-

Budget 2016: Delhi Chief Minister Arvind Kejriwal said the budget did not address the concerns of the farmers and the middle class and accused the Modi government of "cheating" them while questioning the black money amnesty scheme. Kejriwal claimed that loans of industrialists have been "waived" in the Budget and wondered why a similar relief has "not been" extended to the farmers. (PTI)

Budget 2016 on taxing EPF: Arvind Kejriwal took to micro-blogging site Twitter to express his views. "Spoke to many people. They are v angry. EPF/PPF withdrawals by aam admi taxed, loans of rich waived, black money holders get amnesty," he tweeted. <br/>In his proposals in Budget 2016, FM Arun Jaitley said it is proposed to provide that any payment in commutation of an annuity purchased out of contributions made on or after April 1, 2016, which exceeds 40 per cent of the annuity, shall be chargeable to tax. Under the existing provisions of section 80CCD, any payment from National Pension System Trust to an employee on account of closure or his opting out of the pension scheme is chargeable to tax. (Source: Twitter) -

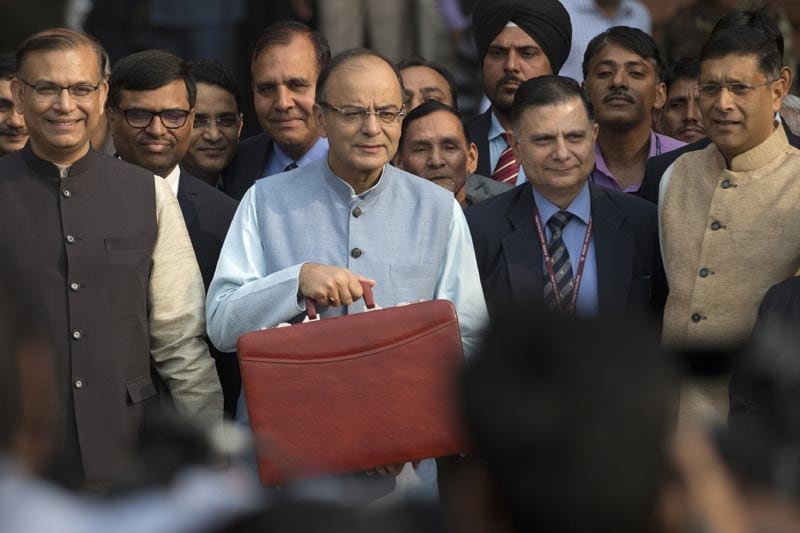

Budget 2016 on taxing EPF: Union Finance Minister Arun Jaitley presented the Union Budget 2016-17 in the Parliament yesterday. The FM has made Employee Provident Fund (EFP) and National Pension Scheme (NPS) withdrawals on retirement partially taxable in the Budget. Announcing measures for moving towards a pensioned society, Finance Minister Arun Jaitley said, "Pension schemes offer financial protection to senior citizens. I believe that the tax treatment should be uniform for defined benefit and defined contribution pension plans." He said, "I propose to make withdrawal up to 40 per cent of the corpus at the time of retirement tax exempt in the case of National Pension Scheme. In case of superannuation funds and recognised provident funds, including EPF, the same norm of 40 per cent of corpus to be tax free will apply in respect of corpus created out of contributions made after April 1, 2016." (AP)

-

Budget 2016 on taxing EPF: This essentially means when a person withdraws from EPF, the 60 per cent of the corpus, accumulated post April 1, 2016, will attract tax and the remaining 40 per cent will not. At present, the deposits, the interest and withdrawals of the EPF are tax free as it is an EEE scheme. It is not clear if the Public Provident Fund (PPF) will also come under taxation but it would need a modification of the PPF Act. The budget has also proposed to increase the threshold for deducting tax deducted at source (TDS) on payment of accumulated balance due to an employee in EPF Rs 50,000 from existing Rs 30,000. Last year budget had provided that the members of private provident fund trusts will not have to pay tax on pre-mature withdrawals provided the amount is either less than Rs 30,000 or their tax liability is nil even after including the withdrawn sum to their income. (Reuters)

Aadhaar card online update: How to change name, address, date of birth and phone number online in simple steps