India has been known as a market for sachets for ages. That was perhaps one of the most successful inventions of consumer product goods companies like Hindustan Unilever (HUL) with its sachets for shampoos. The benefit was consumers could buy small packs at as less as Rs 3-10. Now the same has been adopted in the online gaming industry in the form of microtransactions. Microtransaction seems to have reshaped the way how games are played and monetised. The online microtransaction market size was valued at $84.76 billion in 2023 and is expected to reach $207.7 billion by 2030, as per Verified Market Reports, an advanced analytical research and consulting firm.“ Developers create many games and target multiple kinds of profiles. Some users invest money to win more real-world money. On the other hand, some pay for a better gaming experience. So the second category of gamers will pay via microtransaction models to enhance their gaming experience. 20 years ago, who used to buy mouse-pads, are now buying in-app content,” Sreedhar Prasad, start-up adviser and former partner at KPMG told BrandWagon Online.

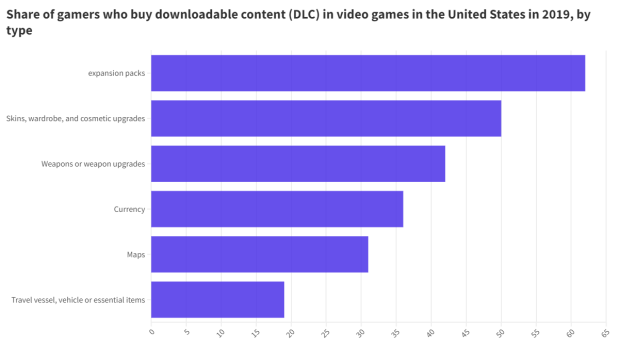

Downloadable content is a way of enhancing the video gaming experience for the players by giving them access to exciting new content which can range from purely aesthetic changes to upgrades to characters and items revealed data from market research firm Statista. During a 2019 survey of gamers, it was found that 62% of gamers spent money on expansion packs to gain more content to enhance the original game, stated the report.

Microtransaction vs advertising

To be sure, In 2023, the number of online gamers in India reached 455 million, among them almost 90 million gamers reportedly paid for online games, as per a recent FICCI-EY report. Esports and Casual games earned revenue worth Rs 3,800 crore in 2023 and are expected to earn Rs 6,700 crore by 2026. For experts, microtransactions have been more effective in keeping online games accessible to users as they pay based on need or usage, when compared with the paid-based app model where users need to pay a certain amount to download the game. “Players love getting lost in a game, and when they’re hooked, they’re willing to spend a bit here and there to enhance their experience. At Hitwicket, we’ve leaned into this model because it keeps the game accessible to everyone while giving players the option to invest more if they want to. Premium apps can work too, especially if you’ve got a strong brand, but microtransactions offer a steady flow of revenue and keep players engaged for the long haul,” Kashyap Reddy, co-founder and CEO, Hitwicket. Experts opine that users who have been engaged with the game deeply, spend on in-app purchases to enhance their experience. Furthermore, it is believed that microtransactions earn more, especially in games with high user engagement. “For example, in one of the previously developed projects, the difference is that the revenue from advertisements was good, but micro-transactions brought in 70% of all the money we earned. The deeper people are in the game, the more they spend on in-app purchases to enhance their experience. Ads do really well in hyper-casual games or at the initial stages of player acquisition. As players get more invested, microtransactions are the main revenue driver. This is the reason you see many top-grossing games like Royal Match ditch ad monetisation in favour of engagement-based IAPs,” Chirag Chopra, founder, Lucid Labs, said.

Besides immersive, experts argue that ads are often viewed as an intrusion. With transactions as a key element and in order to maintain break-free continuity, game developers often up the ante on microtransactions. “In terms of showing ads, there needs to be context too. A gaming app can show ads of headphones or any other products that matches the mindset of the player. For example, an user can happily see an advertisement of any sporting shoes but not a slipper. Because they will most likely be charged up while playing the game. For casual games, random ads might work out but not for high-intensity games. The player will lose interest then. Also the speed of ads matter too. Players, especially Gen-Z has very low patience. So, in such an environment, traditional ads will not work. Ads need to be as fast as the game. Micro ads can be really beneficial for both the developers and advertisers,” Prasad added.

Moreover, from what it is understood, with the right micro-transaction strategy, players dot not go back home with a feeling that they are paying to win or being taken advantage of. Instead, they are often left with the feeling that their experience has been customised by unlocking advantages and continuing to play in a way that fulfills their motivations and meets their willingness to spend. For instance, raids in during the gameplay of Clash of Clans is believed to a huge hit or unlock a new champion in a MOBA. “Game developers always have more control over Mmicro-transactions, since they can brainstorm and come up with new packs or reasons for people to spend. On the other hand, advertising revenue is very seasonal, with spends increasing during specific periods and not throughout the year. For most successful titles, micro-transactions account for about 60% revenue, whereas advertising accounts for about 40%,” Rohit Agarwal, founder and director, Alpha Zegus said.

Types of microtransactions

Typcially, there are three distinct types of microtransactions in gaming. The first one is called – Consumables and these include items that players use up and need to repurchase, like in-game currency or energy. It is believed that these tend to be the main revenue-driver for a game since engaged users are likely to buy them again and again. Second one is non-connsumables and largely comprises of one-time purchases that permanently unlock features, like characters or cosmetics. Third types are subscriptions which are recurring, often automatic purchases that provide users with benefits over time. Case in point: Clash Royale is game where one can categorise micro transactions in the game by consumables, non-consumables, or subscriptions. One of their popular items is packages of their in-game currency – called Gems. When engaged players want to buy in-game upgrades or items, they use this currency to enhance their gameplay. The game also offers other options, like skins and cosmetics. In this scenario, the game utilises consumables (such as Gems) and non-consumables (like skins and cosmetics).

Now the question is What type of miscrotransaction is the most popular one? “It depends from game to game, but based on experience, the most effective ones in terms of benefiting the developers are direct in-app purchases. For example, character skins, power-ups, and season passes. This offers clear value to the player and hence is a great way to build trust and long-term engagement. While loot boxes have their place, they can be more polarizing and sometimes face regulatory challenges. Ultimately, transparency is good for players; they respect this. Also, gifting them with something that is clear, immediate, and touchable brings better revenue and user sentiment,” Chopra added.

Is the future bright?

A recent Swrve report tracking 10 million players over 90 days found that only 2.2% made any purchases in F2P mobile games. However, this small percentage typically includes the most loyal and engaged players. This was highlighted during the Apple vs. Epic trial, where it was revealed that 70% of game revenue on the App Store comes from. Even if the volume of transaction is high, the universe is still small. And of course pricing plays an equally important role. “Once a game developer increases the price of premium content, fewer people will be interested in buying that stuff. So it is very experimental in nature. Depending on the advertising cost, developers should take a call regarding the pricing of the premium content. In my opinion, main problem is advertising cost to get a user. Platforms need to be experimental with the prices here, they should notice where they are getting the optimum numbers of users,” Afsar Ahmed, co-founder, Gameberry Labs said.

And yet, experts opine that it all depnds on the popularity of the game. “If the game is popular, audience will spend to get that ‘premium’ status. If the game is not so popular, audience will be hesitant to spend even the smallest amounts,” Agarwal added.

However, financial success can look a bit different when you realise one important feature about online game microtransactions – developers only keep 70% of what players spend on in-app purchases; the app stores take a 30% cut of each transaction. That means if a player spends $10.00 on a micro transaction, developers only see $7.00 in their bank accounts.