-

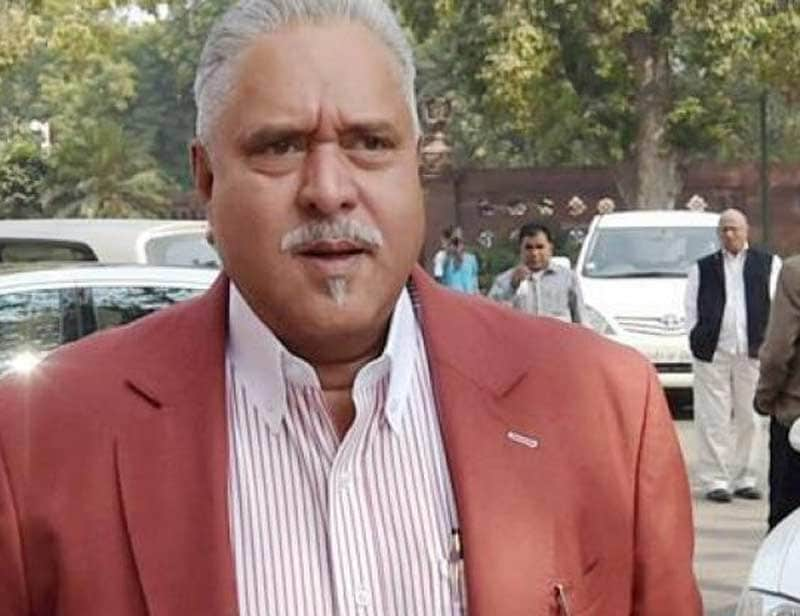

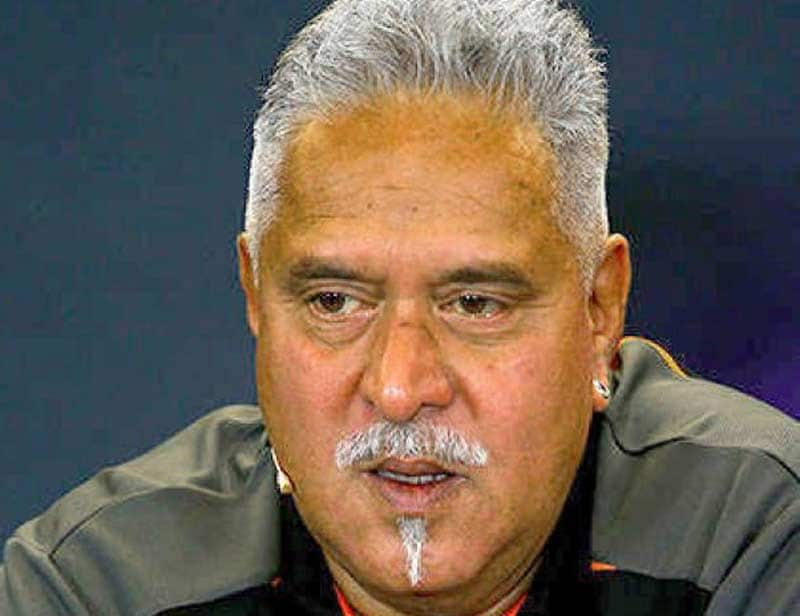

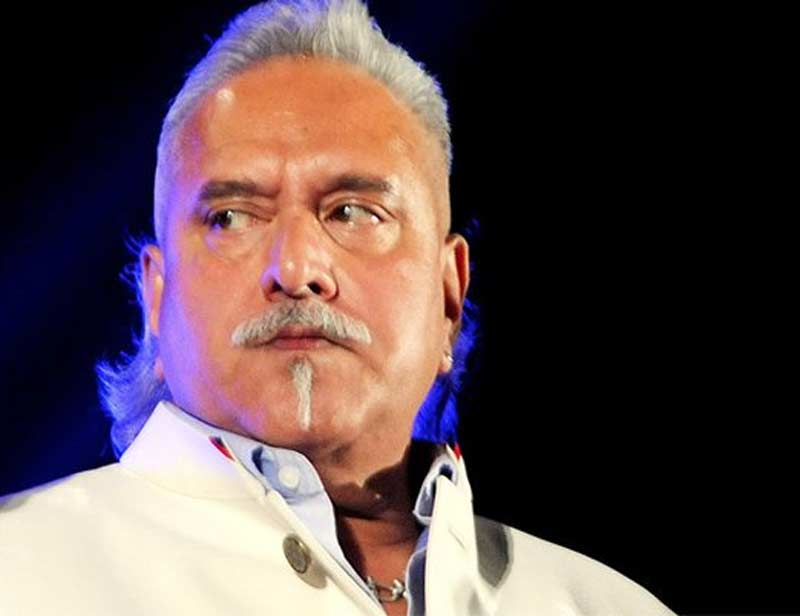

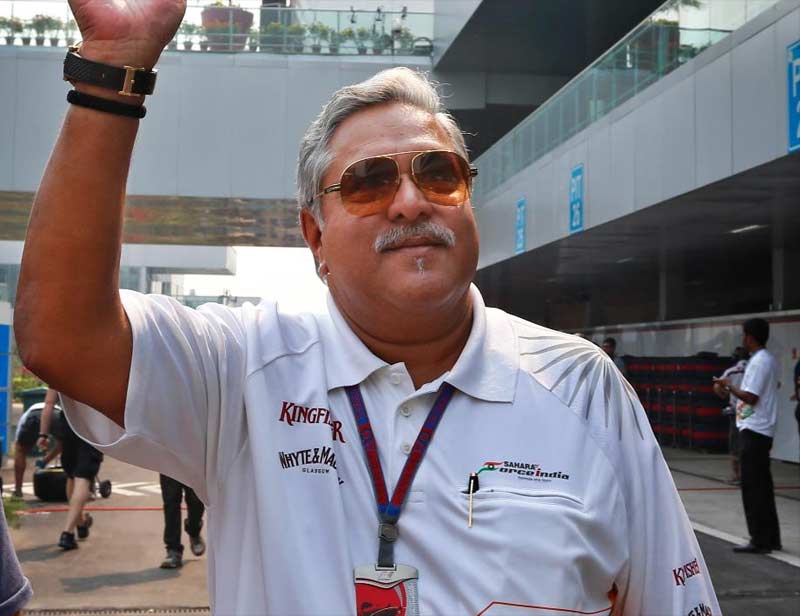

Vijay Mallya and Kingfisher Airlines debt default row: Sometime in 2006, the Mumbai-based IDBI Bank got a proposal from Kingfisher Airlines, seeking funds to acquire aircraft. Vijay Mallya had launched the airline the previous year, in May 2005, on his son’s birthday and he had been cruising. He had bought Shaw Wallace, one of the oldest liquor manufacturers in India, for Rs 1,300 crore from the Chhabria family after the death his arch rival, Manu Chhabria, in 2002. He had topped that by striking a deal with the British beer maker Scottish and Newcastle, which had bought a 37.5 per cent stake in Mallya’s United Breweries Ltd for Rs 940 crore. When things went wrong and the business faltered it didn’t stop Mallya from drawing huge salaries from Kingfisher Airlines – Rs 33.46 crore each in 2011 and 2012, according to some reports. So how did it all go so horribly wrong for Vijay Mallya? (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: Even before Kingfisher could be launched, the aviation industry had started bleeding. Crude oil prices were high, with fuel costs often making up half the operating costs of airlines. But Mallya announced his would be a premium, world-class airline. He personally hired his airhostesses and Yana Gupta, a Bollywood actor, performed in a video that showed safety instructions before take-off. The service standards and comfort provided by the airline in the initial years attracted many passengers, marking it out from other full-service airlines in the business then. At its peak, Kingfisher Airlines was the second largest airline in India in terms of the number of passengers it carried. (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: Mallya, by now unstoppable, moved to acquire a bleeding Air Deccan in 2007 (the deal was completed in 2008), with the group’s cash cow and holding company, United Breweries Limited, paying Rs 550 crore to buy a 26 per cent stake in the low-cost carrier promoted by Captain G R Gopinath. Many say it was this decision that led to the grounding of Kingfisher Airline years later. The Deccan acquisition was ostensibly to allow the airline to fly internationally (airline rules in India say carriers can go abroad only after they complete five years of operation and have 20 aircraft). In September 2008, three years after Kingfisher first took to the skies, the airline launched its Bengaluru-London flight. (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: But as oil prices started to climb (an average of $72.68 a dollar between 2005 and 2010) and the company struggled to run a business that included a