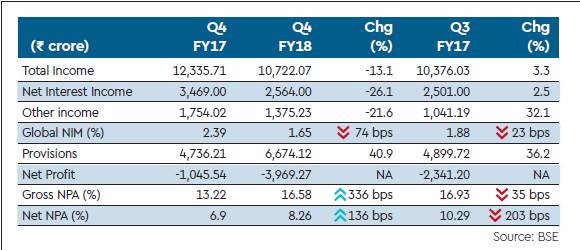

Bank of India (BoI) on Monday reported a standalone net loss of Rs 3,969.27 crore for the March quarter, compared with a loss of Rs 1,045.54 crore in the same period last year as provisions rose 41% year-on-year (y-o-y) to Rs 6,674.12 crore.

Net interest income (NII) — the difference between interest earned and interest expended — fell 26% y-o-y to Rs 2,564 crore, and the net interest margin (NIM), a key profitability ratio, stood at 1.65% in the fourth quarter, down 23 basis points (bps) on a sequential basis.

Asset quality at the bank showed an improvement, with the gross non-performing asset (NPA) ratio falling to 16.58% from 16.93% at the end of December, and the net NPA ratio declining to 8.26% from 10.29% a quarter ago. Provision coverage ratio improved to 65.85% from 56.96% at the end of December. The bank’s gross advances fell 4.5% y-o-y to Rs 3.76 lakh crore, as the bank shrank its corporate book and rebalanced its international exposure.

Retail, agriculture and MSME advances grew over 10% y-o-y to Rs 1.51 lakh crore. BoI saw total deposits drop 3.55% on a y-o-y basis to Rs 5.21 lakh crore. Current account savings accounts (CASA) deposits grew 3.7% to Rs 1.73 lakh crore. The share of CASA deposits in total domestic deposits rose to 41.43% at the end of March from 39.84% a year ago. Slippages fell 29% on a sequential basis to Rs 12,973 crore in Q4FY18, of which about Rs 5,700 crore slipped as a result of the Reserve Bank of India’s (RBI) February 12 circular.

Recoveries during the quarter stood at Rs 11,417 crore, upgradations at Rs 1,539 crore and write-offs at Rs 1,938 crore. Dinabandhu Mohapatra, managing director and chief executive officer at BoI, guided for improved recoveries on the back of resolutions in cases being heard under the Insolvency and Bankruptcy Code (IBC). “We have around Rs 8,300 crore in exposure to NCLT 1 cases and Rs 3,300 crore in NCLT 2 cases.

One account has already been addressed and we have already got back the money,” he said, adding, “Things are progressing well and I’m quite hopeful that this quarter another couple of accounts will be addressed and by June most of the accounts in NCLT 1 will be addressed.” Mohapatra guided for an 8-10% growth in loans and deposits and BoI is trying to raise its credit-deposit (CD) ratio to 75% by the end of FRY19 from 71% at present.