Finance Minister Nirmala Sitharaman presented her eighth consecutive Union Budget on Saturday (February 1), unveiling a series of sweeping changes aimed at boosting economic growth, supporting key sectors and providing significant tax relief. The Union Budget 2025 brings a mix of bold tax cuts, fiscal prudence and policy shifts aimed at stimulating economic growth and job creation.

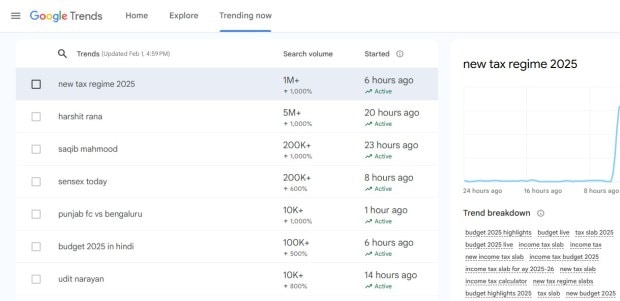

The Budget garnered widespread attention, with major Google trends indicating heightened interest in topics such as income tax rebates, tax regime exemptions and Section 87A, among others. The term “new tax regime 2025” alone had a search volume of more than one million.

Here are five key takeaways from the Union Budget 2025:

Income Tax cuts

Responding to growing discontent among the middle class over high taxation, the Finance Minister surprised many by announcing a major income tax relief. The tax rebate level has been raised to an annual income of Rs 12 lakh, up from Rs 7 lakh. Additionally, the highest tax rate of 30% will now apply only to those earning above Rs 24 lakh per annum.

These changes will leave taxpayers with more disposable income, which the government hopes will spur spending, drive economic growth and encourage businesses to invest in new capacities, ultimately leading to job creation and increased incomes.

Fiscal discipline maintained despite revenue foregone

A common concern with tax cuts is the potential increase in government borrowing. However, despite the Rs 1 lakh crore in foregone revenue, the fiscal deficit is projected to decline further to 4.4% of GDP in 2025-26. This disciplined approach prevents excessive borrowing, curbing inflation risks while ensuring economic stability.

Capital expenditure growth stalls

In previous budgets, the Modi government prioritised high capital expenditure to develop infrastructure projects like roads, ports, and bridges. However, this year’s Budget signals a shift, with capital expenditure growth slowing significantly. The government missed its target for the current fiscal year by nearly Rs 1 lakh crore, and next year’s budgeted capex increase is a modest Rs 10,000 crore. Nevertheless, the allocation remains high by historical standards.

Renewed focus on employment generation

Addressing criticism over the lack of employment-focused policies, this Budget emphasises job creation, particularly in labor-intensive industries like textiles and leather. Unlike previous Production Linked Incentive (PLI) schemes, which primarily benefited capital-heavy industries, these measures aim to boost employment and provide livelihood opportunities to a wider section of the population.

Push for regulatory reforms to improve business climate

The Finance Minister announced the formation of a high-level committee to evaluate regulatory reforms and introduce an Investment Friendliness Index. These measures aim to simplify bureaucratic hurdles and make it easier for businesses to operate in India. While a welcome move, experts note that these reforms come more than a decade after the Modi government first took office.