At a time when markets seem concerned on the possible implications of global uncertainties and with fears of recession looming large, the RBI’s “accommodative stance,” has been hailed as an apt and timely measure.

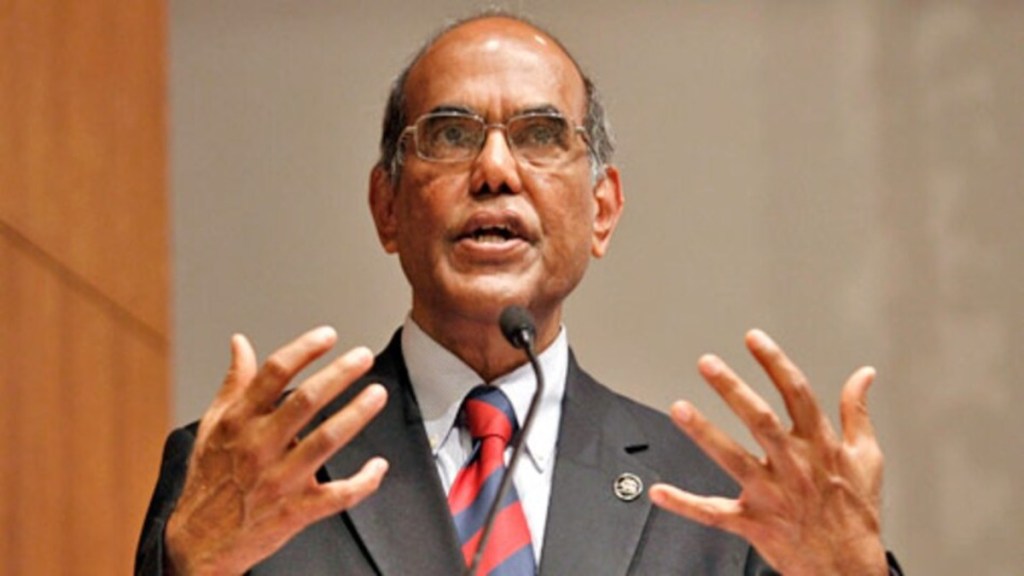

“I think so,” says economist and former RBI governor D Subbarao and explains: “the April monetary policy context has become much more complex and uncertain compared to what was in February. There are growing concerns of a possible recession around the world coupled with intensified geo-political tensions. At times of uncertainties, it is incumbent upon the central bank to provide comfort to the markets in terms of making the necessary adjustments and signalling a change in stance from ‘neutral’ to ‘accommodative’.

Earlier, explaining the change of stance, RBI governor Sanjay Malhotra in his statement said, “going forward, the MPC is considering only two options – status quo or a rate cut.” Our stance, he however also clarified, “provides policy rate guidance, without any direct guidance on liquidity management.”

In the light of the evolving macroeconomic and financial conditions and outlook, the MPC had according to governor Malhotra “voted unanimously to reduce the policy repo rate by 25 basis points to 6.00 per cent with immediate effect; consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) shall stand adjusted to 5.75 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 6.25 per cent.”

Describing the global economy as one that was “going through a period of exceptional uncertainties,” Malhotra had said, “the difficulty to extract signal from a noisy and uncertain environment poses challenges for policy making. Nevertheless, monetary policy can play a vital anchoring role in ensuring that the economy remains on an even keel.”

Chinese digital RMB

While the eyes are mostly on the US, it is hard not to ignore China’s announcement that six middle eastern nations and 10 ASEAN countries have agreed to China’s digital RMB cross-border settlement system. This has an impact on close to 40 per cent of global trade. One view is that perhaps RBI could step up efforts to increase the bilateral rupee denominated trade. But then, Subbarao reminds that India’s global trade footprint is still relatively small compared to China and unless the bilateral trade is roughly balanced it would be difficult for other countries to accumulate rupees therefore for rupee-denominated trade to become a reality, “our trade footprint has to increase substantially.”

RBI governor Malhotra however did state that “we are aiming for a non-inflationary growth that is built on the foundations of an improved demand and supply response and sustained macroeconomic balance. As before, we shall remain agile and decisive in our response and put in place policies that are clear, consistent, credible and in the best interest of the economy.”