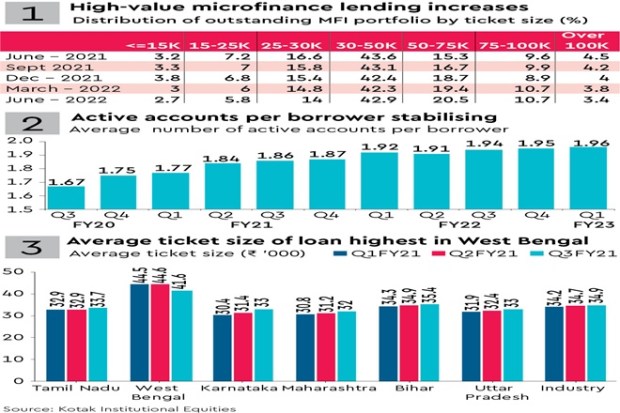

The share of disbursement of higher-ticket microfinance loans, especially in the Rs 50,000-75,000 bracket, is growing gradually, showing signs of a return in growth appetite of lenders after the pandemic and increasing comfort of lenders with borrower-leverage.

This has led to a steady increase in the average ticket-size of fresh disbursement with small finance banks taking the lead.

Credit inquiries are rising each month since May, and growth in rural markets continues to outpace growth in urban markets.

State-wise, the average ticket-size in West Bengal has been consistently higher than the industry average.