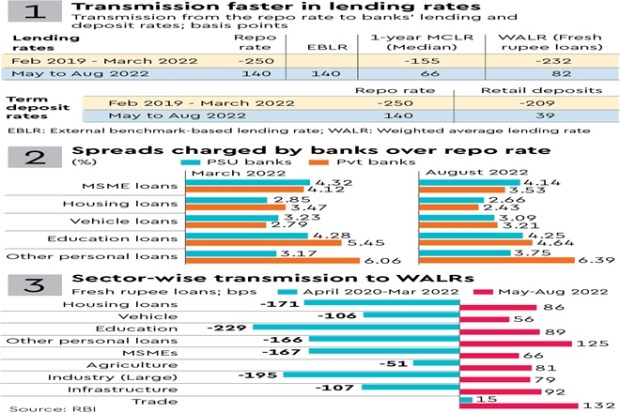

The mandated external benchmark regime introduced in 2019 for loan pricing has strengthened monetary transmission as the proportion of outstanding floating rate loans linked to external benchmarks has increased from 9.1% in March 2020 to 46.9% in June this year.

Continue reading this story with Financial Express premium subscription

Already a subscriber? Sign in

The share of marginal cost of funds-based lending rate linked loans has come down from 78.3% to 46.5% during the period.

However, the transmission is faster for lending rates as compared with deposit rates.

Moreover, the spreads charged by banks over the policy repo rate has moderated in case of MSME, housing and education loans.