Page 10 of loans

Related News

Meta CEO Mark Zuckerberg’s highest-paid employee Alexandr Wang tells teens how to build a lucrative tech future

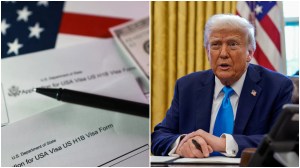

Top H-1B sponsors Amazon, Walmart’s shareholder asks for Trump visa crackdown’s financial impact report

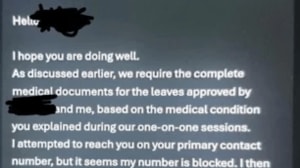

‘Why is recovery treated like favour?’ Employee claims company chased him for documents despite approved medical leave

‘For employees stuck abroad…’: Microsoft’s advice to H-1B workers revealed amid visa stamping delays

Income Tax Department clarifies notices sent to taxpayers on mismatch in transactions, ITR