L&T has been gearing up for a mega naval submarine project- 75I. How do you look at P 75I in terms of key technologies for building next-generation submarines?

J. Patil: L&T has a proven track record in Submarine building. This has been built over the past nearly four decades starting with the indigenous development of Equipment & Systems across Float, Move and Fight segments as well as the manufacture of submarine grade special low alloy steels for plates & forgings to construct complete platforms.

L&T made a difference in the development of wide-ranging technologies, jigs, fixtures, tooling, digital systems, integrated shipbuilding 4.0 practices for building the underwater platforms inhouse without seeking ToT for the development of platform-specific equipment and systems, construction of pressure hulls, other structures, outfitting, system integration, trials, etc. These proven capabilities grant us the unique ability to build submarines with unmatched indigenous content and efficiencies.

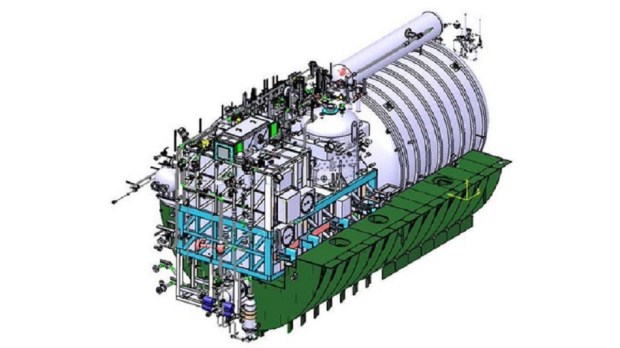

Also, a little over a decade back, we partnered with DRDO (as prime integration partner) for the indigenous development of the Fuel Cell Air Independent Propulsion (FC-AIP) System – the crucial technology to enable conventionally powered submarines to dramatically reduce indiscretion rates and operate without surfacing for 2-3 weeks up from 2-3 days. The land-based prototype of this FC-AIP has been under rigorous testing for a couple of years and today it is ready to be “Navalised”, and integrated into conventional submarines currently in service as an add-on capability.

Leveraging the track record we gained over decades in detailed engineering and manufacturing design of underwater platforms, L&T has today accomplished the in-house design of a Midget Submarine, starting from first fundamentals, basic design, and technical design and had it certified by an international class society. We are currently pursuing detailed engineering and manufacturing design of the same, awaiting a launch customer to begin construction.

L&T remained focused to be ready for participating in P75(I) program right from the CCS approval of the Naval plan to build 24 conventional submarines (later pruned to 18), and more so from the first RFI issued by MoD for the P75(I) program, nearly one and a half decade back.

After the re-issuance of the same about a decade back, MoD decided in May 2017 to pursue the acquisition under the Strategic Partnership Model (chapter VII of DPP-2016). In response to the EoI of June 2019 detailing our technological capabilities, infrastructure, and financial strength, L&T was shortlisted by MoD as a potential Strategic Partner along with MDL.

Key technologies that will take India further ahead by building P75(I) submarines are the FC-AIP and Lithium-ion batteries, besides better stealth characteristics. It is noteworthy that few among the submarine-building Nations have proven FC-AIP and just one with a proven Lithium-ion battery solution, while others are working to mature either/both these technologies.

Therefore, the P75(I) program, targeting the integration of these technologies from a Foreign Technology Partner under ToT, will provide state-of-the-art platforms to Indian Navy.

Being the first program under the Strategic Partnership model with MoD leadership staying committed to its success, we are confident that the SP model will leverage indigenous competence, capabilities and track record to attain an unmatched level of Indigenisation over previous conventional submarine-building programs.

With the mandated commitment of the Strategic Partner, P75(I) shall also be the last submarine-building program to be pursued under ToT to ensure that India becomes self-reliant.

The P75I is also marked under the strategic partnership which requires a foreign partnership with capabilities like AIP systems among other advanced naval tech. How does it fit into overall ecosystems?

J Patil: It is important to note that while pursuing P75(I) program under the SP model, India is currently, maturing her own (DRDO-L&T) FC-AIP and the same is a step away from being Navalised, Integrated and Proven onboard a naval submarine over coming few years to grant India technological independence wrt to FC-AIP technology.

It is well known that India’s Strategic Program has built the required wide-ranging ecosystem across technological domains to attain very high levels of indigenisation. In addition, having built 8 Conventional Submarines in India under ToT from two nations over the past four decades (the last submarine under the P75 program is about to be delivered), and acquired 10 submarines from USSR / Russia, India has created a well-oiled ecosystem to operate, maintain and provide Through-Life support to the fleet of conventional submarines. This ecosystem spans Naval dockyards, DPSUs, and Private Industries with the participation of Large, Medium and Small Industries.

The Strategic Partners will leverage the existing indigenous ecosystem not only in building the P75(I) submarines but to provide Through-Life-Cycle Support. It is noteworthy that the program can not only achieve the mandated percentage of indigenisation but deliver a multiplier effect to our economy through Manufacturing as well as the Services sector ecosystem including a large number of MSMEs and create new jobs.

