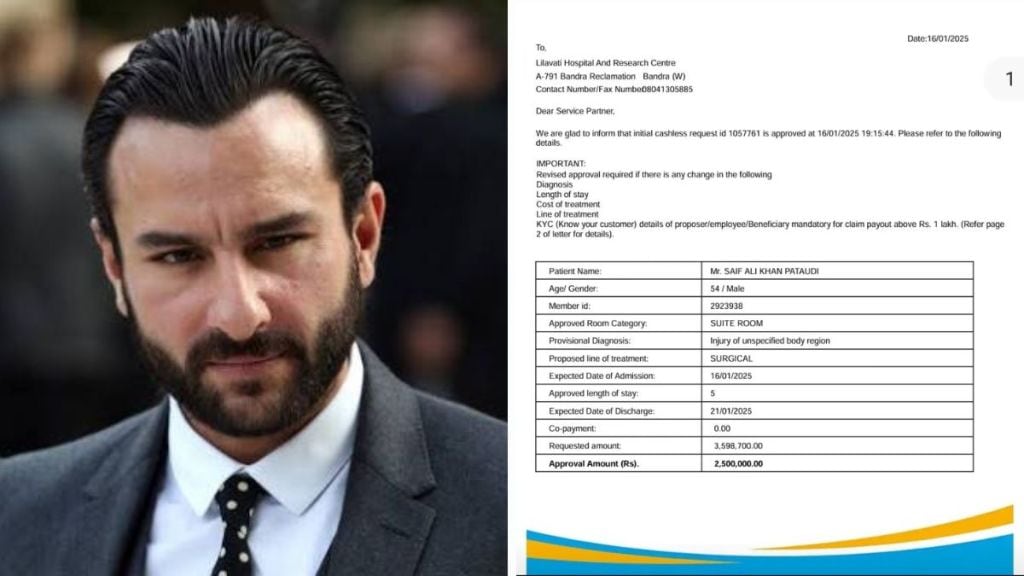

A recent leak of Saif Ali Khan’s health insurance claim document has ignited a vigorous discussion on social media, following an incident where the actor was attacked at his Bandra residence. The leaked document, shared on the microblogging platform X, has brought attention to Niva Bupa Health Insurance, an Indian insurance company based in Delhi.

According to the document, Khan had claimed Rs 35,95,700 for his medical treatment, but the insurance company only approved Rs 25 lakh. Along with this information, the document also included details like member ID, diagnosis, room category, and expected discharge date, further fueling the debate around insurance claim processes. According to a report in Hindustan Times, his hospital bill ultimately totaled Rs 26 lakh.

Saif Ali Khan’s insurance claim stirs debate online

Saif Ali Khan’s claim has sparked widespread conversation online, with many netizens expressing their opinions on the disparities in how claims are handled. The incident has brought attention to the stark contrast in how insurance companies handle claims for celebrities versus ordinary individuals, sparking concerns about the unequal treatment and privileges afforded to high-profile figures.

In a post on X, a user AK Mandhan wrote, “If #Saif Ali Khan has taken health #insurance, in spite of having generational wealth, super good income for himself and spouse – what are you thinking? Take health insurance now.”

Another user wrote, “Inspite of having generational wealth and super good income Saif Ali Khan has taken health insurance for himself and his family. What are you thinking?”

Another user said, “Lakhs of common people don’t get the reimbursement from health insurance companies. If this is resolved this will be a big relief and biggest gift from Modi Govt forever!!”

In a post on X, Dr. Prashant Mishra, a cardiac surgeon at Tunga Hospital in Malad said, “It’s difficult to understand the Health insurance sector. We need to support our senior citizens because most are retired and have no source of earnings or pension. So, Ideally, their Mediclaim premium should be low or fixed. The irony is that Mediclaim premiums for our Senior citizens are very high. Life long tax bharo when you are in job or active. But when you need more support ( at old age ) that time premium is exorbitantly high. But who cares for the Middle class because the Middle class is not a vote bank.”

In another tweet, Dr Mishra said, “For small hospitals and common man, Niva Bupa will not sanction more than Rs 5 lakh for such treatment. All 5 star hospitals are charging exorbitant fees and media claim companies are paying also. Result – premiums are rising and middle class is suffering.”