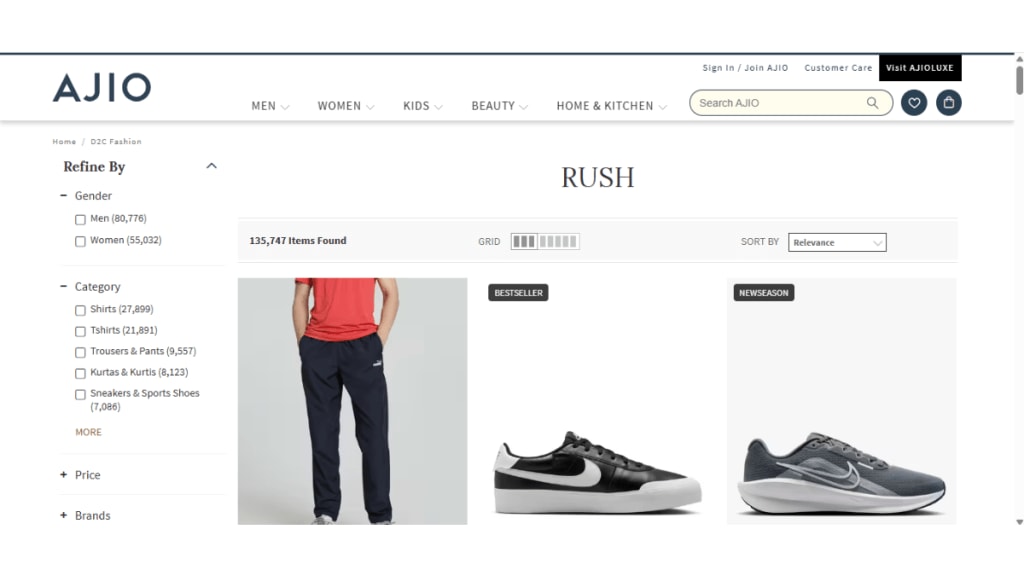

Reliance Retail Ventures Ltd (RRVL) has forayed into the fast-growing fashion quick commerce segment with the launch of Ajio Rush, a four-hour delivery service that went live in the first quarter of FY26. The service is currently operational in six cities and offers more than 1.3 lakh style options, targeting young, fashion-conscious consumers with a need for speed.

Broader digital commerce strategy

Part of Reliance’s broader digital commerce strategy, Ajio Rush aims to blend rapid fulfilment with scale and efficiency. According to the company’s Q1 earnings report, the service is already delivering strong unit economics, driven by higher-than-expected average order values and lower product return rates. While Reliance has not disclosed the standalone revenue figures for Ajio Rush, it reported that revenue from new customers on its marketplace grew by over 150 basis points year-on-year, now contributing 18% to overall digital commerce revenue.

Ajio’s overall product catalogue has also expanded significantly, growing 44% year-on-year to 2.6 million stock-keeping units (SKUs), underscoring the company’s ambition to consolidate its position in fashion e-commerce.

Ajio Rush follows a similar express delivery pilot launched by Myntra in 2024 under its M-Now initiative, offering deliveries within 30 minutes to two hours. It also enters a market already seeing traction from digital-first brands such as Slikk, Newme, and KNOT, all of which are experimenting with rapid delivery models to serve Gen Z consumers and their impulse-driven buying habits.

Startups lead the way, but challenges persist

The launch of Ajio Rush comes as India’s fashion Q-commerce space gains momentum. Myntra, owned by Flipkart, had piloted its M-Now express delivery service last year, promising fashion deliveries within 30 minutes to two hours. Several digital-first brands—such as Slikk, Newme, and KNOT—have also entered the space, catering to Gen Z’s growing preference for on-demand fashion.

Investor appetite remains high despite early volatility. Slikk raised ₹83 crore ($10 million) in May 2025 from Nexus Venture Partners and Lightspeed to fuel its 60-minute delivery format. In the same month, Snitch secured ₹332 crore ($40 million) from 360 One Asset, and Newme raised ₹149 crore ($18 million) from Accel, Fireside Ventures, and AUM Ventures.

Not all ventures have scaled successfully. Fashion Q-commerce startup Blip shut down within a year of launch, citing funding hurdles and operational bottlenecks. Industry watchers believe future growth will likely stem from hybrid models combining online convenience with offline trust.