With US President Donald Trump announcing that the country will likely impose a 25 per cent tariffs on automobile, semiconductor and pharmaceutical imports, Goldman Sachs said that the “reciprocal tariff” plan is expected to impact India in three ways: a) Country-level reciprocity, b) Product-level reciprocity, and c) Reciprocity including non-tariff barriers. Earlier on Tuesday, a Bloomberg report stated that Trump announced the likely imposition of tariffs on the imports from aforementioned sectors, with an announcement coming as soon as April 2.

India’s bilateral goods trade surplus with the US has doubled in level terms over the last 10 years to $35 billion, equivalent to around 1.0 per cent of India’s GDP, in FY24. This was largely driven by an increase in trade surplus in electronics, pharmaceutical products, and textiles.

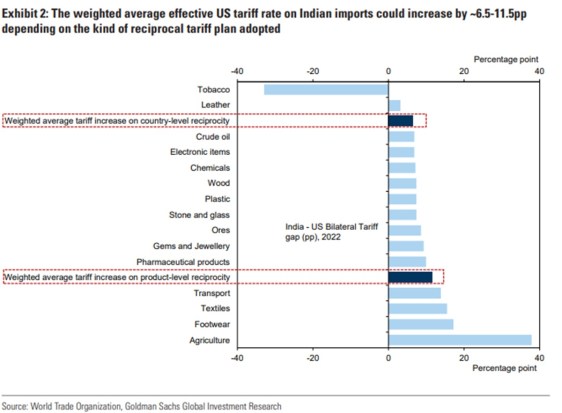

Goldman Sachs maintained that India’s tariff rates are higher than the US on most products (6.5pp on a trade-weighted average basis), with the differential being the highest in agricultural products, textiles, and pharmaceutical products.

India’s gross exports to the US is one of the lowest among its EM peers at around 2.0 per cent of GDP. Goldman Sachs said, “We estimate a potential domestic GDP growth impact of 0.1-0.3pp under different scenarios of increase in average US effective tariff rate on Indian exports (under country-level reciprocity and product-level reciprocity), and different estimates of price elasticity of US demand for Indian exports. However, in case of global tariffs on all countries from the US, India’s domestic activity exposure to US final demand would be roughly twice as high (~4.0 per cent of GDP) given exposure to the US via exports to other countries, and would likely result in a potential domestic GDP growth impact of 0.1-0.6pp.”

Three-way impact on India

Per an analysis report by Goldman Sachs, under Trump’s “reciprocal tariff” plan, there are three ways in which India can get impacted:

a) Country-level reciprocity, with an increase in tariffs on all US imports from India by the weighted average tariff differential. “Under this scenario, the average US effective tariff rates on Indian imports would increase by ~6.5pp. As per our US economics team, this would be the simplest approach for implementation of “reciprocal tariffs” as the officials could apply one uniform rate for each country on top of the pre-existing tariff rates,” the report stated.

b) Product-level reciprocity, where the US matches India’s tariffs on each product imported from India. Goldman Sachs estimates this may increase the average tariff differential by approximately 11.5pp, but would be more complicated with a longer implementation timeline. “As per the memo released by the White House on February 13, the White House Office of Management and Budget (OMB) is supposed to submit a report within 180 days to the President,” the brokerage firm said.

c) Reciprocity including non-tariff barriers like administrative barriers, import licenses, export subsidies, etc. This, according to Goldman Sachs, is the most complicated given the cost of estimating non-tariff barriers, but could presumably lead to higher tariffs than in other two scenarios.

Tariff rates: India vs the US

Tariff rates imposed by India are higher than the US on most products, with the differential being the highest in agricultural products, textiles, and pharmaceutical products.

Here is a look at the data from the World Integrated Trade Solution (WITS) database for product level tariffs available till 2022.