It is often thought that if one is skilled at a certain task, there is a high probability, of her achieving success at that task. Case in point, almost every Indian thought that team would be unbeatable at this year’s recently concluded ICC World Cup. Yet Australia won. This proves that there is a certain element of chance in all kinds of games. And this is what seems to be one of the most hounding issues that the online gaming industry today is facing in India. “The first thing to understand is that without chance, no game can be won or lost. For us to be able to say that it is not a game of chance, we need to satisfy certain criteria. We follow six of these criteria such as if a skilled player consistently outperforms a random player, if a player deliberately can lose a match, do more skilled players consistently outperform less skilled players does more experience improves performance, and if there is a relative role of skill consistency. This is statistical so within certain tries, it goes below a certain number,” Dr Subhashis Gangopadhyay, research director- IDF and Dean, School of Liberal Studies, UPES, told BrandWagon Online.

While this hypothesis is yet to be tested, there is a popular notion at play that online gaming companies can invest in running these, to derive the results.

As per a recently released EY report, the online gaming market in India is expected to grow at a compound annual growth rate of 28%, with the market valuation at Rs 16,428 crore. Real-money gaming consists of more than 84% of the total online gaming market with a market valuation of Rs 13,596 crore.

Cybersecurity: a threat?

Gaming has come to the forefront of media and entertainment. However, the advent of technology has added security threats to the conversation of the already stressed space. The addition of technology to the online gaming space adds certain issues within the gaming sector which have not been a part of it in its existence. Money laundering, the evasion of taxes, and tracing the payment, among others, can be a deterrent for platforms and consumers. However, while there are disadvantages, there are also advantages that have been brought by technology in the online gaming space. “While online gaming space provides a rich and innovative experience, the traceability of online gaming platforms is a positive aspect of the space. Moreover, the advantage here for the government is that they can control it,” Dr Gulshan Rai, former national cybersecurity coordinator, Prime Minister’s Office.

Moreover, there are different levels of harm in the gaming and gambling space. The harms have been classified into three categories namely behavioural, financial and societal.

Behavioural harms or individual-level harms in gaming and gambling have been linked to content available on the service. Moreover, financial harm can range from money laundering to excessive behaviour, and behavioural addiction leading to financial losses. Furthermore, the advent of AI, disinformation, communications, messaging, and recruiting via new channels, are some dimensions that creep in, even into the gaming space have different functionalities for any game. “RTS-14 is a standard that mandates responsible product design aimed at minimising the likelihood that gambling software will exploit behavioural weaknesses. Similarly, there are various online tools like ‘Gamgard’ that assess a game’s structural risk levels,” Vivan Sharan, partner, Koan Advisory Group, said.

Taxation: a deterrent?

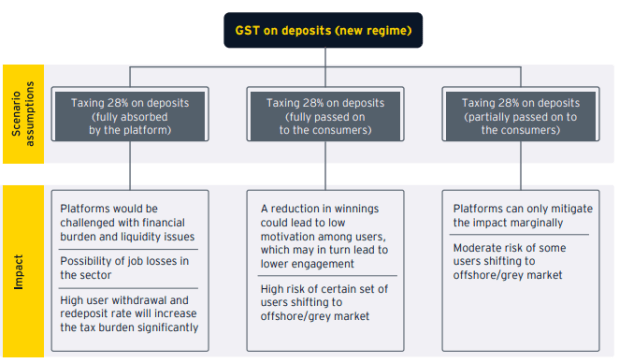

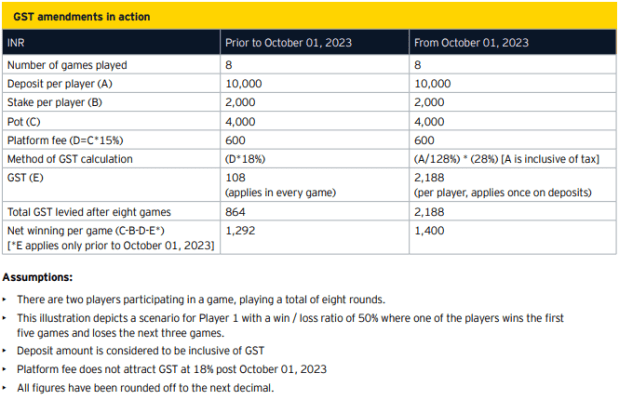

While gambling is putting something to chance and then winning, games of skill were classified based on requiring skill to compete in a game and then to win it. However, as per a unanimous decision of the 50th and 51st GST Council meeting, the government concluded levying a 28% tax on online gaming as a whole, blurring the lines between gambling and betting, and games of skill including casual games and fantasy sports among others.