full-service airline and a low-cost carrier, its finances floundered and its debt burden and losses surged. By the end of March 2008, Kingfisher’s debt had mounted to Rs 934 crore. A year later, it had multiplied to Rs 5,665 crore. Its net losses widened from Rs 188 crore in 2007-08 to Rs 1,608 crore the following financial year. “That acquisition of Air Deccan marked the end of Kingfisher Airlines,” says a person who worked closely with Mallya during that phase and who did not want to be named. “At that time, there was excess capacity (more supply of seats than demand) in the aviation sector and Air Deccan was lowering ticket prices to Re 1, Rs 400 and so on, and that was not viable.” (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: By 2009-10, Kingfisher Airlines had accumulated a debt of over Rs 7,000 crore. It continued to pile up losses and had already turned net-worth negative the previous financial year. That was also the year Kingfisher Airlines turned into a non-performing asset or a bad loan for banks. In November 2010, banks for the first time restructured Kingfisher’s debt. The consortium of lenders led by State Bank of India converted Rs 1,355 crore of debt into equity at a 61.6 per cent premium to the market price of the Kingfisher Airlines stock. Besides, the bankers stretched the period of repayment of loans to nine years with a two-year moratorium, cut the interest rates, and sanctioned a fresh loan. (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: However, a breather on loan repayment wasn’t enough to revive Kingfisher Airlines, which continued to bleed with every passing year. The flamboyance of its promoter, who was then a Rajya Sabha MP, attracted it even more attention, enough to prompt questions in Parliament on the airline’s bad loans. In reply to one such question in 2011, Namo Narain Meena, former minister of state of finance, said Kingfisher Airlines had pledged its brand to banks for an estimated Rs 4,100 crore. Meena also said Mallya had given a personal guarantee of Rs 248.97 crore while United Breweries Holdings has provided a corporate guarantee of Rs 1,601.43 crore. (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: “In addition, Kingfisher has provided a pooled collateral security of Rs 5,238.59 crore, which includes Kingfisher House in Mumbai, Kingfisher Villa in Goa, and hypothecation of helicopters. Besides, the pledged securities include ground support and other equipment (Rs 101.58 crore), computers (Rs 22.43 crore), office equipment (Rs 13.39 crore), furniture and fixtures (Rs 33.35 crore) and an aircraft (Rs 107.77 crore),” Meena had said. In short, Mallya had pledged all of Kingfisher’s movable assets. The official spokesperson of Mallya declined to comment for this story. (AP)

