Recently, the IPO market in India has seen good quality stocks getting listed. This has been a marked by increased participation, larger deal sizes, and a strategic shift toward quality over quantity.

India witnessed about 80 mainboard IPOs in FY25, slightly up from 76 in FY24. The market has seen strong interest in technology, fintech, and consumer tech companies with proven revenue traction.

There are major start-ups that are set to launch their IPOs in 2025.

In this editorial, we will take a look at five of them.

But first, you should know how startup IPOs have fared in the recent past…

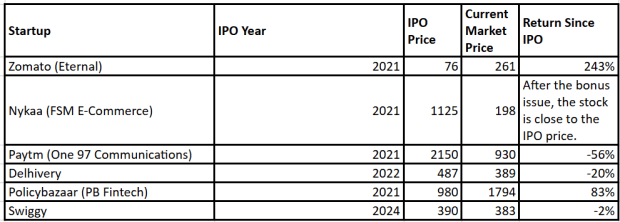

Some Prominent Indian Startup IPOs

The startup IPO story is mixed. Some startups have generated wealth over the last 3-4 years, while others have not.

Zomato was the best in terms of returns, while Paytm has left investors with losses. Clearly, investors will have to do their due diligence in the case of these IPOs. Most companies these days leave very little returns, if any, on the table in their IPO pricing.

A List of Big Startups Set to Launch IPOs

Several of the forthcoming launches are from startups tech companies. So don’t expect them to be cheap. Most of them have a sound track record with a good brand equity.

Let’s take a look at 5 such startups geared up for their IPOs.

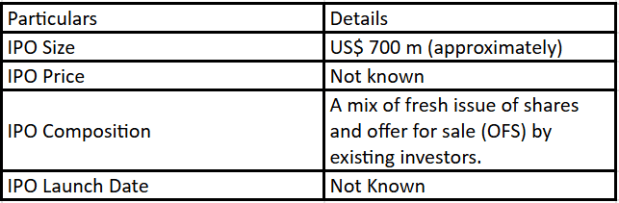

#1 Groww Invest Tech

First on our list is Groww Invest Tech.

Groww is a leading Indian online investment platform.

The expected amount to be raised through its IPO is yet to be determined. We cannot confirm the amount or the size. Some reports in the media have indicated an IPO size of US$ 700 million (m).

The IPO is likely to be mostly an offer for sale (OFS) with a smaller fresh issue.

Groww Invest Tech started in 2016 focusing on mutual funds. It has gradually expanded into stock trading, digital gold, ETFs, intraday trading, and IPO investments. The company claims to be the #1 stock broker based on active client user data by NSE as on 31 January 2025.

The company aims to provide a seamless, user-friendly experience through its web and mobile app.

Rising retail investor participation in the stock market, good digital infrastructure, low data costs, and government initiatives like Digital India and UPI, are positives for Groww’s in the future.

With India’s retail investor base still underpenetrated compared to developed markets, Groww Invest Tech has significant room for growth as more Indians embrace financial services online.

While the IPO is eagerly awaited, it pricing is what everyone is looking out for.

#2 Urban Company

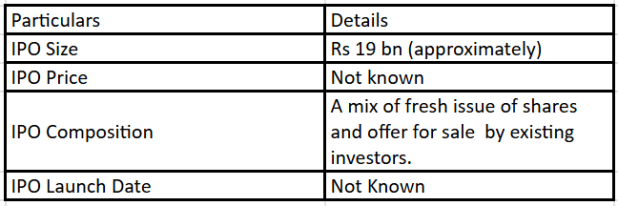

Second on our list is Urban Company.

Urban Company, formerly known as UrbanClap, is a technology-driven digital marketplace that connects consumers with vetted, trained professionals for a wide range of home and beauty services.

While the pricing and other details are not known, some details are available based on the draft red herring prospectus (DRHP) filed with SEBI.

The IPO is a book built issue sized at Rs 19 bn, comprising a fresh issue of Rs 4.29 bn and an offer for sale (OFS) of Rs 14.71 bn by existing investors. These include names such as Accel, Elevation Capital, and Tiger Global.

Urban Company provides a broad services portfolio including beauty and wellness (home salon, massage, grooming), home cleaning (deep cleaning, kitchen, bathroom), appliance repair (AC, fridge, washing machine), home maintenance (plumbing, electrical, carpentry, pest control), and fitness services (yoga, personal training).

Urban Company’s IPO offers investors a chance to participate in the growth story of India’s largest home services platform.

The home services market in India is projected to grow from Rs 50 bn in 2024 to Rs 83 bn by 2029, driven by urbanisation, digital adoption, and rising consumer expectations. This is likely to create good opportunities for the company going forward.

