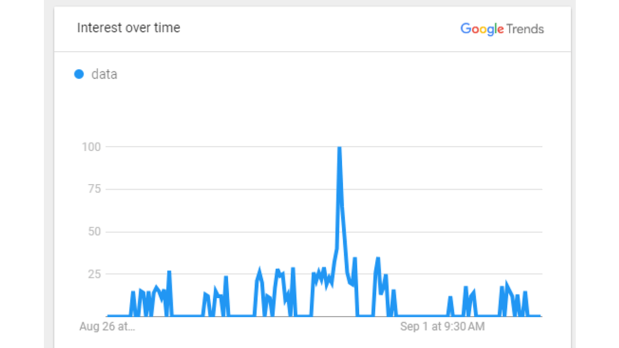

The term ‘Data’ has been amongst the most seached terms in Augusts, especially for those looking for important economic news. One of the most important data points that took centre-stage in August was the RBI’s rate decision at the beginning of the month. However, what really sent worry signals was the Q1 GDP numbers moderating to under 7%.

GDP growth moderates

The moderation in GDP numbers led to growth slipping to 5-quarter lows and below most estimates. However, even at 6.8% India continues to be one of the fastest growing economies in the world. For the full-year the growth outlook is seen between 7-7.2%. According, to data shared by the National Statistical Office (NSO)on August 30, one of the main reasons for the moderation in growth was the slower degree of growth in the agriculture sector. In fact agri growth was down to 2% from 3.7%. The slowdown in agri output is not just a worry point for the economy but also for the inflation outlook.

Managing inflation worries

Inflation is the other key worry and commonly tracked economic data across the country. As the momentum in monsoon picked up and Kharif sowing has been fairly on course, the expectation is that inflation could be on the mend. What’s further encouraged the expectation is the July inflation reading. The data for this was released in August and it showed that Consumer Price Inflation or CPI has eased to a 5-year low in July at 3,54%. Most economists believe that the reining in of inflation coupled with stable GDP growth, gives the RBI the headroom, in terms of how to time the tweaking in rates.

All eyes on Fed rate action

The next data that’s on everyone’s radar is the Fed decision on interest rates. This is significant for the Indian consumers as it will have a direct bearing on the RBI’s rate decision. The RBI MPC or Monetary Policy Committee is set to meet in October and the popular consensus is that they will follow the Fed in terms of rate action.