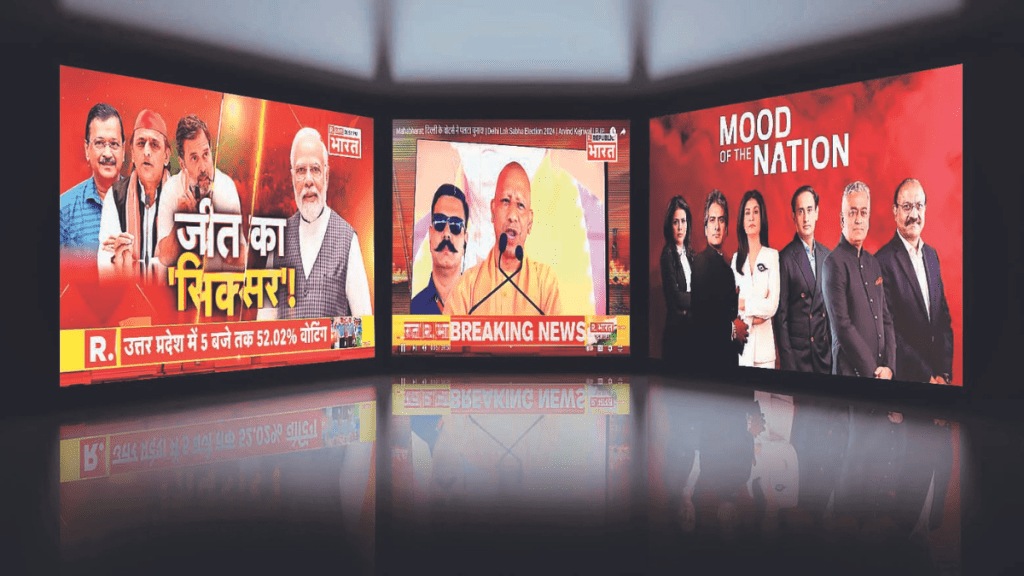

Few things capture India’s public imagination like a general election, cricket and Bollywood. As the poll season reaches its logical conclusion on June 4, TV news channels have been pulling out all the stops to cash in on the build-up to counting day. The general elections have historically been a boom time for news channels, with advertisers shelling out big bucks to capitalise on the heightened viewer interest.

During the 2019 general elections, TV news channels reportedly earned around 300 crore from advertising. Experts believe the news genre, across Hindi, English and regional channels, could possibly earn well over 300-350 crore this quarter. With an average inventory of around 20 minutes each hour on these channels, there is plenty of scope for ad revenue growth.

According to industry insiders, ad rates have seen a five to even ten-fold surge on some channels. Smaller channels that usually sell 10-second ad spots for an average of 5,000 now command a rate of 25,000 to 30,000. National Hindi news channels have hiked their rates to 70,000-90,000 per 10-second slot, compared to 10,000 in a non-election period. For certain popular primetime anchors, the show rates could go up to Rs 2 lakh per 10 seconds.

Big broadcast groups could earn 5-6% higher revenues this year vis-à-vis a non-election year, estimates Karan Taurani, senior VP at Elara Capital. “The TV ad market is somewhere around 30,000 crore, of which news channels account for 3,000 crore. We estimate that they can earn an additional Rs 200 crore revenue in the least during a general election year. Large broadcast players like the India Today group, which has roughly 30% of the news broadcast market share, could see close to 15-18% growth in the election quarter,” he says.

So where is this demand coming from? Vinita Pachisia, EVP for investments at Dentsu’s media investment arm Amplifi says that the spot rates for counting day have skyrocketed and are approximately 20-25% higher than the rest of the election season. “There’s a noticeable uptick in demand for the counting day, suggesting that rates may continue to climb,” says Pachisia. She says there has been a notable surge in advertising expenditure by some brands, with some of them spending 50% more than what they did in March. There has also been a last-minute scramble from a handful of brands that were sitting on the fence.

That said, observers say the revenue surge will come from higher ad rates than any big jump in volume. TAM data shows that while ad volumes on the news genre are largely similar to the 2019 election season, the number of categories and advertisers dropped this year by 11% and 22%, respectively. In 2019, over 430 categories advertised compared to around 380 so far this year.

Spending with caution

As per data from TAM Media Research, some of the categories that have been most active on news channels between January and May 2024 are cement, toilet soaps, auto/cars, spices, life insurance and retail outlets/jewellery brands. Though advertisers are upping their spends, there has been some level of caution by some brands that wish to stay clear of “polarising political content”.

“Moreover, there has been a 30% inventory load increase on key news channels for the period of April to the first week of May this year, over the January to March average. Closer to counting day, the demand is too high compared to the inventory available. There is also a lot of clutter and many brands are particular about the scheduling of their spots. News channels are sometimes unwilling to commit to specific time bands, which is why some advertisers stay away,” points out Vanita Keswani, CEO at Madison Media Sigma.

Mayank Shah, VP of Parle Products says that the brand is considering buying some air time on news channels in these last days of the election season, if there’s a good deal available. He dismissed concerns about polarising content, “Advertisers will not stay away from news channels now because closer to counting day, the content is largely focused on exit polls, analysis and predictions. From a content standpoint, advertising now on news channels makes perfect sense in the last week of the polls.”