Vijay Mallya and Kingfisher Airlines debt default row: In 2012, Kingfisher Airlines was grounded, leaving its employees with unpaid salaries. The company had allegedly not deposited its employees’ provident fund to the government and had run losses in excess of Rs 4,000 crore in 2012-13. Its accumulated losses ran into Rs 16,023 crore, while its net worth fell to a negative Rs 12,919 crore at the end of March 2013. In April 2015, Mumbai International Airport Private Limited (MIAL) sold Mallya’s personal aircraft (its registration number, VT-VJM, matches his initials) for Rs 22 lakh to recover airport dues of the grounded airline. (AP) -

Vijay Mallya and Kingfisher Airlines debt default row: As trouble mounted, Kingfisher Airlines was chased by the service tax department over non-payment of service tax of over Rs 115 crore. The department seized eight aircraft and helicopters of the company, including Mallya’s prized Airbus A319, which it now plans to auction. On March 7 this year, the service tax department moved the Bombay High Court, asking for impounding of Mallya’s passport and seeking his presence in the ongoing court case. The airlines had also defaulted on crediting over Rs 372 crore of Income Tax deducted at source from employees. (AP)

-

Vijay Mallya: Beleaguered businessman Vijay Mallya, mired in a controversy for leaving India in the middle of a massive loan default probe, on Moday appeared to distance himself from an interview that quoted him as having said that time was not "right" to return to the country. "Shocked to see media statements that I gave an interview to Sunday Guardian without verification. I have not given any statement to anyone," Mallya tweeted tonight on his official Twitter page. He did not elaborate further on the contents of the said interview. (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: United Bank of India was the first lender to declare Kingfisher and Mallya a ‘wilful defaulter’ in May 2014. The same year, the SBI too issued a notice to tag Kingfisher Airlines, Mallya and United Breweries Holdings as ‘wilful defaulters’. The SBI notice of August 19 has alleged diversion of funds by Kingfisher Airlines to UB Group of companies and other firms. Mallya has challenged the decision of United Bank and the SBI in various courts. In February, Punjab National Bank, another lender, declared Mallya and Kingfisher a wilful defaulter. (AP)

-

Vijay Mallya and Kingfisher Airlines debt default row: Meanwhile, Mallya’s troubles have only been growing. In February this year, the board of United Spirits Limited (the company his father set up) asked him to resign as chairman after an internal probe alleged financial irregularities. The man himself, meanwhile, is supposed to be in London after signing a Rs 515 crore sweetheart deal with United Spirits and marking attendance in the Rajya Sabha on Monday. On March 11, he tweeted, “News reports (say) that I must declare my assets. Does that mean that Banks did not know my assets or look at my Parliamentary disclosures?” (Text by Khushboo Narayan, Johnson T A and Shaji Vikraman) (AP)

Aadhaar card online update: How to change name, address, date of birth and phone number online in simple steps