-

As the festive season online shopping frenzy surges towards a climax as Diwali approaches, surprisingly, when it comes to downloads, Amazon India is trailing Flipkart and Snapdeal is in the mix too as all ecommerce players . Indeed, e-retailers have been encouraging consumers to transact through apps offering special app-related discounts as that brings them greater traction. Here is all you wanted to know in 5 quick-read points:

-

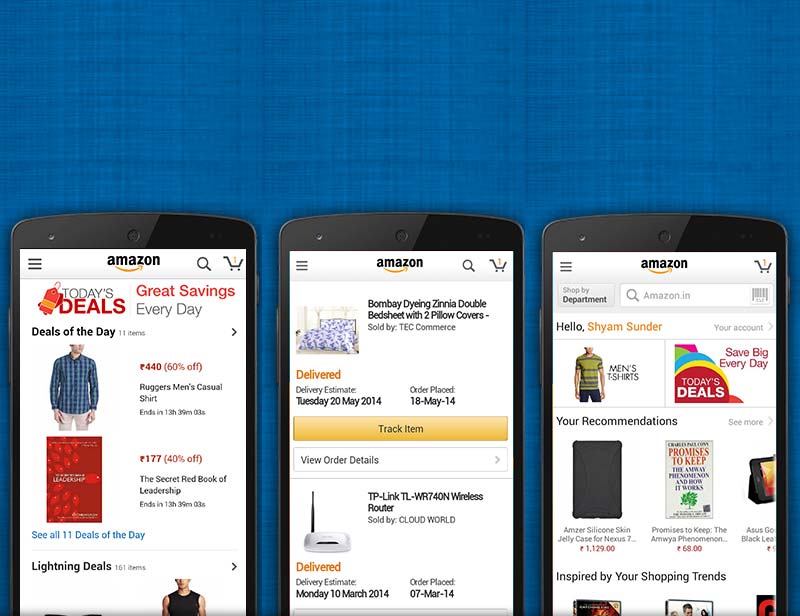

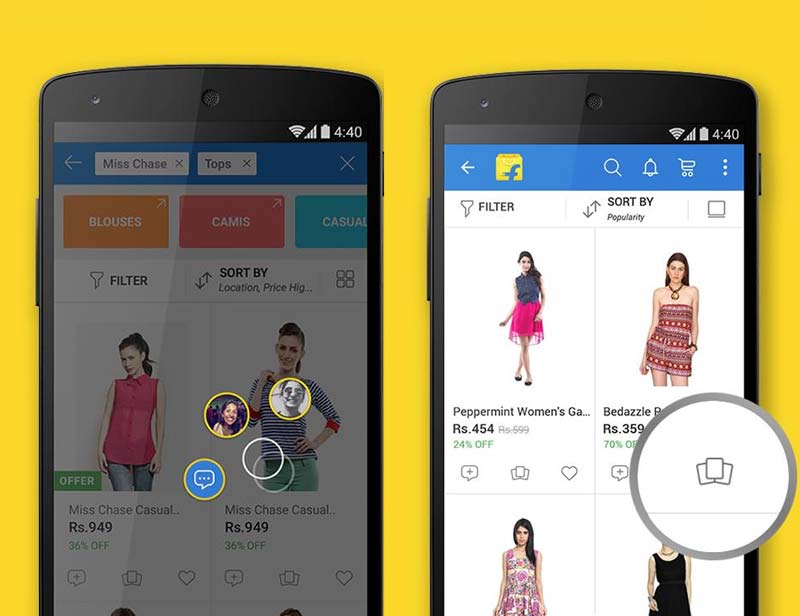

1. Amazon entered India almost five years after Flipkart and Snapdeal set up shop but enjoyed a first mover advantage in the app space. The global retailer was the first to launch its application in September 2013, followed by Flipkart, and Snapdeal a couple of months later. In September, Flipkart had 66,504 average daily downloads, while Amazon had 58,845. </br> Data from App Annie shows that till October 19, Amazon had reported 20.15 million downloads on Android devices while Flipkart counted more than twice that number at 41.5 million. That’s despite the fact that the Amazon app is rated slightly higher than those of Flipkart and Snapdeal. App Annie rates Amazon at four out of a possible five while both its rivals are rated marginally lower 3.9.

-

2. The difference between Flipkart and Amazon in terms of average daily downloads was around 50,000 in December 2014 but this gap has subsequently narrowed to just 8,000 in September.

-

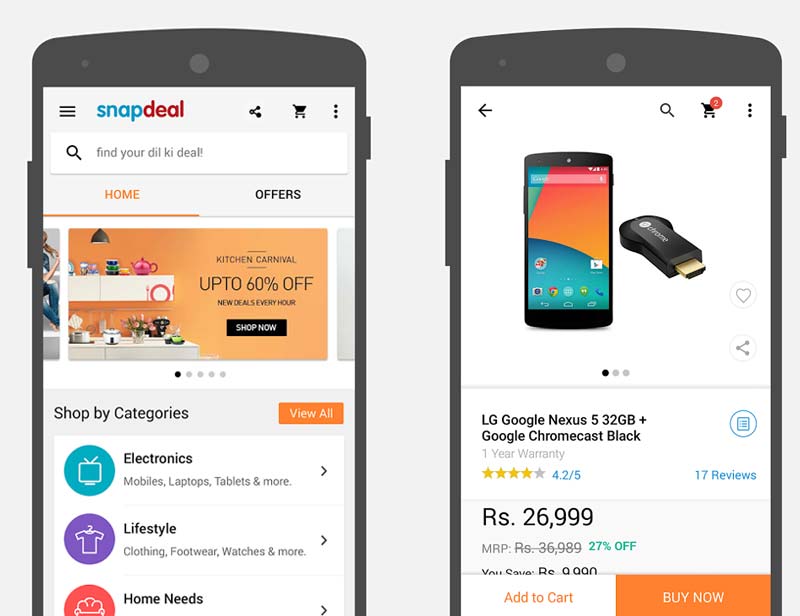

3. Android downloads account for approximately 90% of the total downloads. Until September 2013, transactions in the e-commerce space were taking place tally via the retailers’ websites.

-

4. However, since 2014 website traffic has been falling and in early 2015, app traffic and transactions overtook web traffic. But it is not always a win-win situation for all as earlier this year, fashion etailer Myntra went app only but is understood to have lost 10% of its gross merchandise value (GMV). Mobile wallet brand Paytm, which also has a marketplace, is also accessible to customers only on the app.

-

5. Goldman Sachs expects the Indian ecommerce market to breach $100 billion by 2020. The overall online market, including travel, payments and retail, in the country could reach $103 billion, the US investment bank said in a report this month. The figure is a 27% jump from the $81 billion it estimated in May. The majority of this upward revision is contributed by the etail segment, which is estimated to reach $69 billion by FY20 compared with $47 billion earlier.

Maharashtra Local Body Election 2025 Results Live Updates: Mahayuti ahead in early trends; BJP wins 3 seats unopposed in Dondaicha, Jamner, and Angar