Page 11 of Repo Rate

Related News

Aadhaar card online update: How to change name, address, date of birth and phone number online in simple steps

Meet Prakash Kaur: Dharmendra’s first wife who stood by him through every phase of his life

8th Pay Commission: Govt asked to modify Terms of Reference; employees call protests seeking merging DA with basic pay

Smriti Mandhana-Palash Muchhal wedding called off? Leaked chats spark controversy

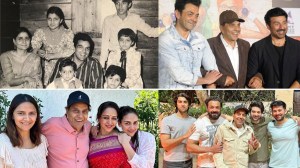

Dharmendra’s family tree explained: Meet the actor’s 6 children, 13 grandchildren, other members of Deol clan