Recalibration of discounted Russian oil imports by Indian companies should be more than offset by gains from lower US tariffs, Nomura said.

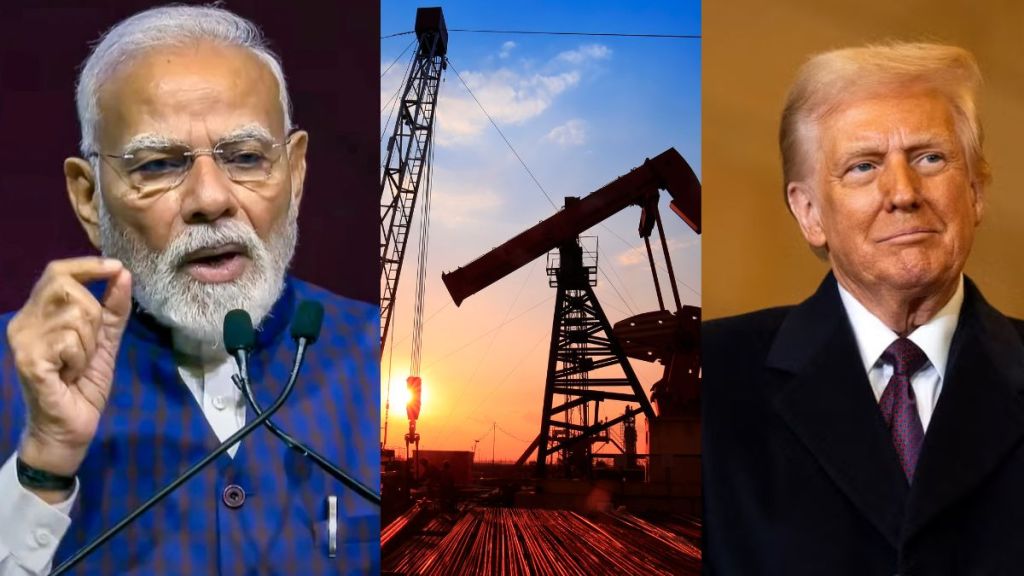

Nomura economists Sonal Varma and Aurodeep Nandi said the shift away from Russian oil following US sanctions could pave the way for a trade deal with Washington and a reduction in tariffs.

The economists expect the 25% punitive levy on purchases of Russian oil to be removed after November, while the reciprocal 25% tariff will remain through the fiscal year ending March. US tariffs on India currently include a 25% reciprocal duty and a 25% penalty for buying Russian oil.

“On the oil import bill, Russian crude oil discounts have moderated to ~$1.8–2.2/bbl, so the macro impact of a shift should be manageable, in our view,” Nomura said in a note.

The direct impact of losing the discount on about 650 million barrels of crude oil imported from Russia would entail an additional annual cost of around $1.5 billion, or 0.04% of GDP, it said.

However, Nomura cautioned that since India is one of the world’s largest crude oil consumers, its attempt to source the shortfall from other countries could push global oil prices higher and further add to its import bill.

Refiners in India — particularly Reliance Industries Ltd (RIL) — are expected to substantially reduce imports of Russian oil after the Donald Trump administration announced sanctions on Russian state oil firms Rosneft and Lukoil. The two companies account for about 60% of the volumes purchased by Indian refiners.

RIL, sources said, will have to halt imports under its long-term deal to buy nearly 500,000 barrels per day of crude from Rosneft. The company, India’s largest buyer of Russian crude and roughly half of the country’s 1.7 million barrels per day of imports from Moscow, has no option but to recalibrate its sourcing.

Prashant Vasisht, senior vice president and co-group head, corporate ratings, ICRA, said that on an annual basis, the replacement with market-priced crude would increase the import bill by less than 2%.

Volumes are expected to fall sharply after November 21, 2025, once the sanctions take effect, Vasisht said.

“The near to medium-term impact on oil prices will depend on the duration of sanctions, their enforcement, and supply ramp-up from OPEC,” said Pranav Master, Senior Practice Leader and Director, Crisil Intelligence.

Shares of oil companies moved marginally on Friday. RIL ended at `1,451.45, up 0.23% from Thursday’s close, while BPCL fell 0.33%, HPCL slipped 0.44%, and IOCL gained 0.17%.