Recently, a German entity, Thyssenkrupp Marine System proposed the design and engineering of vessels with Indian partners. What is technology collaboration in this case?

J. Patil: ThyssenKrupp Marine System (TKMS) is one out of five Foreign Technology Providers shortlisted by the MoD for providing ToT for the P75(I) Program. The SP model calls for the Indian SP to make a bid for the Program by teaming with a Foreign Technology Consultant (FC). Therefore, the SPs have to select an FC of their choice and bid for the Program. As understood from recent media releases Thyssenkrupp has teamed up with MDL for pursuing the P75(I) program.

The FC is expected to provide the design of a proven platform forming the basis of the Submarine offered to Indian Navy after incorporating the Navy’s requirements and provide ToT and/or license to the SP to produce the same in India. The range and depth of ToT as well as the extent of support services needed by the SP is a matter between the SP & the FC to evolve and agree to, based on which the SP would make a bid for the program.

Currently, 47 out of a total of 49 ships and submarines ordered by the Navy are being constructed in Indian shipyards. What is L&T’s share of shipbuilding now and what is the expectation, including the export potential?

J. Patil: Against orders placed in the last five years, at present 47 out of a total of 49 ships ordered by the Navy, 10 Ships ordered by the Coast Guard and 1 DRDO Vessel are being constructed in Indian shipyards. These 60 Ships have been ordered against 13 contracts under 12 programs (worth ~Rs. 71k Cr) of the Navy that were ordered on Indian Shipyards. Of these 40% of order value was nominated to DPSUs. Hence, 60% is left for Indian Shipyards to compete for. This is a huge improvement over the 89:11% mix of nominated to competitive RFPs (by Value) for all Naval, Coast Guard & DRDO Vessels ordered by MoD since the opening of the Defence sector for participation by Indian Industry.

Out of the 58 platforms under construction, L&T has won 6 ships (2 Multipurpose Vessels, 3 Cadet Training Ships, both for the Navy & SPACE for DRDO), while GRSE selected L&T as a PPP partner for the construction of 3 Large Survey Vessels and 4 Shallow Water ASW Crafts. Thus L&T is involved in building 13 Vessels. Thus L&T’s share is 22 % by numbers and 6 % by Value of total ships under construction for MoD.

During this period, we also built and exported 5 High-Speed Ships to a friendly country of India and supplied full kits and empowered a local shipyard in that country to build 7 locally, as also exported 1 vessel to US Navy for gifting to the Chilean Navy and 1 to Ghana Navy. Besides, L&T shipyard’s modern infrastructure with 21500 Ton Shiplift is serving Indian Navy and Coast Guard with refit/repairs of a large number of ships (20 over past five years). We are privileged that L&T’s Shipyard has also been selected by USN as well as USNS vessels for Voyage repairs and refit of their vessels and as of date three vessels have been churned out by our yard over the past year.

Currently, major Capital shipbuilding programs for Indian Navy as also multiple acquisition programs for Coast Guard are in order as well as AON pipelines. We also see strong opportunities for auxiliary vessels on the export front. These should get concluded in the next 3 to 4 years time. We also intend to increase our market share, subject to the restriction of the nomination of programs by MoD.

L&T is heavily focusing on the close-in weapon system, radars, command control, guns Artillery Guns and system. Could you elaborate as to how do you plan to execute such a diverse range of complex military projects?

J.Patil: L&T entered the Defence sector four decades back as a sequel to our deep engagement in other strategic sectors, Nuclear (1960s) and Space (1970s). Those days the Defence sector was not open to production in the Private Industries, however, DRDO enabled us to work with them on technology and product development programs to build prototype systems across segments. Followed by early successes in integrated weapon systems development for DRDO, Indian Navy trusted L&T with the development of a wide range of indigenous Weapon systems followed by engineering equipment. Thus, over the years, L&T emerged as a trusted partner to DRDO and Indian Navy. Post Kargil Govt of India opened up the Defence sector in 2001 for Private Sector Participation in Defence Production and licensed it in 2002.

In a similar approach, we remained committed to the Navy and provided unflinching support in proving and acceptance trials for the Naval equipment and systems, onboard operational as well as new build warships. Therefore, it comes naturally to L&T to handle complex, a system of systems and platforms end to end from concept design to realisation to induction. Thus L&T is today a player in platforms such as Submarines, Warships, Armoured Systems, Artillery Systems, a wide range of Weapon Systems and Engineering Equipment across tri-services, Radars, Military Communication, Sensors, Avionics, Command & Control Systems, Fire Controls, Integrated Platform Management Systems, etc.

Knowing well the value of through-life-support to the Armed Forces on one hand and our ever-growing list of equipment inductions on the other, we extended our offerings to encompass Womb to Tomb journey from basic design and R&D to on-site support, with multiple unmatched success stories under our belt.

