As many as 2,774 stocks—around 75% of the 3,677 actively traded shares—have slipped into negative territory so far in calendar year 2025, underscoring the breadth of the market’s weakness. The downturn has unfolded amid subdued sentiment, driven largely by uncertainty over US tariff policies and lingering geopolitical tensions.

Loses far more widespread than 2024

The contrast with last year is stark. In 2024, losers accounted for just 33% of the market, with 1,180 declining stocks out of a universe of 3,581.

Red spread beyond Nifty, Sensex

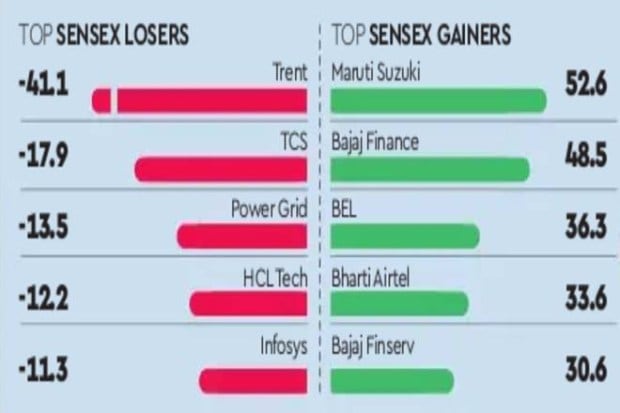

The pain in 2025 has not spared frontline indices, though it has been sharper outside them. Seventeen of the 50 Nifty stocks and nine of the 30 Sensex constituents have delivered negative returns.

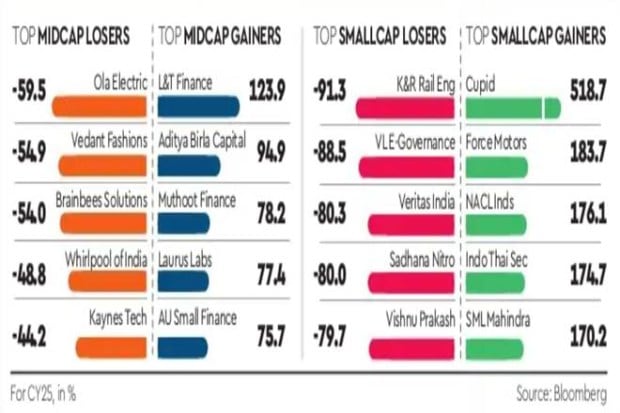

The damage is far more pronounced in the broader market: 61% of mid-cap stocks (85 of 140) and a striking 73% of small-cap ones (869 of 1,190) have ended in the red, testing investor patience.