-

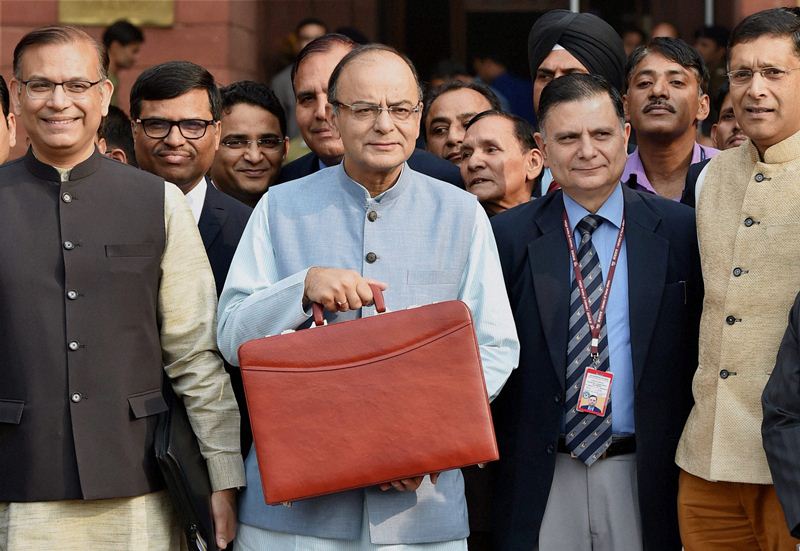

Centre was forced to backpedal furiously after EPF withdrawal tax and also the one on PPF caused a nation-wide furore to break out in the wake of FM Arun Jaitley presenting the Budget 2016 in the Lok Sabha on Monday. Clearing the air on taxing provident fund withdrawals, the PM Narendra Modi government said only interest accruing after April 1 on 60 per cent of the contributions made to EPF will be taxed even as PPF withdrawals will continue to be fully exempt from tax. Here is all you want to know in 5 points:

-

1. EPF withdrawal tax row: All contributions and interest accrued to employee provident fund (EPF) before April 1, 2016, will not attract any tax on withdrawal. Withdrawal of principal amount contributed to EPF after April 1 would also remain exempt from any tax. It is only the interest on contributions made after April 1, 2016 which will be taxed. There is no change in the status of public provident fund (PPF). EEE (tax exempt at the time of contribution, tax exempt on returns and tax exempt on withdrawals) scheme will continue for PPF. There is no 40 per cent limit on PPF. It will be 100 per cent exempt.

-

2. EPF withdrawal tax row: Out of the 3.7 crore active contributors in EPF, about 70 lakh corporate sector employees earning a high salary would be impacted by the proposed taxation of EPF interest on withdrawal. There are about 3 crore people whose monthly income is less than Rs 15,000. They are called eligible members of EPF. For this 3 crore people, there is going to be no change in status of taxation. They can withdraw their 100 per cent corpus when they retire without any taxes.

-

3. EPF withdrawal tax row: Finance Minister Arun Jaitley's Budget 2016 proposed to tax interest on 60 per cent of EPF withdrawal. However, the withdrawn amount would be totally tax exempt if it is re-invested in annuity pension products. According to the government the purpose of the proposal in Budget 2016 is not to mobilise revenue. The idea is make people move towards a pension society. For this, govt said it has given another incentive wherein the investment in annuity product will be tax exempt. Annuity product was always taxable. But here, even after death of a person when the money is transferred to legal heir, has been made tax exempt.

-

4. EPF withdrawal tax row: The reason why the govt made this move is because there is a danger people blowing off the entire 100 per cent amount on retirement and not investing in pension products. Otherwise, the responsibility comes on government to take care of their healthcare.

-

5. EPF withdrawal tax row: Government has proposed to change the provision not to take tax from salaried class, but to help people plan for retirement better. Govt says 40 per cent of EPF amount will be available at the time of retirement. For the remaining 60 per cent, it wants to encourage people to invest in annuity product. So if a man's corpus is Rs 1 crore, Rs 40 lakh he withdraws and uses for house construction or other work and Rs 60 lakh he invests in annuity so that he keeps getting pension.

Property prices see steep fall in leading micromarkets