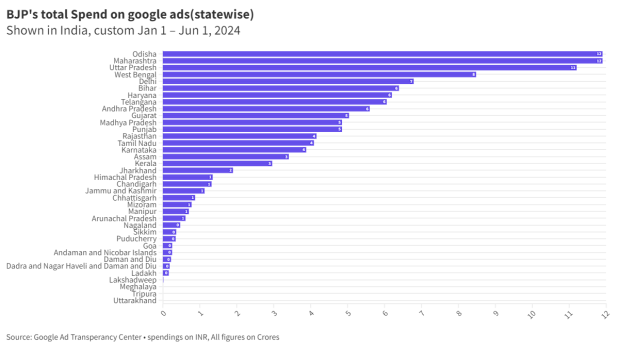

This year’s Lok Sabha election results beat all exit poll predictions. It was perhaps one of the most exhilarating days for many Indians, as the outcome was against all popular notions. What this also means is that news channels were able to keep the audiences glued to the end. “This election, there was an increase in spending by local regional parties especially in states such as Andhra Pradesh, Uttar Pradesh and Maharashtra. The messaging was local with regional issues highlighted, which worked for these parties,” L V Krishnan, CEO, TAM Media Research.

The television advertising market is expected to grow at a CAGR of 3.6% to reach Rs 33,000 crore by 2026, as per the FICCI-EY report. In 2024, television advertising, particularly in news.

The report stated that TV is expected to rebound due to the occurrence of the general election. Government ad spending, both at the state and national levels, was initially low, but with elections approaching, spending has gradually increased, it said.

Grabbing Eyeballs

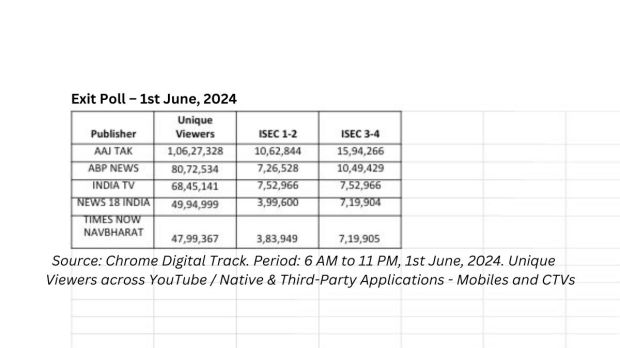

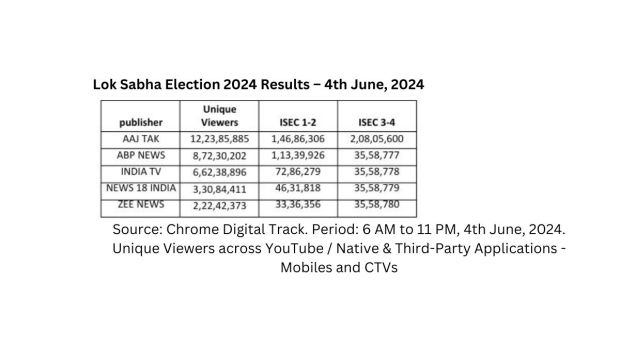

To be sure, news channels were able to grab the attention of, and data says it all. This could be easily attributed to the fact that news channels ramped up their efforts across content, advertising, and to capture the heightened interest. In terms of content consumption trends, this period saw the highest engagement as viewers tuned in after work to catch up on election updates, debates, and analyses. Additionally, there was a notable spike in viewership on counting days and during major announcements or debates, as per data from Chrome Data Analytics and Media, a market research firm. Case in point – on the date of the Exit Poll that is, June 1, 2024, India Today Group-owned Hindi news channel AAJ TAK’s total unique viewers stood at 1.06 crore, as per data by Chrome DM. The total count of audiences which fell in the socio-economic classification between one and two stood at 10.62 lakh, while between three and four stood at 15.9 lakh. “English News Channels were primarily viewed in urban and metropolitan areas with higher English-speaking populations, such as Delhi, Mumbai, and Bangalore. Overall, the combination of comprehensive coverage, language accessibility, and relevance to local and national audiences drives the viewership patterns observed during the elections,” Pankaj Krishna, founder and CEO, Chrome Data Analytics and Media, said.

