More money in the hands of the middle class and a simpler tax regime. This was the focus of FM’s budget 2025 when she acknowledged that – Democracy, Demography and Demand are the key support pillars in our journey towards Viksit Bharat. The middle class provides strength for India’s growth.

Slabs and rates are being changed across the board to benefit all taxpayers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment.

Union Finance Minister Nirmala Sitharaman announced a rise in income tax exemption for individuals earning up to Rs 12 lakh per year, providing significant relief to the middle class. The salaried employees will not be required to pay income tax up to Rs 12.75 lakh after taking into account the Standard Deduction of Rs 75,000.

The FM proposed personal income tax reforms with a special focus on the middle class. The FM said that the new income tax bill will have half of the present laws, and will be simple for taxpayers and tax administrators to reduce litigations.

Right after 2014, the ‘Nil tax’ slab was raised to Rs 2.5 lakh, which was further raised to Rs 5 lakh in 2019 and to Rs 7 lakh in 2023. This is reflective of our Government’s trust on the middle-class tax payers, FM said.

FM announced that there will be no income tax payable upto income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried tax payers, due to a standard deduction of Rs 75,000.

India will focus on boosting middle-class spending power, encouraging inclusive development and boosting private investment to strengthen growth, Finance Minister Nirmala Sitharaman said on Saturday, announcing the annual budget.

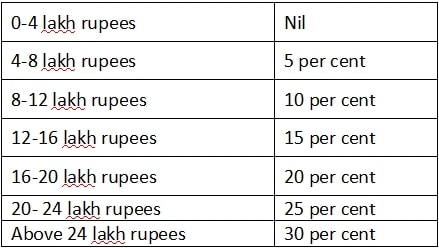

In the new tax regime, FM proposes to revise tax rate structure as follows:

Special Window for Affordable and Mid-Income Housing

Under the Special Window for Affordable and Mid-Income Housing (SWAMIH) fifty thousand dwelling units in stressed housing projects have been completed, and keys handed over to home-buyers. Another forty thousand units will be completed in 2025, further helping middle-class families who were paying EMIs on loans taken for apartments, while also paying rent for their current dwellings.

Building on this success, SWAMIH Fund 2 will be established as a blended finance facility with contributions from the Government, banks and private investors. This fund of ` 15,000 crore will aim for the expeditious completion of another 1 lakh units.

Modified UDAN scheme

UDAN has enabled 1.5 crore middle-class people to meet their aspirations for speedier travel. The scheme has connected 88 airports and operationalized 619 routes. Inspired by that success, a modified UDAN scheme will be launched to enhance regional connectivity to 120 new destinations and carry 4 crore passengers in the next 10 years. The scheme will also support helipads and smaller airports in hilly, aspirational, and North East region districts.