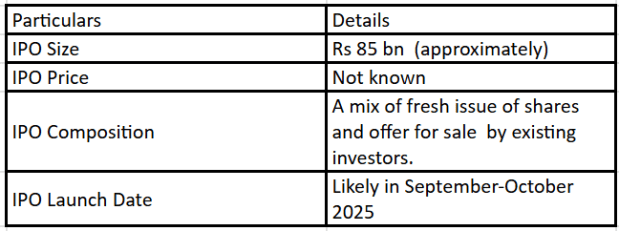

#3 Meesho

Third on our list is Meesho.

Meesho is an Indian e-commerce platform for small businesses, individual entrepreneurs, and resellers to sell products online with zero commission fees.

Meesho is preparing for a Rs 85 bn IPO, which includes a fresh capital raise of Rs 42.5 bn and the remaining amount through an offer for sale by existing shareholders.

The company has filed the DRHP and is targeting a listing around September–October 2025.

Meesho’s IPO is among the largest in the Indian e-commerce sector. It’s expected to strengthen its balance sheet for expansion and compete with major players like Flipkart and Amazon.

Meesho has over 100 million active users and a rapidly growing seller base, with a strong presence in tier 2 and smaller cities.

The company employs AI and machine learning for personalised recommendations, pricing, supply chain optimisation, and customer support. In 2024, it introduced a generative AI-powered voice bot handling 60,000 daily calls in English and Hindi.

Despite strong prospects, Meesho must navigate intense competition from giants like Amazon and Flipkart, maintain service quality, and continue innovating to retain and grow its user base.

#4 PhysicsWallah

Fourth on the list is PhysicsWallah.

The company offers affordable online education primarily for competitive exams and school curricula, gaining significant traction in India’s edtech market.

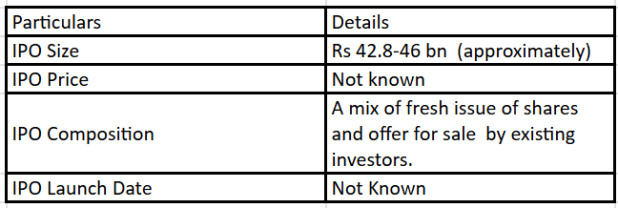

PhysicsWallah is planning to launch an IPO of approximately of around Rs 42.8-46 bn. The IPO would make it the first pure-play edtech company to list on Indian stock exchanges.

PhysicsWallah operates a freemium and hybrid learning model, offering both free and paid content to make education accessible and affordable, especially targeting students in Tier 2 and Tier 3 cities.

It covers a wide range of subjects including school curricula, competitive exams (JEE, NEET, UPSC), and skill development.

PhysicsWallah’s success is attributed to its low-cost, high-quality education model. The company has invested heavily in scaling operations, leading to losses in FY24 despite strong revenue growth.

#5 Wakefit Innovations

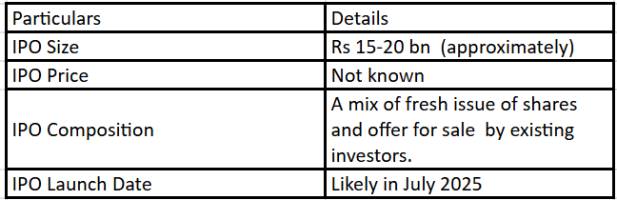

Wakefit Innovations has filed its DRHP for an IPO to raise Rs 4.68 bn through a fresh equity issue and an OFS of about 58.3 m shares by existing shareholders.

The IPO is slated this sometime this month (July 2025). The proceeds of the fresh issue will be for retail expansion – opening 117 new company-owned stores and one jumbo store – upgrading manufacturing equipment, lease and rental payments, marketing and brand-building activities, and general corporate purposes.

Wakefit Innovations offers a wide portfolio including mattresses (memory foam, latex, smart sleep technology), furniture (beds, sofas, wardrobes, dining sets, office furniture), and home furnishings (pillows, home essentials, décor, kitchenware).

The company sells through its own website, COCO (company-owned company-operated) stores, and other online marketplaces, with over 80 stores across 30+ cities in India.

It has 5 manufacturing plants in Bengaluru, Hosur (Tamil Nadu), and Sonipat (Haryana), equipped with advanced machinery and automation to ensure quality and efficiency.

While prospects for the company are good, it will need to continue innovating and managing competition from both domestic and international players to maintain its momentum.

Conclusion

The startup IPO landscape in India is entering a very strong phase in 2025. This will be marked by record fundraising and a sharp recovery in investor confidence after the recent market correction.

After a historic 2024 where 13 startups raised nearly Rs 290 bn (a record), 2025 is expected to be even better with around 25 startups raising over Rs 550 bn.

In the past we have seen a mixed trend of returns from startup IPOs. This time may not be too different. Investors should be selective while considering these and other startup IPOs.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of

the stock as key factors when conducting due diligence before making investment decisions.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.