It all started with newspapers, then it moved to video-streaming platforms and now the movie business to rolling out its subscription package, with PVR-INOX leading this. The movie exhibition company recently joined the bandwagon to launch its monthly subscription plan called PVR Passport. While the subscription model is new to India, it has been prevalent in the European continent and the US, however, the model differs. “PVR Passport largely targets college-going kids and not the core-moving going audience. Typically, weekdays account for 25% of the footfall when compared to weekends which account for 75% of the footfall,” a senior media analyst on the condition of anonymity, told BrandWagon Online.

194 movies were released in 2022 as compared to 84 in 2021 as the cinema industry recovered from the pandemic-induced losses. The filmed entertainment segment is expected to grow to Rs 22,800 crore by 2025 driven by high per capita income, expanding the audience base to 120-150 million.

Movie exhibition company PVR claims that more than 16,000 users have subscribed to its monthly subscription package at Rs 699, which currently gives access to 10 movies a month between Monday-Thursday that too in the morning slot. “This is not a new concept and has been prevalent in markets such as the US. The idea behind this is to increase occupancy during weekdays that is between Monday to Thursday,” Sanjeev Kumar Bijli, executive director, PVR INOX Ltd, said,

Globally versus India

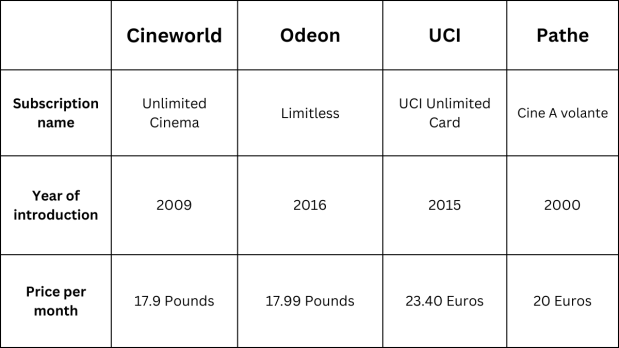

One of the most striking differences between India and other global markets is that in international markets such as the US, the subscription model runs at an industry level as opposed to being limited to just one company, while in Europe this is a practice adopted by almost all exhibition companies. For instance, in the UK, the Unlimited Cinema card by Cineworld enables users to watch all the movies they want for a monthly fee of at least £17.9. Add to this, the audience gets discounts on food and drinks as well as benefits when referring a friend to the service. Similarly, Odeon in the UK runs a subscription card, called Limitless. The subscription card allows users to watch all movies for £17.99 a month. While, Germany’s UCI introduced the UCI Unlimited Card in December 2015 for 12 months at € 23,40, per month. While French cinema chain, Pathé, offers its subscription card €20 a month. On the contrary, the US follows a model under one pass which is valid for all theatres. According to industry estimates, the US cinema subscription provider Moviepass charges members $10 every month. This allows moviegoers to watch a movie every day in a theatre of choice. What is worth 91% of American cinemas are available. Hence, the service is not bound to a certain cinema chain. The company pays theatres the full price for each ticket, through a special debit card to its members.

It is worth noticing that the subscription cost of Moviepass is lower than theater-run subscriptions. In India, this is yet to be adopted by other players. “Mature markets operate on standard weekday and weekend prices. In a country like India which is still growing, there is dynamic pricing in the sense that there is a difference between ticket prices from Monday to Sunday, which attracts the target audience at respective points in time. Furthermore, revenue earned from the tickets is also shared with producers and stakeholders. Fixed ticket prices mean that the share that goes to the stakeholders is also fixed. In my opinion, the subscription model in a growing market might be too early. We are not too sure about it,” Devang Sampat, CEO, Cinepolis India, said.

During a survey carried out in the US in August 2022, around 42% of respondents said they were at least somewhat interested in paying $10-30 a month to subscribe to a movie theatre ticket service and see a set number of films in theatres, as per market research firm Statista. Among frequent moviegoers and the interviewees who had subscribed to MoviePass – a company that provides that type of service – the shares stood at 64% and 70%, respectively.

According to media reports, the company intends to target students, housewives, and senior citizens with its subscription model. A reason for the introduction of the new model can be to unlock unsold inventory on the weekdays since the footfalls are high on weekends and low on weekdays. The domestic footfall for theatres in India stood at 89.2 crore in 2022, as per market intelligence platform, Statista.

While the subscription model offers 10 movies a month, the company would be banking for users to not use all the credits allowing PVR Inox to have an additional revenue stream on the days when the footfalls are nearly not as much compared to weekends. Furthermore, it would not add more operational costs since the cost of adding subscribers would remain minimal. Theatres would be able to accommodate additional consumers during weekdays without increasing operational costs.

The Subscription Boom in India

From OTT platforms to audio, subscription is now a core part of all businesses. For instance, OTT subscriptions increased by 50-60% during the pandemic, according to a Boston Consulting Group (BCG) report.

As the Indian cinema business tries to regain what it lost during the pandemic, experts believe that subscriptions may help in changing the game. The subscription model can change the revenue dynamics by attracting those who are not inclined to watch films in the movie cinema theatres would as a result of the subscription plan, go to watch the movies in cinema theatres. However, good content would be required to support this as well as bringing down the food and beverage (F&B) spend would be great for cinemas,” Taran Adarsh, film critic and trade analyst, said.

As per an Ormax study, the Indian cinema industry lost approximately 2.4 crore moviegoers to the pandemic. The study added that India has 12.2 crore theatre-goers who have at least watched one film in a theatre in the last 12 months. The figure stood at 14.6 crore in January-March 2020. Audiences returned to theatres post post the pandemic with 9.5 crore people visiting the cinema theatres in FY23. Movie ticket prices in India resurged in 2022 with the average cost for a ticket amounting to Rs 119, as per Statista. This was a significant recovery from the previous year when ticket prices dipped to Rs 87. Average ticket prices rose across languages that year and were 12% higher than pre-pandemic levels, with the main contributors being Hollywood and Hind films. However, critics point out that India is a very price-sensitive market, hence not all subscription plans may find a taker. “India is a very price-sensitive market. A Netflix subscription for that matter is lower in price as compared to the subscription model that has been introduced in the market. Moreover, there are only eight to 10 hits in a year so the consumer knows that the other movies other than the hits are just additional movies they might not want to watch,” Komal Nahta, film critic and trade analyst, said.