KuCoin, a cryptocurrency exchange, has announced the findings of its survey report titled ‘Into the Cryptoverse, India.’ The survey takes a look into the development of the blockchain industry and cryptocurrency space in India.

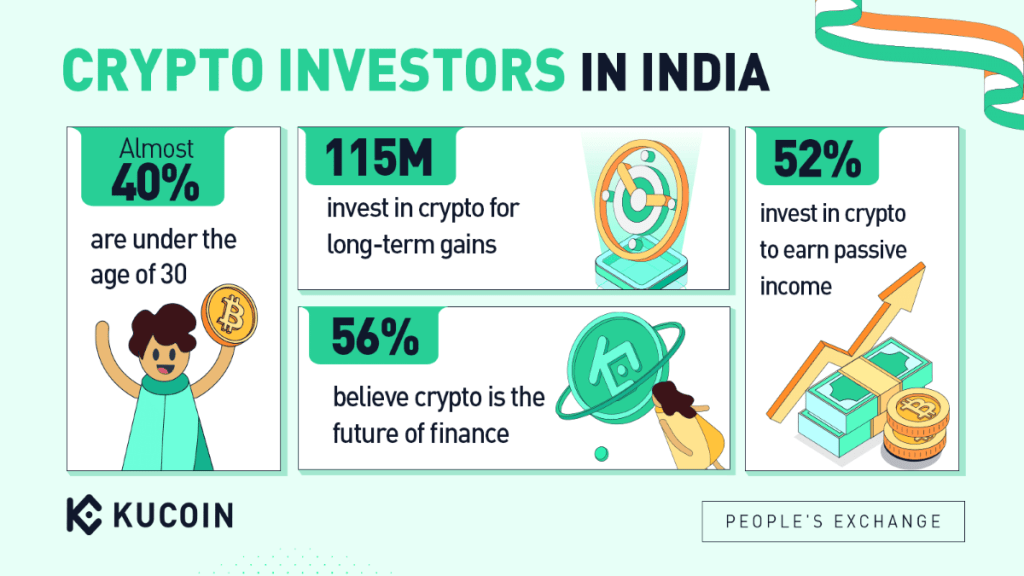

According to the KuCoin report, despite local government’s stance on digital assets and the levying of a 30% tax on income received from digital assets, the Indian cryptocurrency market is expected to reach $241 million by 2030. The survey revealed that as of June, 2022, roughly 115 million cryptocurrency investors in India either hold cryptocurrency or have traded cryptocurrency in the past six months, accounting for 15% of the Indian population aged 18 to 60 years with 54% of these hopeful of gaining long-term ROIs. The report indicates that investors, below the age of 30, recognise the long-term value of cryptocurrency. Another 10% of Indian adults are crypto-curious consumers planning to invest in cryptocurrency in the coming six months. It further highlights that 56% of investors believe cryptocurrency to be the future of finance, and 52% invest in cryptocurrency to earn passive income that can help them improve their quality of living.

The report noted that when it comes to hurdles of cryptocurrency investment, a lack of sufficient knowledge of the cryptocurrency market is reflected by 41% of respondents who state that they are not sure which type of cryptocurrency investment products to choose. While 37% have difficulty managing the risk of their portfolios, 27% have trouble predicting the market directions and values of cryptocurrency and 21% are not clear about how cryptocurrency works. 33% report that government regulations is a concern when considering investing in cryptocurrency. The safety of investing in cryptocurrency is also a concern as 26% worry about hackers being a threat, and 23% fear that they may not get their money back in case of security incidents. In the first quarter of 2022, 39% of crypto investors are aged 18 to 30, up seven percent from the previous quarter, suggesting that the number of young cryptocurrency investors is growing faster than their more mature counterparts. 39% of young cryptocurrency investors below the age of 30 are first-time crypto investors who only started trading over the past three months.

The survey also shed light on investor motivations, highlighting that 56% of crypto investors believe crypto is the future of finance, 54% believe cryptocurrency will bring them a higher return on investment in the long-run, 52% invest in cryptocurrency to gain passive income and improve the quality of living, 24% of young investors consider cryptocurrency a hype for fun and 43% are going for the short-term gains.

As stated by Medha B Dey Roy, head of branding, KuCoin India, the first quarter of 2022 witnessed a downturn in terms of positivity towards cryptocurrency investment. “Our survey indicates a positive sentiment towards the market, as more than half of investors plan to increase their cryptocurrency investments over the next six months. With our technology-driven young population, growing internet users and financial technology (fintech) advancements, crypto is on its way to achieving greater adoption. With regulatory environments and motivations, India has the opportunity to become a global crypto hub. We look forward to see the opportunities that lie ahead, and play a role in supporting the Indian crypto ecosystem,” she added.

Also Read: Bitbns unveils listing of metaverse-based Klaytn token