The Public Gambling Act of 1987 provides states with a framework for determining the regulation of gaming, including betting and gambling, stipulating that the game of chance is prohibited while games of skill are exempted from the purview of this act. Gambling and betting is a state subject meaning that states have the authority to make laws and regulate betting and gambling within their respective jurisdictions. The judiciary has stepped in to uphold and safeguard the constitutionality of games of skill and adherence. The recent case of the Tamil Nadu government attempting to ban Rummy and Poker was overturned by the Madras High Court, stating that Rummy and Poker are games of skill.

The current taxation regime has resulted in a decline for the real-money gaming space as there is a decline in projections to 75.4% by FY28 from an 83% contribution in FY24. Moreover, RMG companies have been served retrospective GST show-cause notices for prior years with the department issuing tax demand notices of up to Rs 1.5 lakh crore to more than 40 companies including the likes of Gameskraft and Dream11, among others. “The online gaming environment in India is still at a nascent stage. Today the mechanism envisaged under the IT Rules to verify certain online real money games (RMGs) as permissible is yet to be set up. Once the regime is in place and the Self Regulating Bodies begin to verify online RMGs it would be easy to identify such online games of skill separate from other forms of online gaming. With this clear distinction, the government must then revisit the lumping in of all online gaming with gambling and tax it appropriately,” Hitesh Jain, managing partner, Parinam Law Associates, said.

Moreover, the Tax deducted at source (TDS) threshold of Rs 10,000 has also been removed with platforms bearing complete responsibility and liability for deducting 30% TDS on the net winnings. The TDS is to be deducted on every withdrawal or at the end of the financial year in case of no withdrawals.

As per the report, online real-money gaming companies are looking at reinventing operating models and business strategies for sustained operations and growth in response to the GST amendments. Media reports indicate that companies including MPL, Hike and Spartan Poker took to laying off their workforce to combat challenging unit economics and achieve sustainable growth.

Meanwhile, experts in India believe that while the implementation of any act – even Digital India Act is the center’s prerogative, at a state level, these governments can monitor. It has to be a PPP model where in the center, state and private organisations join hands to create a sustainable. According to Rai, there could be various monitoring centres or labs across states, which can keep a check on the activities across gaming platforms. “These platforms being online are fairly easy to monitor,” he explained.

India vs the world

India has been one of the fastest-growing markets in the world. However, India’s taxation laws in terms of the gaming space are the most stringent as compared to other countries such as Denmark, South Korea, Australia and the UK with Denmark levying 28% on gross gaming revenue (GGR) while the UK levies 21% on GGR. Most of these countries have no distinction between the game of skill and the game of chance while South Korea has no gambling tax, general corporate tax applies to the space.

While India continues to grow as a market in the online gaming space, the high valuation of taxation which is 28% on the full face value of deposits has led to a slowdown in the market. As per the EY report, India levies the highest tax globally on the online gaming space which is 28% on deposits followed by Poland at 12% and 8% for Portugal. Additionally, the report indicates that the industry stakeholders’ unit economics have been impacted by the GST amendment, bringing down profitability, and affecting investor sentiment. Furthermore, online betting platforms continue to be rampant in India making it hard for RMG platforms as the different classifications are constantly muddled. “It can be implemented by blocking websites directly through instructions provided to Internet Service Providers and the people hiding behind the anonymity of the website can be held accountable by directing the domain name registrars to disclose the details of the owner of the website. Such a system can easily be implemented and is often the relief obtained from courts in copyright suits to tackle online piracy. Regarding identifying which games ought to be banned the answer is simple. Betting requires the deposit and use of real money and such online real money games (RMGs) which are unverified could easily be banned after cross-checking its status,” Jain added.

It is further believed that the industry can follow a model as the likes of NCPI (National Payments Corporation of India) and SEBI (Securities and Exchange Board of India), which monitors companies which are listed on its platforms and whether it meet compliance or not. “Standard setting is an area we need to focus on. The center and the states cannot have fragmented standards. There needs to be one standard for interoperability,” Sharan, added.