This is the tenth edition of the Global India Insights series where I write about foreign investment trends into India. In previous editions, I have discussed the India opportunity, how foreign investors approach the market, the recent exits, and the extent of their under-allocation to India. I encourage new and existing gentle readers of this column to review those editions for context.

In the last edition, I wrote about the ‘Great India under-weight’ – how the lack of dedicated flows and reliance on investing through global emerging market funds/mandates leads to global investors having less than 1% allocation to India and thus missing out on its long-term returns.

In this edition and the following few editions, I will delve deeper into the rationale for Indian public equities being a strategic, dedicated, long-term allocation in global portfolios.

In this edition I argue that given the consistent pace of India’s GDP growth and its predictable reflection in public equity returns, global investors could consider allocating 5% of their portfolio to India, primarily through Indian public equities.

India in History: The economic context

In the 1700s, before the industrial revolution, India and China each accounted for a ~25% share of the global economy. India’s vast agrarian and artisanal economy saw active demand and trading in its goods. India did not participate in the industrial and technological revolution or the ‘enlightenment’ that transformed the western world. Colonisation further drained resources and impacted the growth, income, and wealth creation. India’s share of global GDP shrank below 2% by the 1900s.

India’s growing economy: 3rd largest economy within 10 years? The case for a 5% allocation

India now has a~3.5%-4.0% share of global GDP. As India continues to grow at twice the rate of global GDP, its share in global economy will rise over time. While it may not return to historical highs, India is likely to reach a double-digit share of global GDP sometime in this century.

GDP growth drives activity and opportunity attracting global capital. While allocation percentages may vary, corporations and investors actively seek investments in countries which offer higher growth and return potential.

There is increasing research into whether global capital allocates based on a country’s share of global GDP. I’ve long argued that it should and that India deserves a 5% weight in global portfolios, reflecting its economic trajectory.

India’s growth in GDP is 2x that of global growth

Since 1980, when India began liberalizing its economy — encouraging private enterprise, deregulating sectors, and building institutions — the country has averaged a real GDP growth rate of 6.3% per annum. This growth has been remarkably consistent across political regimes, economic ideologies, and market cycles.

India is not China and has been unable to grow at the pace at which China did in the decades of 1990-2000.

GDP Growth = Equity Returns?

India GDP Growth Reflected in Equity Markets

Past performance does not guarantee and is not indicative of future results

India’s real GDP growth of 6.3% translates into double-digit nominal growth. Private sector companies convert this into revenue and profit growth, which is reflected in stock market performance.

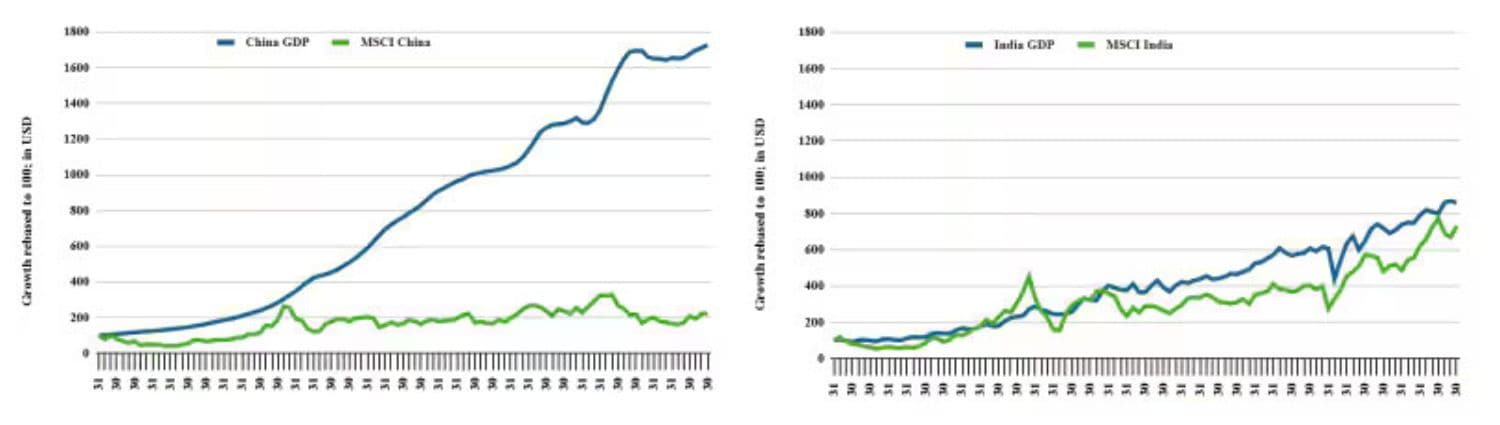

The chart above (Nominal GDP in black, MSCI India Index in green, both in USD terms since 2000) shows a strong correlation between GDP growth and equity returns. This link is notably absent in China, where economic growth hasn’t translated into stock market performance.

India’s democratic institutions, rule of law, and private sector dynamism help ensure that GDP growth is mirrored in corporate earnings and market returns. In contrast, countries with authoritarian regimes, weak property rights, or state-dominated sectors often show a disconnect between economic activity and investor returns.

India’s Unique Investment Case

India may lack advanced technology, critical natural resources, and perfect governance. But it offers a bottom-up, diverse economic story. Growth is broad-based, spanning multiple sectors and regions. This diversity ensures that the benefits of growth are widely distributed and reflected in the stock market.

The link between GDP growth → corporate revenues → profitability → stock market returns has held true for decades. I believe it will continue.

Conclusion: A sensible, strategic allocation

Investing in Indian public equities offers a simple, predictable way to participate in India’s growth story. For global investors seeking long-term returns aligned with economic fundamentals, a GDP-weighted allocation to India — around 5% — is both rational and rewarding.

Disclaimer:

Arvind Chari is a Chief Investment Strategist and has been with Quantum Advisors India group since 2004. Arvind has over 20 years of experience in long-term India investing across asset classes. Arvind is a thought leader and guides global investors on their India allocation.

This article is for educational and discussion purposes only and is not intended as an offer or solicitation for the purchase or sale of any investment in any jurisdiction. No advice is being offered nor recommendation given and any examples are purely for illustrative purposes. The views expressed contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, or reliability of the information.

The views and opinions expressed in this article are my personal views and should not be construed of the Firm. There is no assurance or guarantee that the historical result is indicative of future results, and the future looking statements are inherently uncertain and cannot assure that the results or developments anticipated will be realized.