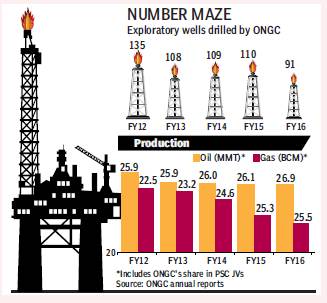

Reversing a fall in the number of exploratory wells being drilled, state-run ONGC expects an increment in the number this financial year compared with last year. “Almost 7-8 wells will increase this year compared with last year. Till February, 86 wells have already been drilled and we expect another 11 to be completed by the end of this month (March),” said an ONGC executive requesting anonymity.

Last financial year, the national oil company drilled 91 exploratory wells.

According to a government official who did not want to be named, the reason for fall in production of ONGC is low productivity and the number of wells that it drills per annum is not adequate. The sustained trend has also prompted the government to put more projects of ONGC under production enhancement contracts, as reported by FE earlier.

While the company’s oil production has fell from 26.92 MT in financial year 2012 — the year since when the company’s production has been falling each year — to 25.93 MT by financial year 2016, the gas production during the period fell from 25.51 BCM to 22.53 BCM.

You may also watch this:

“This year it will not fall compared with last year. There were issues regarding rig resources and now most of the issue are sorted. For onland wells, there are issues with land acquisition and forest clearances,” said the ONGC executive.

The company expects to invest to the tune of R5,000-6,000 crore in drilling this year, wherein R6,000 crore figure will be reached if it is able to drill 120 wells. “It will be a little lower than that (R6,000 crore) as we will reach 97-98 wells this year,” added the executive.

Of these around 40 wells will be offshore and the rest onshore.

The company has also been able to monetise eight of the 17 discoveries notified this year and all of them are onland. The executive added that it is easier to monetise onland resources.

“We are trying to monetise as soon as possible. Early monetisation will keep the wells under ‘wells-in-progress’ category. In offshore, the problem is with respect to the infrastructure. If the wells are close-by to the existing infrastructure and can be connected, then those are also monetised and more wells go into ‘wells-in-progress’ category,” added the executive.

If an offshore well is kept unconnected for more than five years then it is written off. ONGC’s board recently approved three offshore projects of which discoveries were made around 2013-14. These will now be monetised.

The company is expecting since infrastructure is being created both on the east and west coast, especially the KG 98 development, many wells which otherwise would have been written off will be monetised.