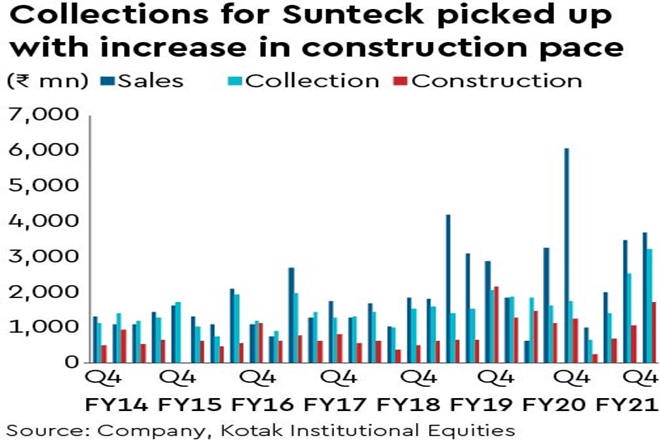

Sunteck reported improved sales of Rs 3.7 bn (6% y-o-y) against collections of Rs 3.2 bn in Q4FY21 with a marked change in sales profile from luxury segment in BKC to more affordable and mid-income segments. Sunteck Realty has (i) low leverage – 0.18X net debt/equity as of March 2021; (ii) no land bank; and (iii) has been aggressively expanding its portfolio across lower-ticket projects in suburban Mumbai. We do concede weak sales for high-ticket units in BKC, although note the increasing contribution from projects with a more affordable ticket size. Maintain Buy with revised FV of Rs 360/share (from Rs 345/share earlier).

Mid-income and affordable housing segment contributed 68% of sales in FY2021: Sunteck recognised revenues of Rs 1.9 bn (-7% q-o-q), Ebitda of Rs 391 mn (-13% y-o-y) and PAT of Rs 159 mn (-25% q-o-q), with an Ebitda margin of 20.5% in an operationally strong Q4FY21. In FY2021, Sunteck reported revenues of Rs 6.1 bn, Ebitda of Rs 1.4 bn and PAT of Rs 536 mn with Ebitda margin of 22.3%.

New launches at recently acquired JD projects to accelerate sales: Sunteck has added a slew of JDA projects (totaling ~8 mn sq. ft) over the past year. It is planning to launch phases across Vasai, Vasind and Borivali (~Rs 4-5 bn each) in FY2022/ 23 in order to maintain sales momentum achieved in FY2021.

Maintain Buy: We note that (i) launches of new mid-income projects, (ii) sustenance sales from new phases of extant projects, as well as (iii) clarity on surplus land in Oshiwara will act as a key catalyst for the stock, notwithstanding impact of Covid on sales .