Typically, Hindi news channels see the most traction compared to regional and English news channels. This is because Hindi is widely understood and spoken across a significant portion of the country, making these channels accessible to a broader audience. The peak viewership time band for all genres of news channels, including Hindi, regional, and English, is typically the morning and evening primetime, that is, between 6:00 am-9:00 am and 6:00 pm-10:00 pm, respectively. Major cities like Delhi, Mumbai, Bangalore, Chennai, and Kolkata tend to show high engagement, especially on Hindi and English news channels, as per the findings by Chrome DM. Meanwhile, state capitals and regional hubs such as Lucknow, Patna, Hyderabad, and Ahmedabad, also exhibited significant viewership, particularly for regional news channels. Moreover, Hindi news channels were dominant in northern and central India, including cities like Delhi, Jaipur, Lucknow, and Patna. Regional news channels showed high traction in their respective states, that is, Tamil news channels in Chennai, Telugu news channels in Hyderabad, and Bengali news channels in Kolkata.“The audience and viewership growth during these elections also drew in advertisers from across categories. This has translated into ad spend growth throughout the election season and especially on crucial days like counting day,” Neeraj Kohli, CEO, Asianet News Network, said.

Let the money do the talking!

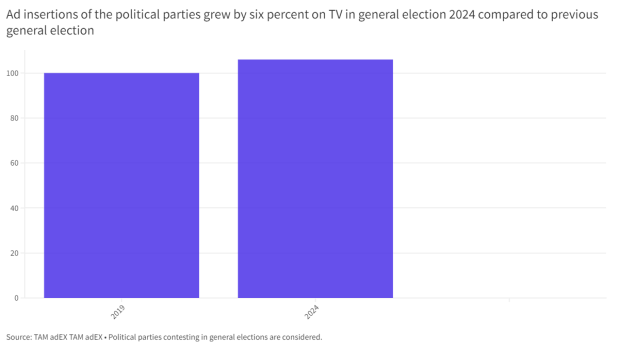

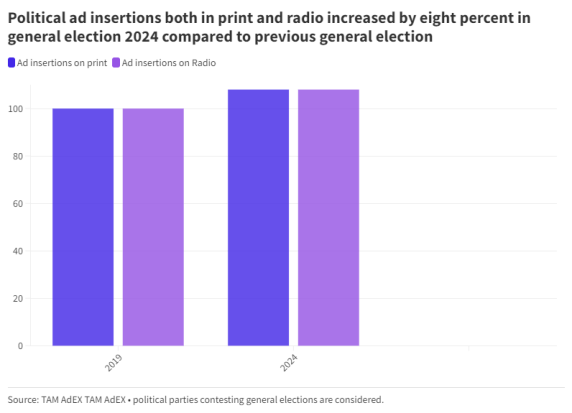

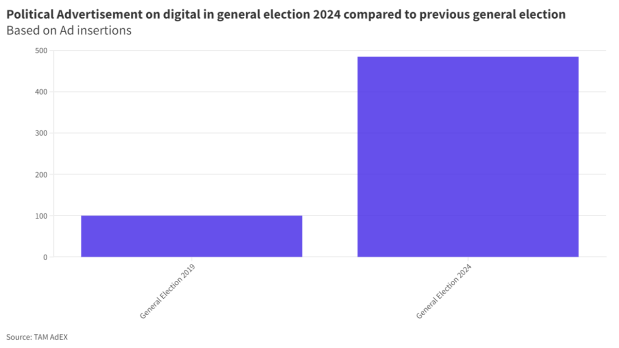

To be sure, all formats of media saw political parties spending increase. Case in point – ad insertions of political parties grew by six percent on TV in 2024 when compared with the Lok Sabha Elections of 2019. Similarly, print and radio posted an eight percent increase, each, respectively, as per data revealed by ADEx India (A Division of TAM Media Research). Meanwhile, political ads on digital surged by 4.8 times during 2024 when compared with 2019. “While digital has seen a tremendous increase with YouTube playing a key role, this election print medium too got its due,” a senior media planner said on the condition of anonymity.

