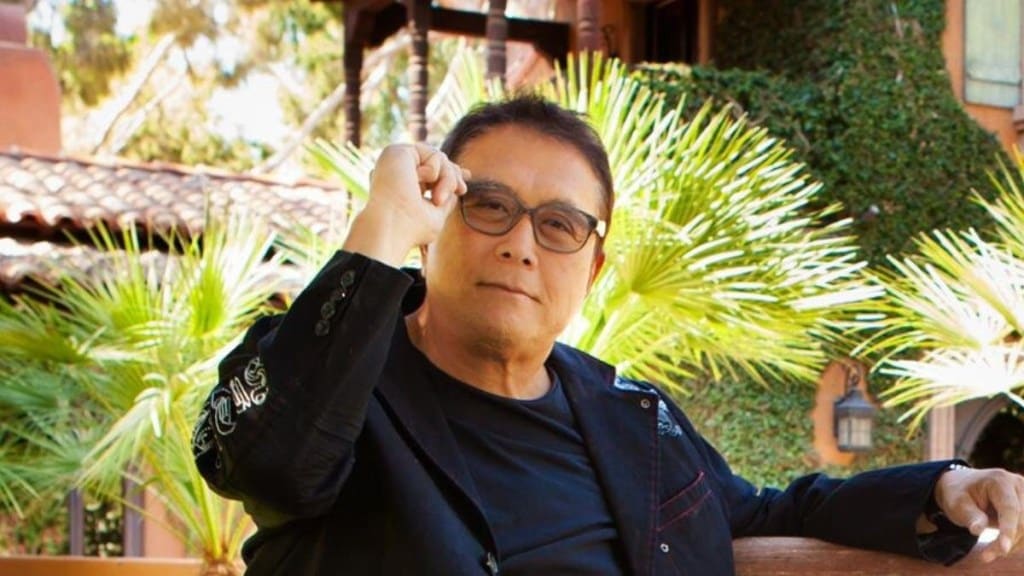

Rich Dad Poor Dad author, Robert Kiyosaki explains in a social media post on X about how the “fear of unemployment spreads like a virus across the world”. Signing off “take care”, the author talks about the deep-seated reality of the problem of unemployment in today’s global economy. Referring to his previous book where he cautioned about a “possible New Great Depression”, he hopes he is proven wrong.

In the post dated April 30, the 78-year old author wrote, “If I was prescient…. and the global economy crashes…. Just remember crashes….for those who are prepared….not panicked….can be the opportunity of a life time”. As an e`xample he shared that he found a way to turn around the 2008 global financial crisis (GFC) and make it a learning opportunity more than a meltdown.

FEAR of UNPLOYMENT spreads like a virus across the world.

Obviously, this fear is not good for the global economy.

As warned in an earlier book, Rich Dads Prophecy, the biggest market crash, a crash that is leading to the recession we are in…. and possible New Great…

— Robert Kiyosaki (@theRealKiyosaki) April 30, 2025

Borrowing from the ‘Oracle of Omaha’, the Rich Dad Poor Dad author shared his ideal of investing wisely especially in a time of crisis. As he wittily remarks the market crash as “real assets go on sale”, he explains his philosophy behind his 2004 Rich Dad’s Prophecy. Panic selling is a common phenomenon in a state of the market mayhem as several global factors dominate it. Best tackled by the likes of Warren Buffett, he shared this post because he wanted his audience “to be prepared for the global panic….that is beginning…. now”.

To further diffuse the situation for the majority who didn’t hop on the cryptocurrency bandwagon almost immediately, he wrote, “Bitcoin were to crash back to $300 a coin….would you cry or celebrate?”

Suggesting a Strategy for investors, in a previous post he mentioned. “Your profit is made when you buy…. Not when you sell”. However, putting a positive spin on the situation, he shared quotes from Oprah Winfrey, Abraham Lincoln, Benjamin Franklin and George Paterno only to comfort the worried investors with a sense of caution.