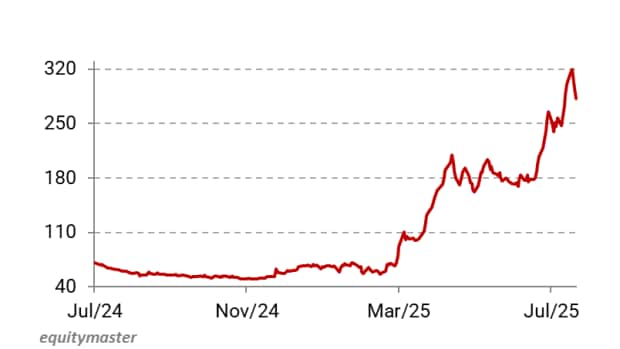

NACL Industries has delivered 41% return in the last one month.

For a company that’s been under pressure from weak earnings and sluggish global demand, this sudden rally has sparked fresh interest.

What’s changed?

The entry of a new promoter, known for turning around companies, expansion plans and a clear growth roadmap, has caught the attention of investors.

In this piece, we break down what’s driving the optimism and what may lie ahead.

Let’s take a look…

About the Company

NACL Industries manufactures a wide range of crop protection products, including insecticides, pesticides, acaricides, herbicides, fungicides, and other plant growth chemicals. The company serves 5 million (m) farmers across 31 locations.

The company has obtained 518 product registrations in India and 120 product registrations for exports. It has technical manufacturing plants with a combined annual production capacity of 23,000 tons (TPA).

It also has a formulation unit with a packaging facility of 12,000 kiloliters of liquids, 5,600 metric tonnes of powders, and 35,475 metric tonnes of granules. The formulations business offers over 60 branded products across insecticides, herbicides, fungicides, and plant growth regulators.

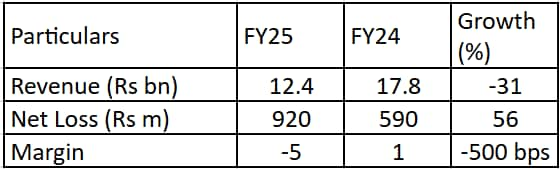

Financial Performance

NACL’s revenue in FY25 was Rs 12.4 billion (bn), a 31% year-over-year (YoY) decrease. International trade slowed, but domestic business remained strong.

The net loss rose from Rs 590 million (m) in the previous fiscal year to Rs 920 million (m), a 56% YoY increase.

Weak worldwide demand for agrochemical products and a sharp decline in product prices presented the company with serious challenges.

Due to insufficient restocking by channels in major markets, demand from important international accounts decreased, which decreased global sales revenue.

NACL Financial Snapshot

Higher input prices and supply chain disruptions have also negatively impacted margins, which turned negative at 5% in FY25.

Also, erratic monsoon conditions, and uneven rainfall distribution negatively impacted domestic sales.

Future Outlook

Despite the weak performance in FY25, NACL has implemented strategic measures that are showing positive signs.

It’s expected to benefit from the expertise of its new promoter, Coromandel International, a Murugappa Group-owned entity.

Coromandel is set to acquire a 53% stake in NACL for Rs 8.2 bn from its existing promoter, KLR Products. The transaction is subject to regulatory approvals.

Coromandel is a well-established and strong player in the agrochemical sector. Investors are viewing the acquisition positively, given the synergies and the group’s expertise in turning around businesses.

NACL Share Price – 1 Year

NACL is following a dual growth strategy to strengthen international operations and reduce over-reliance on a single segment.

This approach aims to drive expansion by focusing on its key accounts business, which involves supplying active ingredients to large multinationals. 29% of its revenue comes from international operations.

NACL is working on building a portfolio of registrations with national importers, moving beyond active ingredients into both generic and differentiated formulations.

The company also plans to introduce new active ingredients and intermediates to scale up volumes with national importers as more registrations for its generic and differentiated formulations are secured.

NACL’s research and development team is also actively engaged in the development and synthesis of new off-patent generic products. This includes introducing new products through indigenously developed technology for both domestic and export markets and exploring new areas such as pharma intermediates.

Capacity expansion is underway in agrochemicals, specialty chemicals, and advanced intermediates. It’s expanding the annual capacity of Srikakulam technical plant from 17,000 metric tons (MT) to 25,000 MT.

It’s also in the advanced stages of acquiring additional land and obtaining necessary approvals and licenses to achieve a projected annual capacity of 38,000 MT.

In addition to expanding manufacturing capabilities, the company aims to tap into new geographies and expand its distribution network.

NACL has also raised Rs 1 bn from EQ India Fund through a preferential issue at Rs 57 per share for future expansion plans.

The company has already made significant strides in energy efficiency, achieving 50% cost savings and a reduction in carbon emissions by transitioning to LPG at its Ethakota and Srikakulam sites.

External Growth Drivers

After China, Japan and the United States, India ranks fourth in the world for agrochemical production. Through 2030, the Indian agrochemical market is estimated to expand at a 5–6% annual rate.

Development is estimated to be inspired by the growing global population, expanding agricultural practices, high crop yields, government support, technological progress and needs of climate change.

India’s agrochemical use is relatively low, at 0.27 kg per hectare, is quite lagging from developed economies, offering adequate development opportunities.

The Government of India has identified the agrochemical industry as one of the 12 champion industries. Initiatives like Pradhan Mantri Krishi Sinchai Scheme and Soil Health Card Scheme are aimed at increasing irrigation and improving soil health.

In addition, India will require more than 450 meters of food grains to feed its population of 1.65 BN by 2050, which would be a challenging task.

The world will face similar challenges in stepping up food production to meet the growing needs of the world population. This is expected to increase demand for agrichemicals.

Conclusion

NACL’s sharp rebound has caught attention, but it’s still in a turnaround phase.

With Coromandel stepping in as promoter, there’s optimism around better execution and strategic clarity.

However, sustained recovery will depend on how well the company scales exports, improves margins, and delivers on its expansion plans.

Instead of relying only on hype, it’s necessary for investors to carefully analyse the company’s fundamentals, including financial performance, corporate governance practices, and growth prospects.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.