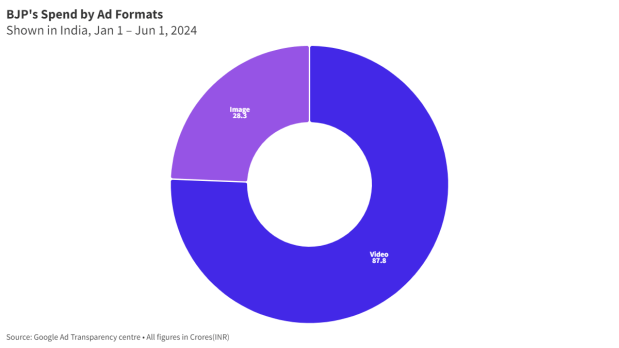

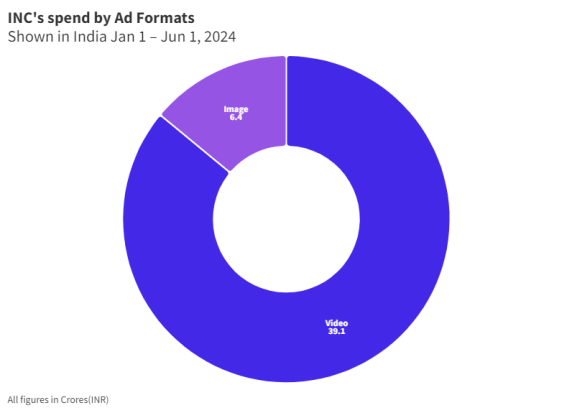

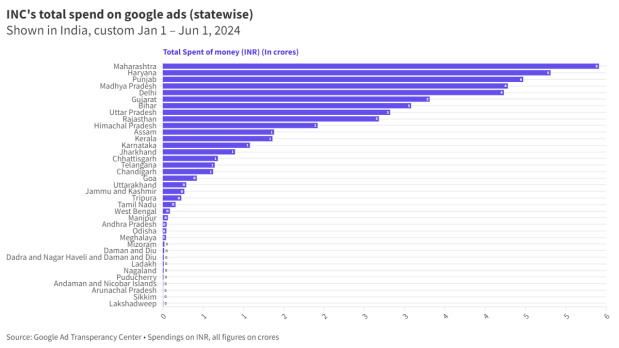

To provide a perspective, the ruling party the Bharatiya Janata Party (BJP) which released a total of 1.84 lakh ads spent Rs 116.1 crore between January 01-June 01, 2024, as per Google Ads Transparency Center, compared to the Indian National Congress party spent just Rs 45.4 crore during the same period. Interestingly, within digital video remained a sweet spot for both parties. Of the total spent the BJP spent 75.6% on video while the INC spent 86%. Industry experts opine that between 2019 and 2024, ad spending on digital grew at a CAGR of 20% has been steeper versus other media. Naturally, spending on digital during these elections has followed a similar trend and seen relatively higher growth. “However, when it comes to advertising during elections, media planners are increasingly taking an audience first view rather than treating each media as separate. In this context, TV offers a large reach and works well for national and state-level messaging. Digital, which offers sharper targeting, is leveraged for more customised and localised advertising,”Kohli of Asianet News Network Pvt, said. He further claimed that with a cumulative audience of 150 million across various platforms, Asianet News Network’s digital and TV brands have both seen healthy growth in ad spends during this general elections cycle versus 2019.

Meanwhile, as per the AdEX data, the BJP dominated the general election campaign advertising on TV with 38% share in 2024. What is to be noted here is that in 2019, the BJP stood second in terms of ad duration share on TV with 30.6% share, that is the BJP had 0.5% share less than Congress in 2019. This year, however, INC stood second with a 35% share, while

Shiromani Akali Dal has a seven percent share, followed by YSR Congress Party and DMK at four percent each, respectively. Over the years, the amplification of political ads across both traditional and new media has steadily increased. For the seven-phased election in 2024, advertising strategies were tailored to target regional pockets. With the Indian youth as a clear focus, there was a notable shift to digital media, resulting in a sharp increase in spending by political parties,” Vinita Shah, Senior Media Consultant said.