The ICICI bank on Wednesday revised its minimum balance requirement for new savings account after massive backlash for raising it to Rs 50,000. The bank has reduced the amount to Rs 15,000. The bank was at the receiving end of the critics after it increase the minimum maintenance amount in new savings account with effect from August 1.

The decision was heavily opposed by the account holders, many of whom took to social media to register their protest on the sudden hike of the Minimum Account Balance (MAB). However, now the bank has withdrawn the same and reduced the amount.

What are the new MAB amount for different accounts?

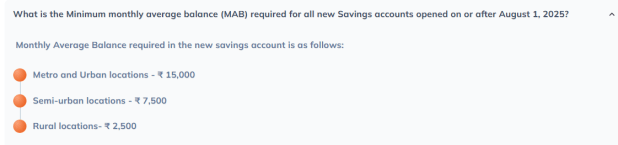

The ICICI Bank‘s website now states that customers operating a savings account in Metro or urban locations, will have to maintain a minimum of Rs 15,000 in their accounts to avoid any penalty. It was this amount that was previously hiked to Rs 50,000.

Furthermore, for the semi-urban locations, the MAB has been set to Rs 7,500 and for rural locations, the MAB has been fixed at Rs 2,500.

In case the MAB is not maintained, the bank will deduct 6% of the shortfall amount or Rs 500, whichever is lower. Apart from this, the bank said those opening pension or student savings account will not bound by these MAB, and subsequent penalties.

What RBI had said

When ICICI bank raised the MAB amount, many questions were raised if the country’s central bank, the Reserve Bank of India (RBI) has any guideline in place to monitor the minimum balance requirement.

RBI Governor Sanjay Malhotra responded to the queries and said that banks are free to decide the minimum balance for savings accounts, and the same does not fall under the regulatory domain of the central bank.

“The RBI has left it to individual banks to decide on what minimum balance they want to set. Some banks have kept it at Rs 10,000, some have kept Rs 2,000 and some have exempted (customers). It is not in the regulatory domain (of RBI),” he said.