI. The founders initially engaged with SST through remote engineering interns whose work impressed them enough to base their operations at the Scaler Innovation Lab. The association provides HandaUncle with access to a growing pool of young engineers working on AI and personalization models, allowing the startup to scale quickly while maintaining quality.

The power of budgeting

As per Handa, a solid financial plan begins with budgeting. By tracking income and expenses, individuals can identify spending leaks and set aside funds for savings and investments. A 50-30-20 rule allocating 50% of income for necessities, 30% for discretionary spending, and 20% for savings offers a balanced framework.

Data from the Association of Mutual Funds in India (AMFI) shows that SIP investments touched Rs 20,000 crore monthly in 2025 – a reflection of growing investor confidence.

“Financial planning is not just about saving money – it’s about building freedom, security, and confidence in one’s future,” he concluded.