As banks are offering higher rates for specific tenure deposit schemes, individuals should consider laddering for higher returns.

For example, State Bank of India’s special deposit scheme (Amrit Vrishti) is offering 6.6% for 444 days. In contrast, it is offering 6.25% for one-year, 6.30% for 3-year and 6.05% for 5-year fixed deposits (FD).

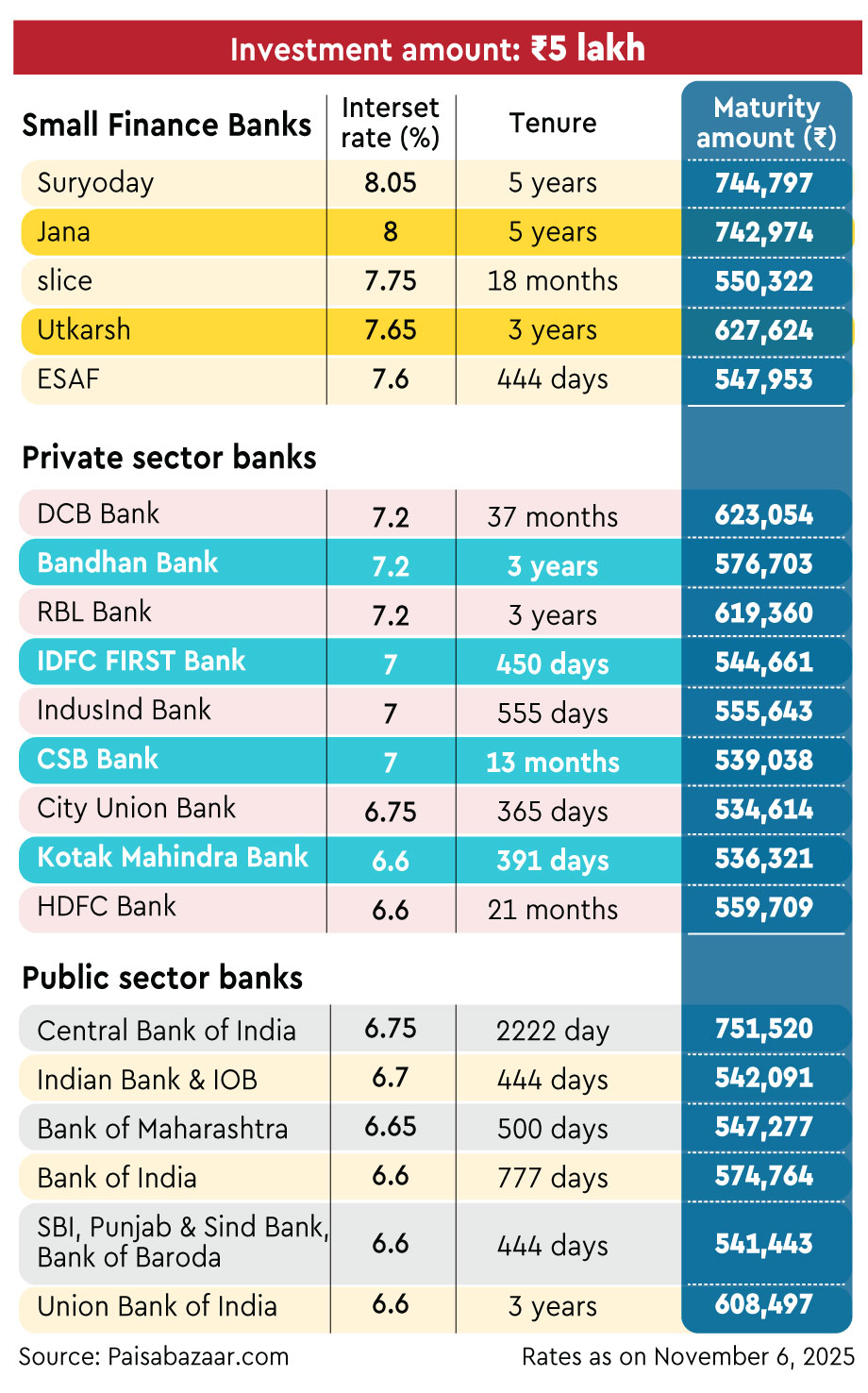

Interest rates at small finance banks (SFB) are higher than private and public sector banks. The highest rate is offered by Suryoday Small Finance Bank at 8.05% for a 5-year tenure. The tenures of the highest FD slab rates vary across banks due to the variations in their asset liability requirements.

While investors can benefit from these schemes by locking in higher rates for a specified period, they cannot go for premature withdrawals. However, laddering deposits will ensure liquidity at regular intervals. Opening special FDs with multiple banks will help ladder their deposits across multiple maturities.

Deposits with predefined tenures will helpthem align their short- to medium-term financial goals and get a higher maturity amount in the long run. Depositors can benefit from changing interest rates. If rates rise, they can reinvest the matured deposits at higher rates. If rates fall, only a portion of their money is affected, as the longer-term deposits were locked in at higher rates earlier.