It became clear last year that the government was determined to push the New Tax Regime, as evidenced by the increase in the income threshold for rebate eligibility under Section 87A from Rs 5 lakh to Rs 7 lakh. At the same time the amount of tax rebate was also raised from Rs 12,500/- to Rs 25,000/- for those opting for the New Tax Regime. A specific provision for marginal relief was also introduced in case the taxable income exceeded the threshold limit in case of New Tax Regime. In this budget also the finance minister has proposed certain amendments to make the New Tax Regime more attractive. Let us discuss these proposals.

Higher Standard Deduction for salaried employees:

Salaried and retired persons are allowed a fixed standard deduction of Rs 50,000/- against their taxable salary and pensions under both the tax regime. The finance minister has proposed a higher standard deduction of Rs 75,000/- against your salary or pension income if you opt for the New Tax Regime. For those opting for the Old Tax Regime the standard deduction will continue to remain Rs 50,000/.

Higher deduction for employer’s contribution toward your NPS (National Pension System)

Under the present scheme of taxation, employer’s contribution towards your NPS account is first added to your income and then the same is allowed as deduction under Section 80CCD(2) under both the tax regimes. Central Government employees can claim deduction, in respect of employer’s contribution to their NPS account, up to 14% of their salary. For others, the maximum deduction is restricted to only 10% of the salary. In order to make the New Tax Regime more attractive for salaried employees, the government has proposed to raise the limit of 10% for employer’s contribution to 14% of the salary for contribution toward the NPS account for all categories of employees under the New Tax Regime.

Also Read: Budget 2024: Standard deduction for salaried class increased from 50,000 to 75,000

Please note that though the finance minister has proposed to raise the percentage limit in respect of employer’s contribution towards your NPS account, the overall limit of Rs 7.50 lakh has not been changed, beyond which employer’s contribution towards your NPS, Provident Fund and superannuation taken together gets taxed as it is treated as your perquisite.

Enhanced deduction in respect of family pension

Presently you are eligible to claim deduction of an amount equal to 1/3 of the family pension received by you subject to a maximum of Rs 15,000/- as standard deduction against the family pension received by you. The same is proposed to be enhanced to the maximum of Rs 25,000/- provided you opt for the New Tax Regime. I do not think this will have any significant impact on a person choosing between the Old and New Tax Regime.

Revised rates and slabs

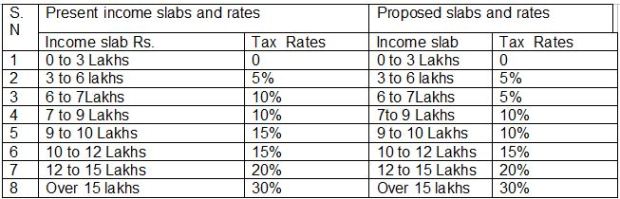

The finance minister has proposed some tweak in the tax slabs and tax rates for the New Tax Regime from the current financial year. The present and proposed tax slabs and tax rates are tabulated below for easy compassion:

From the above discussion, it is apparent that the government is trying its best to lure the salaried people to opt for the new tax regime. The new tax regime has become very attractive for those who are under the lower tax slabs and are not able to spare money to invest to be eligible for various investment-based deductions.

However, looking at the benefits and deductions which a salaried person has to forgo for opting for the New Tax Regime like House Rent Allowance, Leave Travel Concession, deduction under Section 80C and 80D and tax benefits in respect of a home loan, in most of the cases, the old tax regime is beneficial specially for the younger people who are either staying in rented premises or are servicing a home loan.

(The author is a tax and investment expert)

Disclaimer: Views expressed are personal and do not reflect the official position or policy of FinancialExpress.com. Reproducing this content without permission is prohibited.