If you are just starting off your mutual fund investment journey or are even a seasoned investor, then an aggressive hybrid fund may be considered as part of your satellite holdings.

Aggressive hybrid funds offer you exposure to a mix of equities and debt. However, as the name suggests – aggressive – they invest a predominant portion of their assets in equities.

As per the regulatory guidelines, they are mandated to invest at least 65-80% of their total assets in equities and the remaining 20-35% into debt instruments.

These asset classes share a low correlation with each other. The debt portion helps cushion the downside risk during market corrections and bear phases, while equities (with a higher allocation) post aggressive returns during market rallies and bull phases.

In equities, an aggressive hybrid fund usually invests across largecaps, midcaps, and smallcaps and a range of sectors.

During uncertain and volatile market conditions or when the valuations seem stretched, the fund managers take a pragmatic view of their weightage to largecaps, midcaps, and smallcaps (while maintaining the broader allocation to equities as prescribed by the regulator) to manage the risk.

Similarly, when it comes to the debt portion, it invests across maturity papers–short, medium, and long-term debt papers–of various credit/rating profiles.

In the current interest rate cycle, where interest rates are moving down, the debt portion of aggressive hybrid funds is expected to do well.

This is because of the inverse relation between interest rates and bond prices. Meaning, when interest rates fall, bond prices go up, leaving a positive impact on the NAV of these funds.

In this editorial, we will take you through the Sundaram Aggressive Hybrid Fund and explain how it has fared.

Fund Overview

Launched in January 2000 as the Principal Hybrid Fund before the acquisition of Principal Mutual Fund by Sundaram Mutual Fund in the year 2021.

Post acquisition, the schemes of Principal Mutual Fund were subsumed into Sundaram Mutual Fund, and thus Principal Hybrid Fund became Sundaram Equity Hybrid Fund.

Further, in line with the mutual fund categorisation and rationalisation norms and to ensure better clarity to investors, Sundaram Equity Hybrid Fund was renamed as Sundaram Aggressive Hybrid Fund.

Since the launch, the fund’s AUM has grown, and today it’s one of the top 10 funds by AUM in the aggressive hybrid funds category, managing assets over Rs 76.55 billion (bn).

The fund allocates 65-80% of its total assets in equity and equity-related instruments, 20-35% in debt & money market instruments (including cash & cash equivalents, units of liquid/ money market/ debt mutual fund schemes and securitised debt), and up to 10% in units of REITs and InvITs.

When investing in equities, the fund house reserves the right to invest up to 50% of the net assets in derivatives.

Further, it may invest up to 15% in foreign securities, ADR’s and GDRs, subject to the regulatory guidelines.

The investment objective of the fund is to provide long-term capital appreciation and current income from a balanced portfolio of equity and debt securities.

The fund is co-managed by S Bharti (since December 2021), Sandeep Agarwal (since December 2021), Clyton Fernandes (since October 2024), and Dwijendra Srivasta (since December 2021). Before that, several other fund managers have managed the fund.

Sundaram Aggressive Hybrid Fund – Snapshot

| Inception Date | 14-Jan-00 | SI Return (CAGR) | 14.07% |

| Corpus (bn) | Rs 76.55 | Min. Lumpsum & SIP | Rs 100 |

| Expense Ratio (Dir/Reg) | 0.64% / 1.75% | Exit Load | 1.00% |

Source: ACE MF

What is the Investment Strategy of Sundaram Aggressive Hybrid Fund?

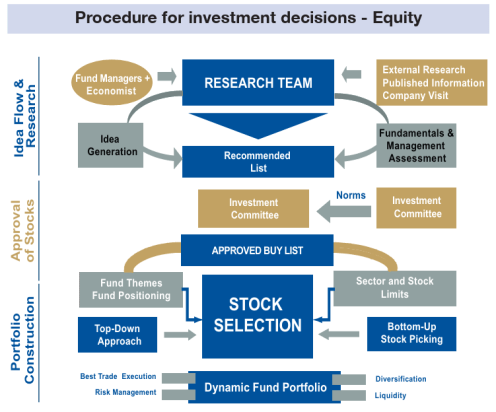

For the equity portion of the portfolio, companies would be selected after research covering areas such as quality of management, competitive position, and financial analysis.

The research looks at opportunities differently from the market and competition. The analysis focuses on the performance and future prospects of the business, financial health, the competitive edge, managerial quality and practices, minority shareholder fairness, and transparency.

To get a good understanding of the company being researched and its management, contact is made either by way of a visit or any other form of communication to assess its potential.

Only those companies that adequately satisfy the prescribed criteria are included in the portfolio.

The weight of individual companies is based on their upside potential relative to downside risk and will be decided by the fund manager.

The fund follows a mix of both top-down and bottom-up approaches to stock picking for a dynamic fund portfolio.

Source: Scheme Information Document

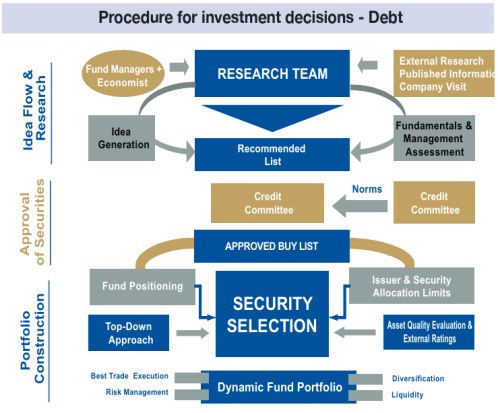

When investing in debt & money market instruments as well, the fund does a thorough evaluation.

