Income tax efiling made easy! It’s that time of the year again when you have to file your income tax return and with the last date – July 31 – just a few days away, you are wondering how much time it will take you to get the task done. Don’t worry, be happy! Filing income tax returns using the ITR-1 form takes less than 10 minutes if you have all the necessary documents ready. Don’t believe us? Read on…

The first thing that you have to understand is whether you are liable to file tax returns or not. If your taxable income is more than Rs 2.5 lakh – you have to file tax returns. In the case of senior citizens this threshold is Rs 3 lakh and for very senior citizens (80 years and above), the threshold is Rs 5 lakh. There is another category of people who have to file tax returns even if their income is below Rs 2.5 lakh. “These are those who have sold equity or shares which are exempt from tax under Section 10 (30A). For the purpose of calculating the taxable threshold this capital gains income would also be included to know if you have a filing obligation or not,” says Kuldip Kumar, Partner and Leader for Personal Tax at PwC. “You may not be paying any tax, but you will still have a tax filing obligation,” he explains.

According to Kumar, the next step is to determine the sources of income; example income from salary, income from one house property, interest on bank deposits etc. For those of you who used ITR-1 to file their returns last year, will find a pre-filled form available on the Income Tax website. However, if your income exceeds Rs 50 lakh, you will not be able to use ITR-1 this time.

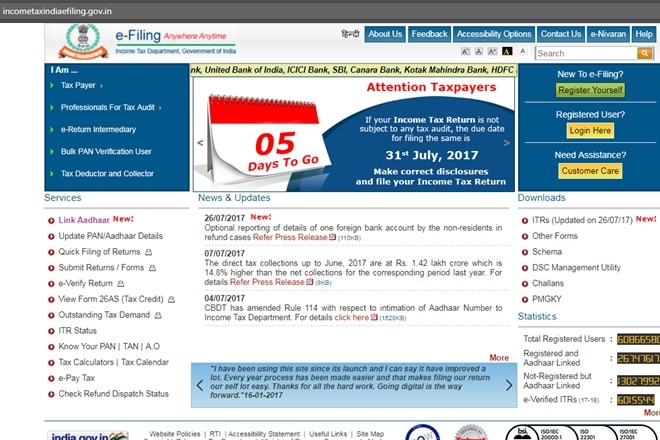

Still confused? Financial Express Online got PwC’s Kuldip Kumar to explain the process in a step-by-step way on the income tax website. Watch the video above to know whether you are liable to file a tax return, which form you should use and how you can file income tax return on the website incometaxindiaefiling.gov.in in less than 10 minutes.

As pointed out by Kumar, the responsibility doesn’t end at just e-verifying and filing the income tax return. Don’t forget to keep with you the necessary filing documents to avoid any hassle in case any query is raised by the Income Tax Department in the future. Happy tax filing!