This gives us the ability to concurrently handle a wide range of complex projects simultaneously, in different work centres without loss of focus.

What is the current state of the light tank Zorawar and trials in the high-altitude mountainous? What is the expected order and production timeline?

Patil: L&T initiated the concept design of the Light Tank in 2019 and began discussing the same with DRDO. Working together closely, this teaming evolved multiple concept designs of varying weight classes. Concurrent with the process of evaluation of partnership options and the Industry partners, as per the DRDO process, and placing a development contract on L&T in early 2022, the basic design option for the Light Tank was finalised.

After multiple iterations, simulations and reviews to make the design robust, hardware production for the Prototype was initiated about a year back in June 2022. The Prototype assembly and integration began a few months back and is currently in an advanced state and we expect the Tank will be ready for internal trials in the coming couple of months. We expect to conduct Technical Trials, and User Assisted Tests and Trials in plains, deserts and High-Altitude Mountainous terrains thereafter.

Having been associated with extensive trials of K-9 Vajra Tracked SPG in high-altitude mountainous terrains, L&T has gained invaluable experience and the same has been factored-in in the design of the Light Tank while the design was being evolved. It is relevant to note that the K-9 Vajra High Altitude version adaptation was pursued suo-moto through in-house R&D efforts and offered to the User. This proactive effort was rewarded by the User by ordering the high-altitude kits, post-trials.

Knowing the well-set MoD processes, the Light Tank order should be a reality over the coming 2-3 year horizon followed by serial production.

Have you received further orders for the K-9 Vajra-T gun at the Larsen and Toubro Armoured Systems Complex at Hazira?

J. Patil: Repeat order for K-9 Vajra-T Guns is currently in the acquisition pipeline and we expect contract conclusion during the current Financial Year.

The government has pointed out that private industry’s investment in R&D is utterly low for developing military platforms. What is your take on this? What is the policy uptick required from govt. as military innovation is the key to economic growth besides security?

J. Patil: While the government’s take on low R&D spending by Industry is in-general right, L&T is truly an exception.

Over the four decades, L&T Defence developed more than 300 equipment & systems, technologies, solutions, and platforms of which more than 2/3rd have been through in-house R&D, design development and more than 80 programs as development partners to DRDO.

It is therefore natural for L&T Defence to invest 20% of our gross cash earnings in R&D. The quantum of development projects at hand totals about 15% of our current revenues.

This is the reason L&T is a long-term partner of trust to India’s Scientific establishments across the Strategic Sectors (DAE, DoS, DRDO) and has been deeply entrenched in Programs of National Importance. It is also relevant that L&T’s own in-house portfolio of products, systems, technologies, solutions and platforms are designed and developed in-house from first fundamentals with just a few exceptions where we teamed up with Foreign OEMs but led from a position of strength as prime contractors, saw the equipment through FETs. The only program-level exception to this has been the Towed Gun Program where the MoD’s categorisation disallowed an Indian Company to bid as a prime contractor.

Globally, governments provide significant tax incentives to Industry for expenditure on research and Development to ¬foster innovation, technology & Product Development. Even in India GoI policies are used to encourage R&D by providing Tax incentives to Industry through accelerated Tax deductions, if done in DSIR-approved R&D labs. While on the one hand, GoI funds R&D departmentally, the announcement of gradual withdrawal of R&D incentives to the Industry was made in 2015 and since 2016, the accelerated weightage was reduced from 200% to 150% and to 100% (no incentivisation) in 2020.

While Income Tax rates were indeed cut by GoI in 2020 to make India competitive, the PLI scheme began getting introduced for targeted production in select segments of Industry, the vital backbone of the Make-in-India initiative, the Defence Sector players lost Tax incentives on R&D, was not considered for PLI, and no program under Make-1 category (Joint funding of Design and development programs by MoD and Industry) was concluded by MoD since the introduction of this category in 2006. The defence R&D funding thus remained exclusive to R&D being done departmentally in DRDO.

Realising this, MoD began funding startups under IDEX, IDEX Prime and TDF scheme (through DRDO), seeing early gains under these schemes, however, no major platform technology or product development is yet funded / grant authorised to fund the same. It is also relevant to note that Govt notification that Industry funding Academia and recognised R&D establishments can be considered as CSR expenditure / deductible to Tax as an expenditure.

On 1st Feb 2022, while announcing the Union Budget for FY 22-23, the finance minister made an announcement of the allocation of 25% of Defence R&D expenditure to fund Defence R&D in Industry, Startups and Academia. While MoD facilitated multiple discussions on the modus of granting these R&D funds to the Industry including the Make Programs, SPVs, etc, as of date no allocation has been disbursed under the scheme.

There is an urgent need for policy intervention to actively facilitate and promote R&D in Industry, especially for major platforms. The Intellectual property developed as part of such developments will not only enable India to become AtmaNirbhar, it will enable us to unrestricted exports to the world and gain Strategic Independence.