It analyses the financial performance as well as the analysis of the business, the industry that the company operates in, and the outlook for the company and the sector. The credit outlook for the company is also carefully evaluated.

Apart from quantitative analysis, qualitative analysis is also undertaken to form an opinion on the corporate governance status of the company.

Based on the analysis, the credit team puts out a detailed credit review for approval by the credit committee.

The credit team also constantly looks for all news flows on the companies in the universe, and adverse news flows are immediately highlighted with a plan of action, as may warrant considering the severity of the news.

The credit team also monitors the industry/sector news and policy announcements, etc., affecting the companies. Any adverse development is analysed for its likely impact on the companies.

Source: Scheme Information Document

When investing in REITs & InvITs as well, the fund assesses the prevailing market conditions and outlook for the real estate market.

It looks at parameters such as the status of the rental property market, especially commercial in the case of REIT, outlook for the project that has been placed in an InvIT, dependability of cash flows emanating from the REIT / InvIT, the interest rate outlook, correlation of these assets with pure equity and debt, etc.

Overall, decent investment processes and systems are followed when approaching the asset classes.

What is the Portfolio of Sundaram Aggressive Hybrid Fund?

As per the November 2025 portfolio, 69% of the fund’s assets are in equities (including derivative futures), 20% debt, and 11% in others (which include cash & cash equivalents, REIT & InvITs, domestic mutual fund units, and derivative futures).

As per the current portfolio, the fund has 52 stocks, of which 54% are largecaps, 10% midcaps, and 3% smallcaps.

The top 10 stocks comprise 41.5% of the portfolio, and include names such as HDFC Bank (7.5%), ICICI Bank (5%), Reliance (4.2%), etc.

Among various sectors, the top 3 are banks (21.7%), finance (13.9%), and auto & ancillaries (8.4%), comprising 44.1% of the portfolio.

In the debt portion, the fund’s assets are spread across maturity papers but currently has a higher weightage in the 7 to 10 years maturity bucket, followed by the 2 to 3 years maturity bucket.

A dominant portion is in AAA-rated papers and sovereigns. The Government of India (GoI) bonds are 8.1% and are in the top 10 holdings.

Besides, the fund is holding 4.7% of its assets in domestic mutual fund units and 1.9% in REITs & InvITs.

Currently, the fund is holding 4.3% of its assets in cash & cash equivalents.

The portfolio turnover ratio of the fund is average, in the range of 56-94% over the last one year.

What Are the Historical Returns of Sundaram Aggressive Hybrid Fund?

Since its inception, the fund has clocked a 14.1% CAGR (under the Direct Plan).

The fund’s 3-year, 5-year, and 7-year, compounded annualised rolling returns are 14.1%, 17.6%, and 12%, respectively, higher than the benchmark, CRISIL Hybrid 35+65 – Aggressive Index.

However, compared to many other funds in its category, the fund has lagged in performance, thus faring below the category average.

Sundaram Aggressive Hybrid Fund – Performance

| Scheme Name | Absolute (%) | CAGR (%) | Risk Ratios | ||||

| 1 Year | 3 Years | 5 Years | 7 Years | SD Annualised | Sharpe | Sortino | |

| Sundaram Aggressive Hybrid Fund | 7.59 | 14.11 | 17.58 | 12.88 | 8.84 | 0.25 | 0.51 |

| Category Average* | 7.67 | 15.78 | 19.03 | 13.81 | 9.63 | 0.29 | 0.59 |

| CRISIL Hybrid 35+65 – Aggressive Index | 6.66 | 12.93 | 15.78 | 12.65 | 7.98 | 0.23 | 0.48 |

Data as of 11 December 2025

Rolling period returns are calculated using the Direct Plan-Growth option. Returns over 1 year are compounded annualised.

Standard Deviation indicates total risk, while the Sharpe Ratio and Sortino Ratio measure the Risk-Adjusted Return. They are calculated over 3 years, assuming a risk-free rate of 6% p.a. *All aggressive hybrid mutual fund schemes are considered to compute the category average returns. Please note that this table represents past performance. Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory. Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

What About the Risk Profile of Sundaram Aggressive Hybrid Fund?

On the risk-o-meter, the fund is classified as high risk.

That said, the risk the fund has exposed its investors to is low (standard deviation of 8.84) compared to its category average, but higher than the benchmark (as of 11 December 2025). In fact, the volatility registered by the fund is among the lowest in its category.

On a risk-adjusted basis as well, as reflected by the sharpe and sortino ratios of 0.25 and 0.51, respectively, the fund has lagged its peers, although it fared better than the benchmark.

Should You Consider Sundaram Aggressive Hybrid Fund?

Despite defining out investment processes & systems, the investment strategy has yielded below-average returns. Although the risk is low, the risk-adjusted returns are nothing to vie for. Many other aggressive hybrid funds have displayed far better performance.

Having said that, past returns are not indicative of the future. If the underlying portfolio of the fund begins to do better, it may reflect in the returns.

The portfolio currently seems to be designed for conservative-to-moderate investors, keeping in mind investors who have the objective of lower volatility.

Invest sensibly, considering your risk profile, investment objective, time horizon, and the asset allocation best suited for you.

Be a thoughtful investor.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary