Figma went public on July 31, 2025, with its IPO debut on the New York Stock Exchange. Shares were priced at $33 each, and the company offered 36.9 million shares of Class A stock, some from Figma itself and others from existing investors. The IPO raised about $1.2 billion, most of which went to early backers like venture capital firms.

The $68 billion valuation comes from Figma’s share price rising sharply after it started trading, not from the original price set for the IPO. This big jump happened because investors were excited about Figma’s fast growth, its popular design tools, and new AI features.

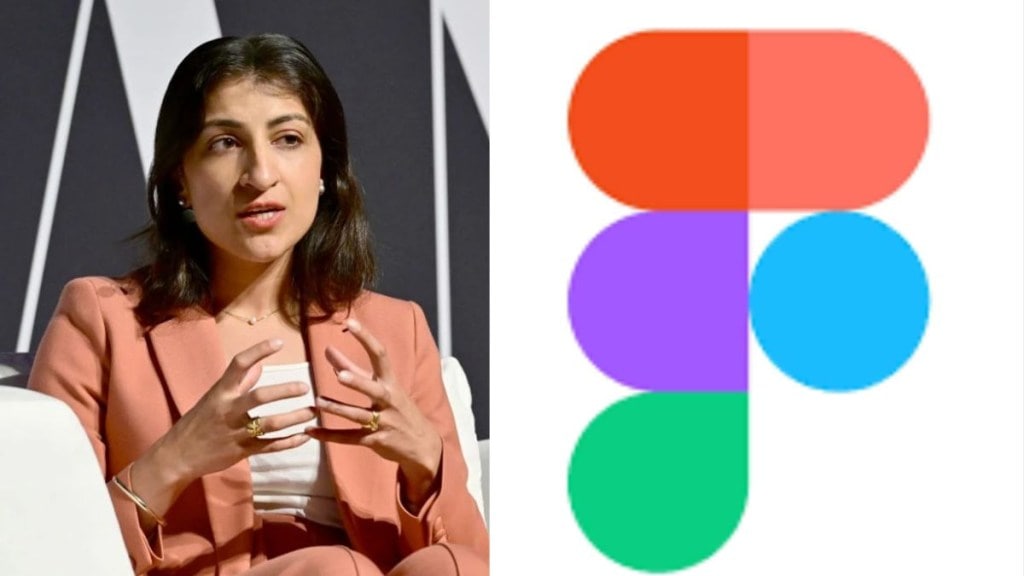

Behind this successful IPO was antitrust advocate Lina Khan. As chair of the US Federal Trade Commission from June 15, 2021, to January 20, 2025, Khan played a key role in blocking Adobe’s $20 billion bid to acquire Figma.

Who is Lina Khan?

American legal expert Lina Khan, who was born in Britain to a Pakistani family, served as the head of the Federal Trade Commission from June 15, 2021, to January 20, 2025. At 32, she became the youngest FTC chair ever and the first person of South Asian heritage to hold the position after being nominated by President Joe Biden and confirmed by the Senate.

She worked with the US House Judiciary Committee on antitrust matters and taught law at Columbia University prior to joining the FTC. Her strong opinions on regulating large tech firms like Amazon, Apple, Meta, and Google to safeguard consumers and competition have made her most famous. In his role as FTC chair, Khan concentrated on modernising the government’s antitrust enforcement to better suit the tech-driven economy of today.

What were the key focus areas of Lina Khan during her time as FTC chair?

Lina Khan tried to change the way the government examines business mergers. According to her, the impact of deals on market competition should be taken into consideration in addition to whether or not prices increase. In her role as FTC chair, she spearheaded significant legal actions against Amazon and Meta, challenging their past transactions and monopolistic business practices.

Additionally, she broadened the FTC’s purview beyond mergers. Khan pushed to outlaw certain employment contracts that prevented employees from changing jobs, helped lower drug prices, and supported new regulations that allowed people to repair their own devices. Even though the FTC didn’t win every case while she was in charge, there was a noticeable rise in lawsuits and more aggressive attempts to check corporate power.

How is Lina Khan linked to Figma IPO?

Lina Khan is connected to Figma’s IPO mainly because of her role as the former chair of the U.S. Federal Trade Commission. In 2023, she helped block Adobe’s $20 billion plan to buy Figma, arguing that it would hurt competition. This decision allowed Figma to stay independent, grow quickly, and go public in 2025 with a massive IPO, reaching a valuation of nearly $68 billion much higher than what Adobe had offered.

Khan celebrated the IPO on social media, calling it a “victory lap” for her antitrust policies. She said Figma’s success showed the importance of letting startups grow on their own instead of being taken over by big tech companies. She also said the IPO was good not just for employees and investors, but also for innovation and the public.

Some people in Silicon Valley believe that the Adobe-Figma deal could have helped both companies innovate more. But her supporters argue that strong antitrust rules help create more value by keeping markets competitive. While Figma’s own creativity and hard work were key to its success, Khan’s actions gave the company the chance to reach its full potential as an independent player.