-

Low investment demand affected the stocks of real estate companies in 2015. During the year, the BSE Real Estate index wiped off the gains of 2014 as the index plunged nearly 14 per cent to 1,344 on December 31 from 1,555 on December 31 last year. The index gained 8.5 per cent in the previous calendar year. There has been key policy related progress in the real estate sector like the Cabinet approval of the Real Estate Bill and rationalisation of tax structure for REIT listings in 2015. According to market experts, these steps should bring back transparency in the sector, thereby bringing back consumer and investor confidence in the long run.(PTI)

If you are planning to invest in real estate stock in 2016 then you should prefer a company with fair past execution track record, strong balance sheet, regional spread, quality land bank and a company with ability to generate strong cash flows. We list the top 5. </br><br> Disclaimer: The stocks are recommended by the respective brokerage houses and not a recommendation from Financial Express online. (PTI)

Oberoi Realty</br><br> Recommended By: HDFC Securities</br><br> Why Buy: Oberoi Realty delivered strong pre-sales volume with big launches. While investors were concerned that the Mulund and Borivali projects would see a muted response owing to weak real estate macros, the company surprised with robust sales. Within a month, around 70 per cent of the launch area was sold vs. around 50 per cent for the Goregaon/JVLR projects (achieved over FY10-12). High land bank quality, superior brand recall and healthy access to finance put Oberoi Realty in the top quartile vs Western peers. The share price of the realty major can touch Rs 411.(PTI)

Mahindra Lifespace</br><br> Recommended By: ICICIdirect.com</br><br> Why Buy: The brokerage house prefers players who have quality management execution bandwidth and relative strength in the balance sheet. ICICIdirect is positive on Mahindra Lifespace and Oberoi Realty in the sector. (PTI) -

2. Budget 2016: Deduction of interest on housing loan – A roof over one’s head is a necessity for all and sundry. Given the fact that the PM Narendra Modi government is widely advocating 'housing for all' home owners are expecting that they will receive a 100% deduction on home loan interest. Currently homeowners are eligible for deduction of only up to Rs 2 lakhs under section 80 C. Also for houses that are under construction, this deduction is only Rs 30,000 that too if the construction of the house is completed after 3 years from the end of the year in which the loan has been availed of. This provision has caused a lot of heartache to property buyers because there after often delays well beyond 3 years in case of the completion of housing projects. There is therefore a widespread expectation that the government will allow interest deduction without a cap of Rs 30,000 and will be calculated from the year in which possession is due.

Sobha Ltd</br><br> Recommended By: SAMCO Securities</br><br> Why Buy: Sobha, a south based developer, is growing consistently inspite of sluggishness in the realty sector. The company has reasonable debts with asset light model operating in south based cities. The company has generated superior return on equity (ROE) of 10 per cent even in sluggish demand phase which gives an indications that during good times the results will exceed expectations. (PTI) -

As the Real Estate Regulation & Development Act (RERA) kicks in, many developers are now shifting their strategy towards building more office projects.

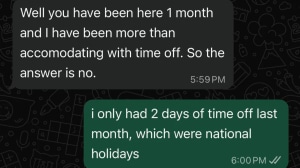

‘We can’t match that’: Employee quits job in 2 weeks for higher pay and remote work, says ‘boss started lecturing me about…’