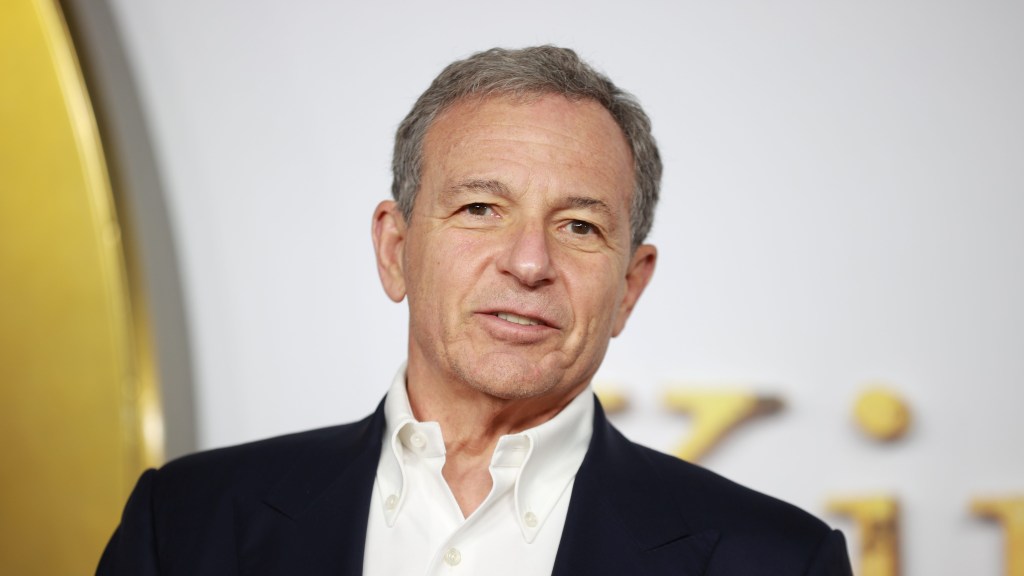

Activist investor Nelson Peltz’s contentious proxy battle against Walt Disney culminated at the company’s annual shareholder meeting on Wednesday with Chief Executive Bob Iger and other company directors emerging as victorious.

The decision to re-elect all 12 members of Disney’s current board members, was announced at the company’s annual shareholder meeting, concluding a high-stakes battle initiated by billionaire Nelson Peltz and Blackwells Capital.

“With the distracting proxy contest now behind us, we’re eager to focus 100% of our attention on our most important priorities: growth and value creation for our shareholders and creative excellence for our consumers,” CEO Bob Iger said in a communique.

Following the announcement of the results, Disney shares plummeted by 1.6% to $120.86 during afternoon trading.

Peltz, CEO of Trian Fund Management, and Blackwells were seeking five seats between them on Disney’s board. The activists contended that the $225 billion media company had mishandled its CEO succession planning, lost its creative edge, and neglected to effectively utilise new technology.

“All we want is for Disney to get back to making great content and delighting consumers and to creating sustainable long-term value for all of us,” Peltz mentioned before the results were announced.

“Regardless of outcome of today’s vote, Trian will be watching the company’s performance,” he added. Notably, Iger received the backing of 94% of voting shareholders while Peltz was supported by 31%.

How it all started: A backgrounder

It all started in November 2023, when Peltz re-launched a shareholder campaign against Disney, months after a brief attempt early that year.

Through Trian Fund Management, Peltz nominated himself and Jay Rasulo (Disney’s CFO) for a seat on the board. Disney fiercely opposed this move.

Peltz’s core argument hinged on Disney’s management allegedly neglecting to address sluggish earnings growth and underwhelming return on investment. He bolstered his case by pointing to Disney’s nearly 50% decline in earnings per share between 2018 and 2023, and subpar returns compared to the S&P 500 over the past five years.

To note, Peltz’s hedge fund along with former Marvel Entertainment chair Ike Perlmutter, holds $3 billion worth of common stock in Disney. Through various open letters, Trian Fund emphasized the loss of tens of billions in shareholder value, decreased consensus earnings estimates for the next couple of years, and unsatisfactory studio content as key reasons behind their advocacy for change within the company.

However, the timing of Peltz’s renewed campaign could have been better, as Disney recently reported its strongest quarter since 2019, marked by robust earnings, reinstated dividends, and projected increased cash flow for the year. Analysts praised CEO Bob Iger for prioritizing financial health, especially evident in narrowing streaming losses.